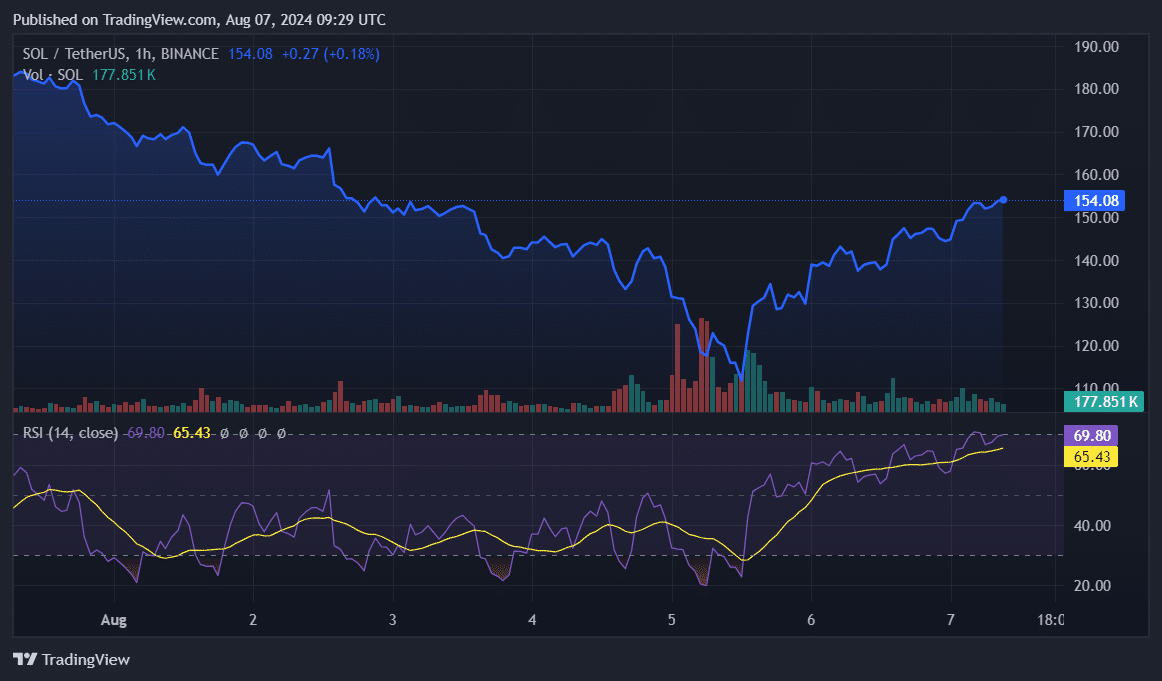

As a seasoned analyst with over two decades of experience in the financial markets, I find Solana’s current trajectory quite intriguing. After navigating through the bearish storm that swept across the market on Aug 5, Solana has shown remarkable resilience, reclaiming the $150 zone.

On August 5, Solana displayed robust performance against the general downtrend in the crypto market. Once more, it managed to break into the price range of $150.

Right now, Solana (SOL) is experiencing a 12% increase over the past 24 hours and its current price stands at approximately $154. The total market value of this asset is currently estimated at an impressive $71.8 billion, with a daily trading volume amounting to around $5.5 billion.

To date, SOL‘s price has surged approximately 40% since it hit $110 on August 5th, and following a retest at $140, its standing has become even more robust.

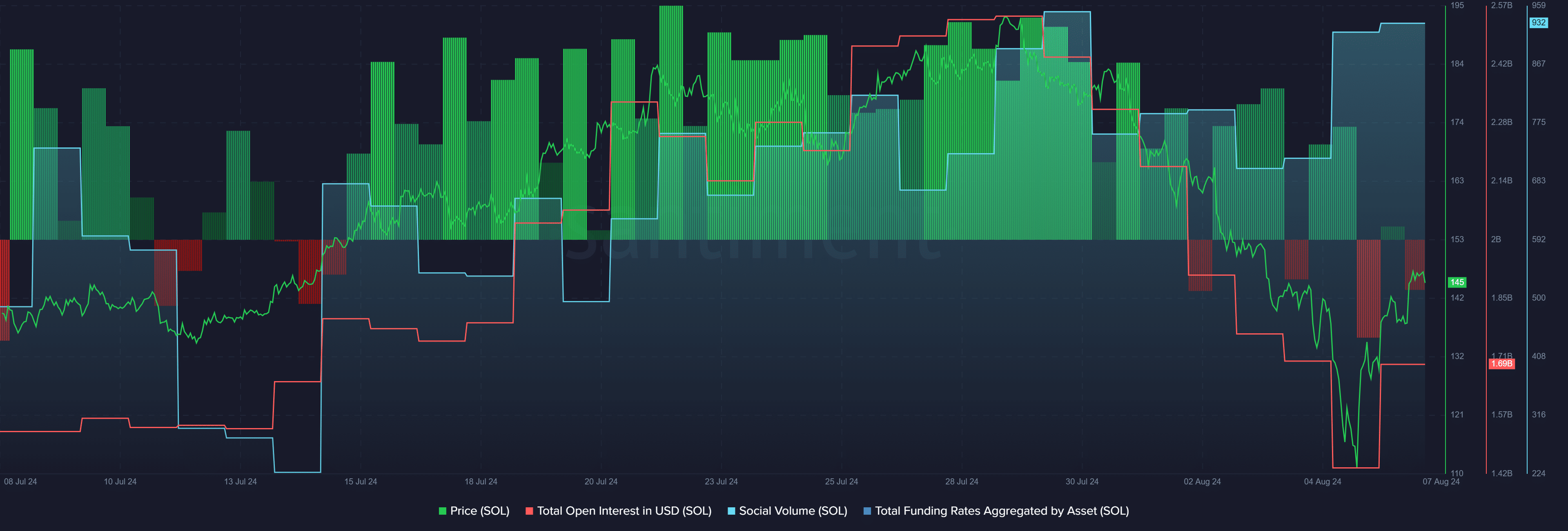

The price hike of the asset is occurring alongside escalating talks about Solana. As per data from Santiment, there’s been a 30% rise in social chatter about SOL over the last two days, positioning it as the most buzzed-about token on popular social media sites.

Data shows that the majority of the social volume comes from X and Telegram.

According to information gathered from a market analysis tool, the overall number of open positions in Solana has grown by 18% within the last day, going from $1.44 billion to $1.69 billion. This suggests that there’s growing enthusiasm among traders for Solana as its price recovers.

Over the last day, the combined funding rate for SOL has dipped back into the red, falling from a marginal 0.0007% to -0.002%. This indicates that short bets on Solana’s price decrease are outnumbering long positions slightly at the moment.

Historically, Solana witnessed a quick rebound after its funding rates dropped below zero.

Based on the data from crypto.news, I’ve observed that the Relative Strength Index (RSI) for Solana is presently around the 65 mark. This suggests that Solana (SOL) may be slightly overbought at its current price level, indicating a potential need for correction or consolidation.

Currently, Solana’s price is susceptible to significant fluctuations because of the rise in open interest, potentially leading to forced sell-offs (liquidations), and an elevated Relative Strength Index (RSI).

Keep in mind that unexpected changes in the economy or politics might swiftly affect financial markets, such as stocks and even cryptocurrencies, even if there are optimistic trends in their technical analysis.

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- PUBG Mobile heads back to Riyadh for EWC 2025

- Maiden Academy tier list

2024-08-07 13:32