As a seasoned researcher with over two decades of experience in financial markets, I must say this recent development in the approval of Bitcoin and Ether index ETFs is indeed a groundbreaking moment. Having closely observed the evolution of the digital asset class, it’s fascinating to see how traditional finance is slowly embracing this new frontier.

The United States Securities and Exchange Commission (SEC) has given its approval for Bitcoin and Ether index exchange-traded funds (ETFs) proposed by Hashdex and Franklin Templeton. In simpler terms, the SEC has given these two companies permission to create investment products that track the prices of Bitcoin and Ether, which can be traded on stock exchanges.

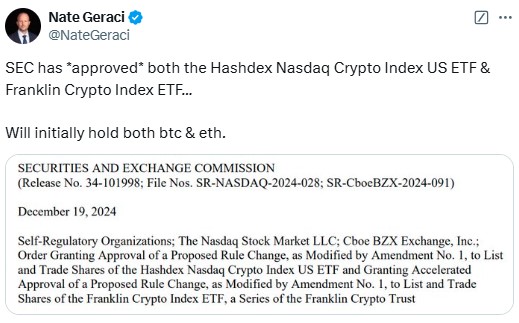

On December 19th, the U.S. Securities and Exchange Commission (SEC) granted approval for Hashdex’s Nasdaq Crypto Index US ETF to be traded on the Nasdaq stock market. Simultaneously, Franklin Templeton’s Crypto Index ETF received approval for trading on the Cboe BZX Exchange.

1) In simple terms, both ETFs (Exchange-Traded Funds) will directly own Bitcoin and Ether. The Franklin Crypto Index ETF is designed to mirror the Institutional Digital Asset Index, while the Hashdex Crypto Index ETF aims to reflect the Nasdaq Crypto US Settlement Price Index.

After both companies revised their submissions, the Securities and Exchange Commission (SEC) gave its approval. This was because the proposed funds satisfied the essential conditions to safeguard investors’ interests and serve the public good.

Nate Geraci, head of The ETF Store, anticipates that the SEC’s approval might inspire other companies such as BlackRock to introduce their own crypto-based ETFs. He is confident that there will be a high level of interest in these financial products, particularly among advisors seeking diversification opportunities within emerging asset classes like cryptocurrency.

This approval represents a major milestone propelling Cryptocurrency ETFs in the United States. Previously in 2023, entities such as Hashdex and Franklin Templeton experienced setbacks with their submissions.

Consequently, other companies, such as NYSE Arca, are now considering listing their own Bitcoin and Ether ETFs, indicating a rising wave of interest in cryptocurrency investment options. Such a development may accelerate the widespread acceptance of digital currencies.

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- PUBG Mobile heads back to Riyadh for EWC 2025

- Maiden Academy tier list

2024-12-20 10:13