As a seasoned researcher with over two decades of experience navigating the complex world of financial markets and regulatory landscapes, I can’t help but feel a sense of deja vu reading about the SEC’s reluctance to approve Solana ETFs. It seems like we’re stuck in a time loop, with each new application for a crypto ETF facing similar hurdles as its predecessors.

It appears that the United States Securities and Exchange Commission (SEC) has yet to make a decision about approving Exchange-Traded Funds (ETFs) based on Solana (SOL), as they are still debating whether or not SOL should be classified as a security.

As a researcher, I’ve witnessed the long-awaited arrival of Bitcoin-based exchange-traded funds in the U.S. market after several years. The process for getting an Ethereum (ETH) ETF approved was no less complex and challenging, with issuers encountering similar hurdles along the way.

It appears that the path towards launching a Solana ETF may become significantly tougher, as the Securities and Exchange Commission seems determined to resist this process by firmly standing its ground.

Over the past few months, I’ve noticed a significant influx of funds, amounting to billions, into cryptocurrency Exchange-Traded Funds (ETFs). This trend is driven by investors who seek a more indirect way to capitalize on the price fluctuations of leading digital assets, without having to hold these assets directly.

Emboldened by the achievements of these products, it appears that providers are eager to expand options by introducing funds tied to coins that have a less established market value.

However, there’s an issue that needs attention: The Securities and Exchange Commission (SEC) has yet to determine Solana’s status as a security, and this uncertainty appears to be hindering the progress of applications due to their current stance.

Obtaining approval entails dealing with numerous documents and negotiating between the parties who issue these documents and those who regulate them. In simpler terms, this situation seems to be about filling out a lot of paperwork and coordinating with both issuers and regulators.

Recently, the focus has shifted to Cboe Global Markets, as they’ve made submissions for 19b-4 filings, representing two separate companies eager to introduce Solana Exchange Traded Funds (ETFs) within the United States.

Based on my extensive experience in the financial industry, I can confidently say that the move by VanEck and 21Shares to request permission from the SEC to list exchange-traded funds (ETFs) focused on cryptocurrencies is a strategic one. As someone who has observed the evolution of the crypto market over the years, I am aware that these two companies have already established themselves as key players in the crypto ETF sector. This latest development underscores their commitment to innovation and their belief in the potential growth of digital assets.

As someone who has worked extensively with regulatory bodies and experienced their tendency to procrastinate on important decisions, I find this move to be a strategic one. By setting a firm deadline, it forces regulators to act promptly, rather than pushing crucial matters aside until a more convenient time. However, from my past experiences, I must admit that the SEC has demonstrated a pattern of delaying decisions by kicking the can down the road. This practice is not only inefficient but also frustrating for those who are eager to see progress and move forward with their projects. Hopefully, this time will be different, and the regulators will prioritize timely action.

As a crypto investor, I’ve got some important news: The timer for potential Bitcoin ETF approval doesn’t start ticking until the 19-4b filings are officially published in the Federal Register. It appears that Cboe’s application didn’t make it that far, according to a report released yesterday.

As a seasoned investor with over two decades of experience, I’ve seen my fair share of regulatory hurdles when it comes to launching exchange-traded funds (ETFs). While the Solana ETFs may indeed have a chance of being approved at some point in the future, the recent rejection by Cboe Global Markets highlights that they might need to go back and refine their proposal. The language used in their initial submission may not have been clear or convincing enough to meet regulatory standards, which is something I’ve encountered multiple times throughout my career. It takes patience and persistence to navigate the complexities of the financial industry, and I would advise the creators of Solana ETFs to take this rejection as a learning opportunity and work on strengthening their application before resubmitting it.

What about the issuers?

As a crypto investor, I find myself pondering over another crucial aspect. Regardless of how many 19-4bs Cboe chooses to file, the creation of a Solana ETF is contingent upon an issuer submitting an S-1 form. This comprehensive document outlines their strategies and plans prior to debuting on a national exchange.

As a crypto investor, I find it noteworthy to mention VanEck’s role in the market. They are currently managing a Bitcoin Spot Exchange-Traded Fund (ETF), named HODL, which ranks seventh among numerous competitors with over $648 million in assets under management. On the other hand, their Ether ETF counterpart, ETHV, holds a more modest $58 million.

As a researcher, I find myself reporting that despite the ongoing resistance from the SEC, VanEek remains steadfast in their position, with no signs of backing down. This week, Matthew Sigel, head of digital assets research at VanEck, stated publicly…

“Keep in mind that platforms such as Nasdaq and CBOE propose rule modifications (19b-4) to introduce new Exchange Traded Funds (ETFs). Companies like VanEck are accountable for drafting the prospectus, referred to as S-1. Our application is still active.”

As a crypto investor, I’ve noticed that the situation with the 21Shares Solana ETF seems to be in limbo compared to others. This could indicate that the issuer is choosing to step aside while they navigate through the complexities of the regulatory landscape.

What makes SOL different?

As a researcher, I’m often asked about the seemingly paradoxical situation where the Security and Exchange Commission (SEC) approves Bitcoin (BTC) and Ethereum (ETH) Exchange Traded Funds (ETFs), yet remains reluctant towards Solana (SOL). To put it simply, the decision isn’t necessarily a matter of favoritism, but rather a careful evaluation of each asset’s readiness for such an investment vehicle. The SEC’s primary concern is ensuring that any ETF is underpinned by robust market infrastructure and regulatory safeguards to protect investors. While BTC and ETH have matured in these areas, SOL may still be perceived as needing more time to meet these stringent requirements.

