As a seasoned crypto investor with battle-scarred fingers from navigating the rollercoaster market, I must admit that the recent surge of Sei (SEI) has caught my attention like a moth to a flame. With my eyes glued to the charts and my heart pounding like a drum, I can’t help but feel a tinge of excitement as this token breaks through resistance levels left and right.

In the past day, the value of the native token for a fast-paced cryptocurrency trading blockchain called Sei has surged by over 25%.

On September 25th, the price of SEI increased significantly, climbing from its lowest point during the day at $0.366 to reaching a peak of $0.471 on prominent trading platforms, earlier in the same day.

On June 12th, this token reached its peak level since then, and its market value skyrocketed to a staggering $1.6 billion. As a result, it currently ranks as the 59th largest digital currency worldwide, based on data from CoinGecko.

The cost increase occurred at the same time as a 187% jump in its daily trading volume, which is approximately $523 million right now. Moreover, data from Coinglass reveals that the daily open interest for SEI increased by 34.4%, reaching $170.3 million during writing, suggesting elevated investor involvement driving SEI’s continuing upward trend.

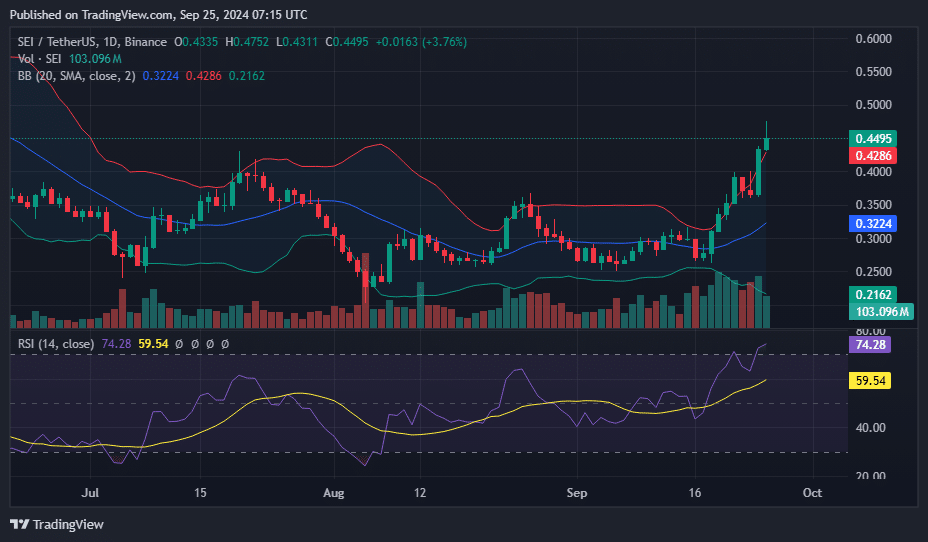

Looking at the one-day graph, SEI has broken free from a declining wedge formation, which is usually an indication of potential for further price increases in the future, based on a common technical analysis perspective.

The price has additionally surpassed the upper limit of the Bollinger Band, currently set at $0.4503, suggesting that the bullish trend continues to gain strength.

