As a seasoned crypto investor with a keen interest in following the latest developments in the digital asset space, I’m thrilled to see another publicly traded company, Semler Scientific ($SMLR), joining the ranks of those embracing Bitcoin as a treasury reserve asset.

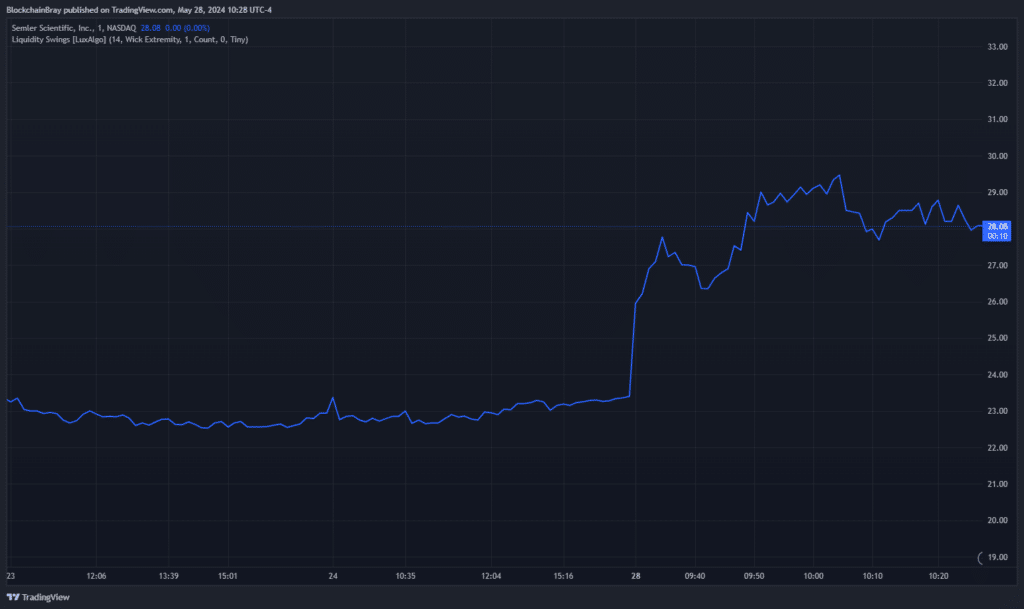

Semler Scientific announced the acquisition of 581 bitcoins for their company reserves, leading to a significant surge of approximately 25% in their stock prices during early U.S. market sessions on Tuesday.

Based on its latest financial report, the company, whose market value was under $200 million prior to today’s stock surge, held cash and cash equivalents amounting to $62.9 million at the close of the first quarter. The company generated revenue of $15.9 million during this period and recorded an operating cash flow of $6.1 million.

Based on the information in this morning’s announcement, Semler bought 581 bitcoins for a total of $40 million, which equates to approximately $68,850 per bitcoin.

Another company has added Bitcoin to their reserve – this time healthcare giant Semler Scientific $SMLR has adopted #Bitcoin as its primary treasury reserve asset by purchasing $40 million worth of the Bitcoin.

Following in Microstrategies footprints?

The stock goes up 22% on…

— MartyParty (@martypartymusic) May 28, 2024

“Chairman Eric Semler stated that Bitcoin has surpassed the $1 trillion mark in terms of market value, making it a significant asset class. Its scarcity and finite nature distinguish it as a potential hedge against inflation and a safe-haven investment during global turmoil. Furthermore, we hold the view that its digital structure provides advantages over gold, which boasts a market worth around ten times greater than Bitcoin.”

Today’s 25% gain has brought the stock to just a 2% decline year-over-year.

Read More

- 10 Most Anticipated Anime of 2025

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- USD CNY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Castle Duels tier list – Best Legendary and Epic cards

- Maiden Academy tier list

- Cookie Run Kingdom: Lemon Cookie Toppings and Beascuits guide

- Silver Rate Forecast

- USD MXN PREDICTION

2024-05-28 17:56