As a seasoned crypto investor with experience through multiple market cycles, I strongly believe that adding Ethereum (ETH) to one’s portfolio is a prudent decision based on diversification, use cases, and historical analysis.

Matthew Hougan, the Chief Investment Officer (CIO) at Bitwise Asset Management, has expressed his perspective on cryptocurrency investments, highlighting the potential benefits of including Ethereum in an investment portfolio.

As an analyst, I’d interpret Hougan’s statement in Xpost as follows: In his post on X, Hougan mentioned three compelling reasons for considering the addition of Ethereum (ETH) to one’s investment portfolio. Furthermore, he acknowledged that some investors might prefer sticking with a Bitcoin-only portfolio for specific reasons.

As an analyst, I want to emphasize that my remarks should not be construed as investment advice. Nevertheless, I believe that with the imminent introduction of spot Ethereum ETFs in the United States, many individuals may find it opportune to consider investing in this cryptocurrency, which is currently the second largest by market capitalization.

Why consider ETH for a portfolio?

Based on Hougan’s perspective, the key factors are diversification, the distinct uses of Bitcoin and Ethereum, and a historical analysis of their respective values. In simpler terms, according to Hougan’s viewpoint, having a diverse investment portfolio that includes both Bitcoin and Ethereum, along with understanding their unique functions in the market and considering historical price trends, are crucial reasons for consideration.

As a crypto investor, I’ve often found myself reflecting on the investment environment we find ourselves in today and drawing parallels to the dot-com boom era. Back then, it seemed like every other person was investing in tech startups, each one promising to revolutionize the world. The allure of potentially exponential returns led many to pour their savings into these ventures, often with little to no due diligence or diversification.

Predicting the future with absolute certainty is a formidable challenge. Even seasoned investors during the dot-com era, who recognized the potential of the internet as a whole, made incorrect assumptions about which companies would thrive. AOL and Pets.com are prime examples. They successfully identified the trend, but unfortunately, their specific investments did not yield the desired returns.

In today’s dynamic world, crypto technology represents a promising and revolutionary force. Although it’s impossible to foresee the future with certainty, a strategic approach to capitalize on this trend is by “taking ownership of the market.” A hypothetical balance of 75% Bitcoin (BTC) and 25% Ethereum (ETH) could serve as an effective starting point.

The market value of Ethereum (ETH), the cryptocurrency underlying the Ethereum blockchain, is currently approximately $420 billion. This represents around one-third of Bitcoin’s market capitalization, which stands at roughly $1.3 trillion. As a starting point for investment, it may be suitable to consider allocating around 75% of your funds to Bitcoin and the remaining 25% to Ethereum.— Matt Hougan (@Matt_Hougan) June 20, 2024

As a researcher, I would express this idea by saying, “From my perspective, the rationale behind considering the addition of Ethereum (ETH) to a portfolio, based on the viewpoint of the Bitwise executive, lies in the distinct use cases of Bitcoin and Ethereum.”

Bitcoin stands out as the most superior form of currency ever created, while Ethereum aims to transform money into a programmable entity. Applications such as stablecoins and Decentralized Finance (DeFi) are thriving in this innovative framework.

As a crypto investor, I acknowledge that it’s challenging to predict which specific applications of new technology will yield the best results. However, I believe expanding my portfolio by holding both Bitcoin (BTC) and Ethereum (ETH) could be beneficial in the long run due to their broader market exposure and significance within the crypto ecosystem.

“Ethereum serves as the foundation for creating financially viable applications through programming. It is a technological infrastructure supporting innovations such as stablecoins and Decentralized Finance (DeFi) that operate on public blockchains.”

— Matt Hougan (@Matt_Hougan) June 20, 2024

For the third reason, Hougan opines, it’s the historical analysis.

“Speaking historically, incorporating Ethereum into your investment portfolio during a complete cryptocurrency market cycle has enhanced not just the total returns but also the risk-adjusted ones, in comparison to solely investing in Bitcoin,” he explained.

An example of a portfolio with ETH

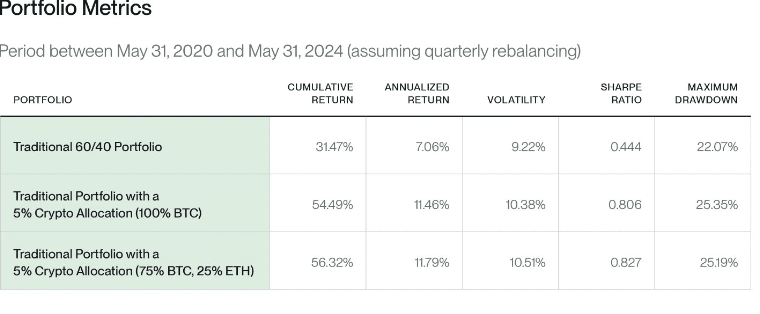

Over the period from May 31, 2020 to May 31, 2024, a conventional 60/40 investment portfolio yielded a total return of 31.47%, which averaged out to an annual return of approximately 7.06%.

If we consider the contrast, increasing such a portfolio with a 100% allocation in BTC by 5% results in a total return of 54.49%, equating to an annualized yield of 11.46%. By incorporating ETH into the mix, these figures rise to a cumulative return of 56.32% and an annualized return of 11.79%.

Notably, the portfolio with ETH added shows both a higher return and lower maximum drawdown.

But Hougan also says:

Based on my perspective, if you’re looking to invest in the broader crypto and public blockchain market, it would be wise to hold various crypto assets. On the other hand, if your goal is to place a more focused wager on a novel type of digital currency, consider purchasing Bitcoin.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Maiden Academy tier list

2024-06-20 17:46