After much deliberation, with issues like “market manipulation” and possible legal disputes with Grayscale at play, the SEC appears to have changed its stance. They now seem to believe that Bitcoin and Ether can be categorized as commodities rather than securities. The involvement of major players such as BlackRock and Fidelity in offering ETF products based on these two leading cryptocurrencies may have influenced this decision.

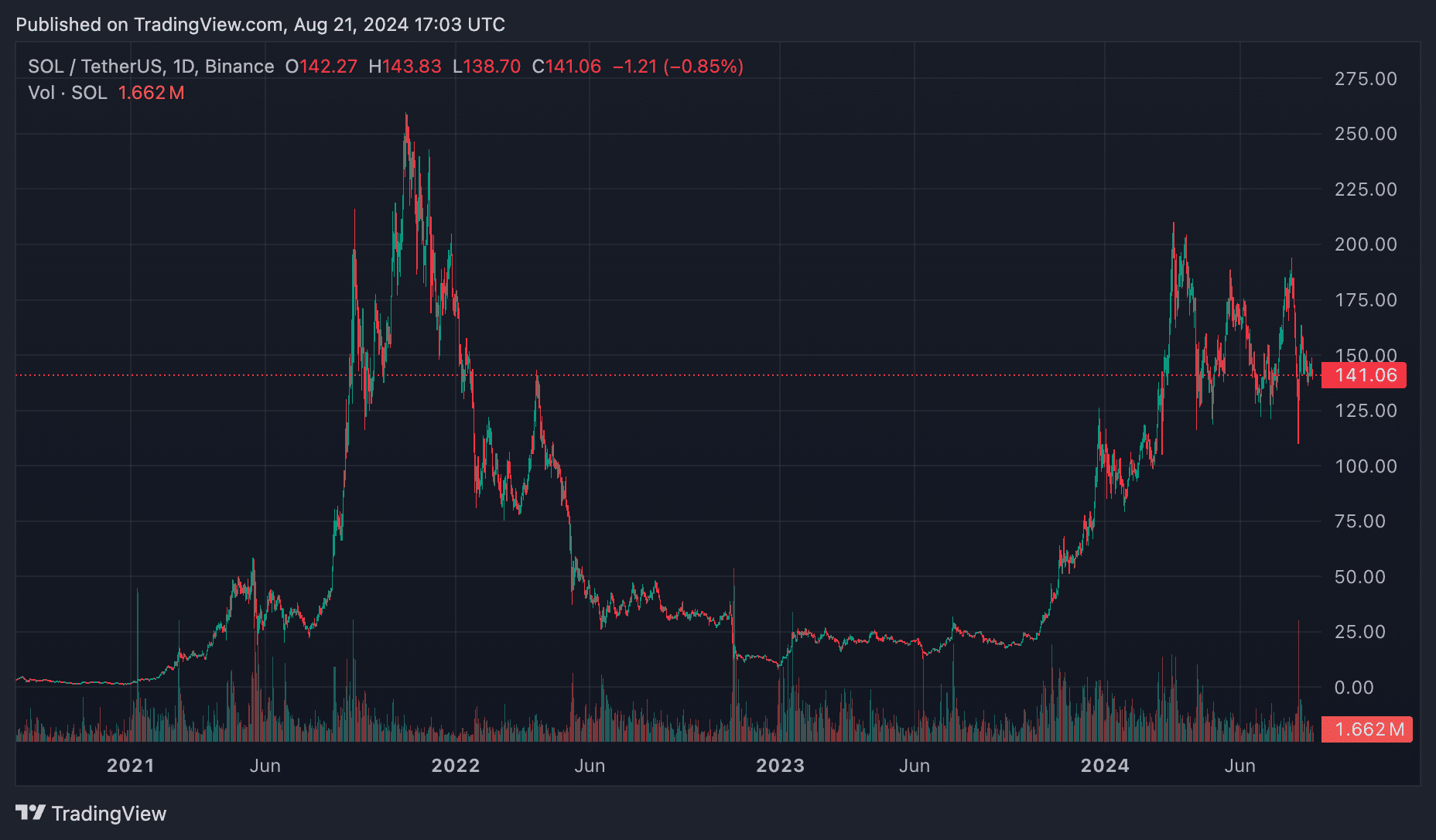

Moving forward, let’s discuss Solana, a platform with connections to Sam Bankman-Fried that has faced several high-profile downtimes. The Securities and Exchange Commission (SEC) has been aggressively pursuing actions, and they have accused companies such as Coinbase for functioning as unregistered securities brokers by enabling trading of SOL tokens initially. Softening its stance on ETF applications could potentially weaken its standing in ongoing legal battles elsewhere.

However, it’s important to acknowledge an additional challenge that requires attention: should a Solana ETF ever come to fruition, the potential for demand could be relatively low.

Brand recognition helps explain why Bitcoin exchange-traded funds have a total of $48 billion in assets under management, but Ether ETFs are lagging behind on $7.3 billion.

A significant portion of the intense action is primarily influenced by entities such as BlackRock and Fidelity, who have not yet indicated plans to develop a Solana-related product.

With both players absent, there might be little incentive for the SEC to change its stance.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Maiden Academy tier list

2024-08-21 20:19