Ah, the $0.34 zone—a place where SEI bulls gather like wizards around a cauldron, chanting spells of “momentum” and “support.” Analysts are practically frothing at the mouth over this pivotal level, which has become the battleground for sustaining upward enthusiasm. After a rally that shot SEI from below $0.22 in June to a heroic high of $0.3902, the recent 5.87% pullback feels less like a defeat and more like someone spilled their drink at the party. Oops! 🍹🍺

But fear not, dear reader! Despite this minor hiccup, SEI remains stubbornly perched above its 20-day moving average, as if it’s clinging to the last lifeboat on a sinking ship. Technical projections whisper sweet nothings about Fibonacci resistance levels at $0.55, $0.73, and beyond—like distant lands on an adventurer’s map. All they need is for the bulls to defend $0.34 like it’s the last piece of pie at a family reunion. 🥧⚔️

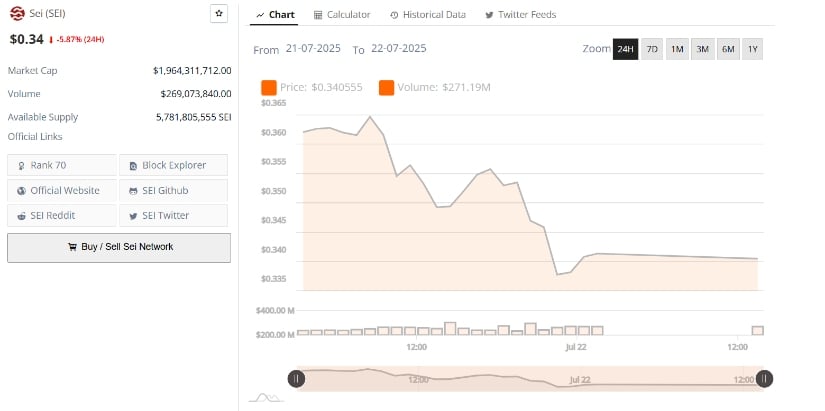

SEI/USDT is currently doing what it does best: wobbling around $0.34 after pulling back from its recent high of $0.3902. The daily chart shows a 4.16% drop in the latest session, opening at $0.3555 and closing at $0.3407. Sounds dramatic, doesn’t it? But really, it’s just the market equivalent of stubbing your toe—painful but unlikely to ruin your day.

This downward shuffle started from a local high of $0.362, with the pair dipping as low as $0.3402 before recovering slightly. And guess what? The $0.34 mark continues to act as the bouncer at an exclusive club, keeping further downside attempts firmly outside. Market volume during this period stayed steady at approximately 5.83 million SEI, with USDT trading volume recorded at 2.03 million. It seems even the bears can’t resist hanging around this price range, probably because the snacks are better here. 🍿🐻

Long-Term Moving Averages: The Trend That Refuses to Die

The SEI/USDT chart looks like the plot of a soap opera—an uptrend that began in late June 2025 following a breakout from below $0.22. Since then, SEI has been climbing steadily, only pausing briefly when it hit resistance near $0.39. Even now, despite the recent dip, SEI clings to its key moving averages like a child clutching their favorite teddy bear. These averages remain upward-sloping, signaling that the medium-term trend is still alive and kicking. Or should we say moo-ing? 🐄📈

The 20-day moving average, beloved by swing traders everywhere, sits comfortably below the current price, ready to catch any slips. Traders using trend-following strategies will likely keep their bullish hats on (or horns?) as long as SEI holds above its 20-day average on a closing basis. Because let’s face it, nobody wants to be the one who sold too early and missed out on the next big thing. 😅💸

$0.34: The Pivotal Support Zone Everyone’s Talking About

According to sage-like analysts @moneyhunter443 and @i_bot404, $0.34 isn’t just a number—it’s a *mood*. Hollow candles on charts gleam with clarity, showing SEI approaching this level after a strong accumulation pattern earlier in July. Holding above this zone on the daily timeframe is crucial for maintaining the current trend formation. In other words, if SEI loses this fight, things might get awkward faster than you can say “sell-off.” 📉🔥

Above the current SEI crypto level, Fibonacci-derived resistance points loom tantalizingly at $0.5505, $0.7398, $0.9086, and finally, $1.1429—the promised land of profits. These levels remain valid unless SEI decides to throw a tantrum and fall below the $0.32–$0.34 support range. Observers are watching price closes and volume activity like hawks, trying to figure out whether SEI will soar like an eagle or just flap around like a confused pigeon. 🦅🕊️

Volume Stability: The Silent Hero of This Saga

Even during the most recent decline, SEI’s trading volume remained consistent, clocking in at $269 million in the last 24 hours. Consistent volume during a downturn is like finding money in your pocket—you didn’t expect it, but it makes everything feel a little better. Declines with steady volume are often seen as controlled pullbacks rather than outright catastrophes. So take heart, dear investor; the bulls aren’t giving up without a fight. 🤑💪

If SEI manages to reclaim $0.35 with stronger bullish volume, it could set the stage for another run toward $0.39. For now, all eyes are glued to the $0.34 level, which has played both hero and villain in recent sessions. Holding above this line might keep the longer-term structure intact, allowing the bulls to dream of higher targets. Or, you know, they could trip over their own hooves again. Either way, it’s bound to be entertaining. 🎭🎉

Read More

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- USD CNY PREDICTION

- Gold Rate Forecast

- Arknights celebrates fifth anniversary in style with new limited-time event

- Hero Tale best builds – One for melee, one for ranged characters

- Every Upcoming Zac Efron Movie And TV Show

2025-07-23 00:40