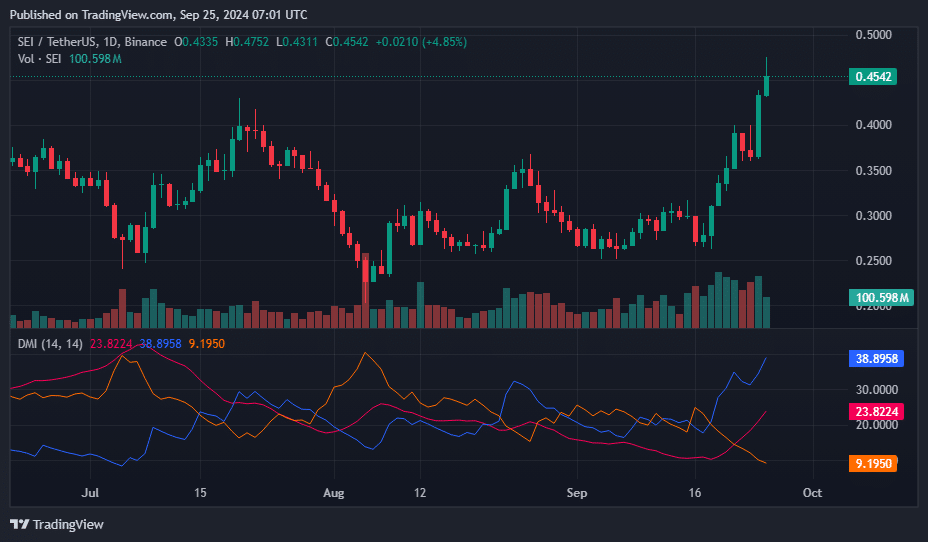

The Directional Movement Index (DMI) indicates a growing bullish trend as the positive DI (Directional Movement +ve) increases while the negative DI (Directional Movement -ve) decreases, implying less resistance from selling forces. Additionally, the Average Directional Index (ADX) is on the rise, hinting at an enhancement of the previously fragile bullish momentum.

As an analyst, I’m closely monitoring the market trend and suggest traders to stay vigilant at the $0.50 mark. This level could potentially act as the next psychological resistance. If this level is successfully surpassed, accompanied by substantial volume, it might propel the price upward towards $0.55 or even higher.

If the RSI (Relative Strength Index) is overbought at 74, it suggests that a short-term correction or pause might occur. Should there be a turnaround, the middle Bollinger Band positioned around $0.3224 could potentially function as a crucial support level.

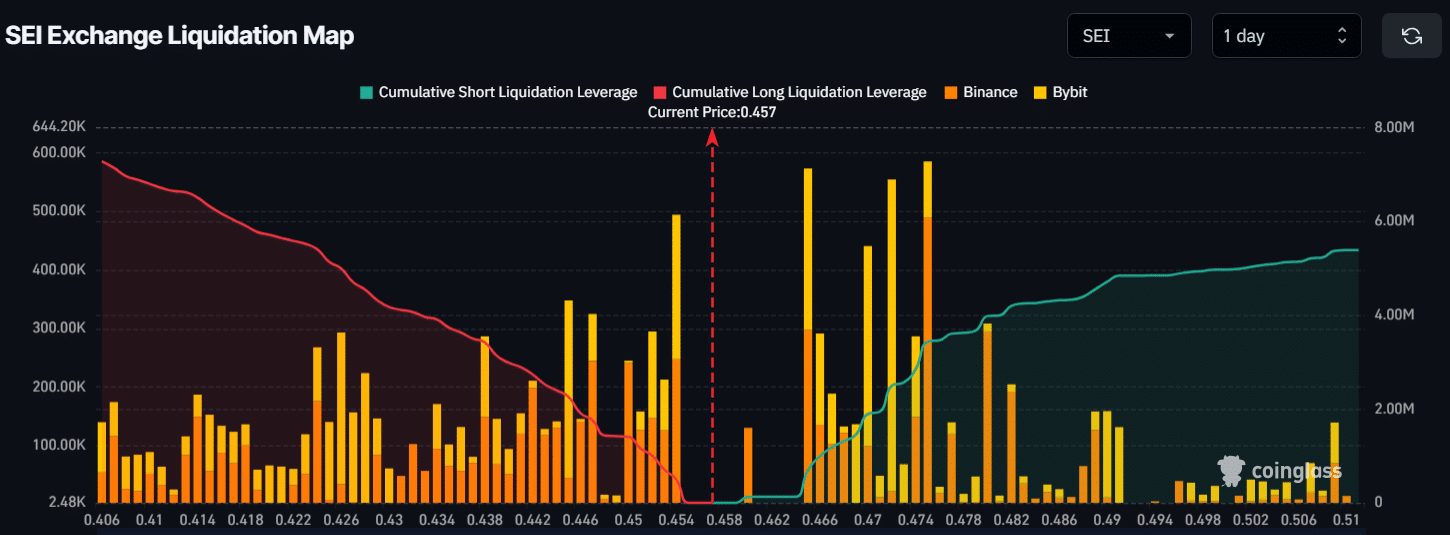

Major liquidation levels

At present, the crucial liquidation points for SEI stand approximately at $0.454 when prices drop and $0.475 when they rise. Notably, there’s a high level of leverage among day traders around these price levels, as indicated by Coinglass.

If the price of SEI falls to $0.454, it might trigger the sale (liquidation) of around $494,470 in long positions. On the other hand, if the price rises to $0.475, an estimated $3,440,000 in short positions could be liquidated.

Currently, the situation shows that bears appear to be losing their grip, possibly causing the unwinding of short positions at elevated prices.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Black Myth: Wukong minimum & recommended system requirements for PC

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Castle Duels tier list – Best Legendary and Epic cards

2024-09-25 11:13