As a seasoned analyst with over two decades of experience in the financial markets, I find Solana’s recent price action intriguing and potentially promising. The current 7.8% drop from its high this week might be disheartening to some traders, but it’s essential to remember that such corrections are a normal part of any bull run.

Solana price has fallen for two consecutive days, dropping 7.8% from its highest level this week.

On November 13th, Solana (SOL), the fourth largest digital currency, dipped to $207, which is a decrease from its peak of $225 reached this week.

The withdrawal or decrease in value was similar to that experienced by Bitcoin (BTC), along with other digital currencies such as Ethereum (ETH) and Cardano (ADA).

As a researcher, I’m cautious about taking a short position on SOL at present prices, given the current market conditions. In a recent post on X, Kingpin Crypto, a well-respected analyst with over 27,000 followers, has highlighted potential risks associated with shorting Solana. He suggests that the coin is breaking out of an eight-month trading range, which could indicate a bullish trend ahead.

For individuals considering a short position on SOL, remember that you’re contemplating shorting an asset that has recently broken out from its 8-month price range. Here’s my take…

— Kingpin Crypto (@Kingpincrypto12) November 13, 2024

As an analyst, I can attest that Solana continues to demonstrate strong foundations within the dynamic landscape of the cryptocurrency sector. To elaborate, Solana has carved out a significant role as it’s now preferred by numerous developers when creating meme coins.

As a crypto investor, I’m thrilled to note that, according to CoinGecko, the collective market capitalization of Solana meme coins has soared past an impressive $17.8 billion! Among them, Dogwifhat stands tall with a market cap of approximately $3 billion. Bonk, Peanut the Squirrel, and Popcat are also making waves, each boasting a valuation exceeding $1 billion.

In a recent development, Solana has managed to surpass Tron, moving up to the second spot among blockchains in the decentralized finance sector. The value locked within Solana now stands at approximately $7.58 billion. Some of the major players on its network include Jito, Kamino, Jupiter, and Raydium.

In October, Solana surpassed Ethereum in terms of decentralized exchange (DEX) volume. This month, it’s showing similar dominance as its trading volume has increased by 91% over the past week, reaching approximately $24.55 billion. A significant portion of this growth can be attributed to popular Solana-based meme coins such as Department of Government Efficiency and Happy Coin.

Solana price to form break and retest before roaring back

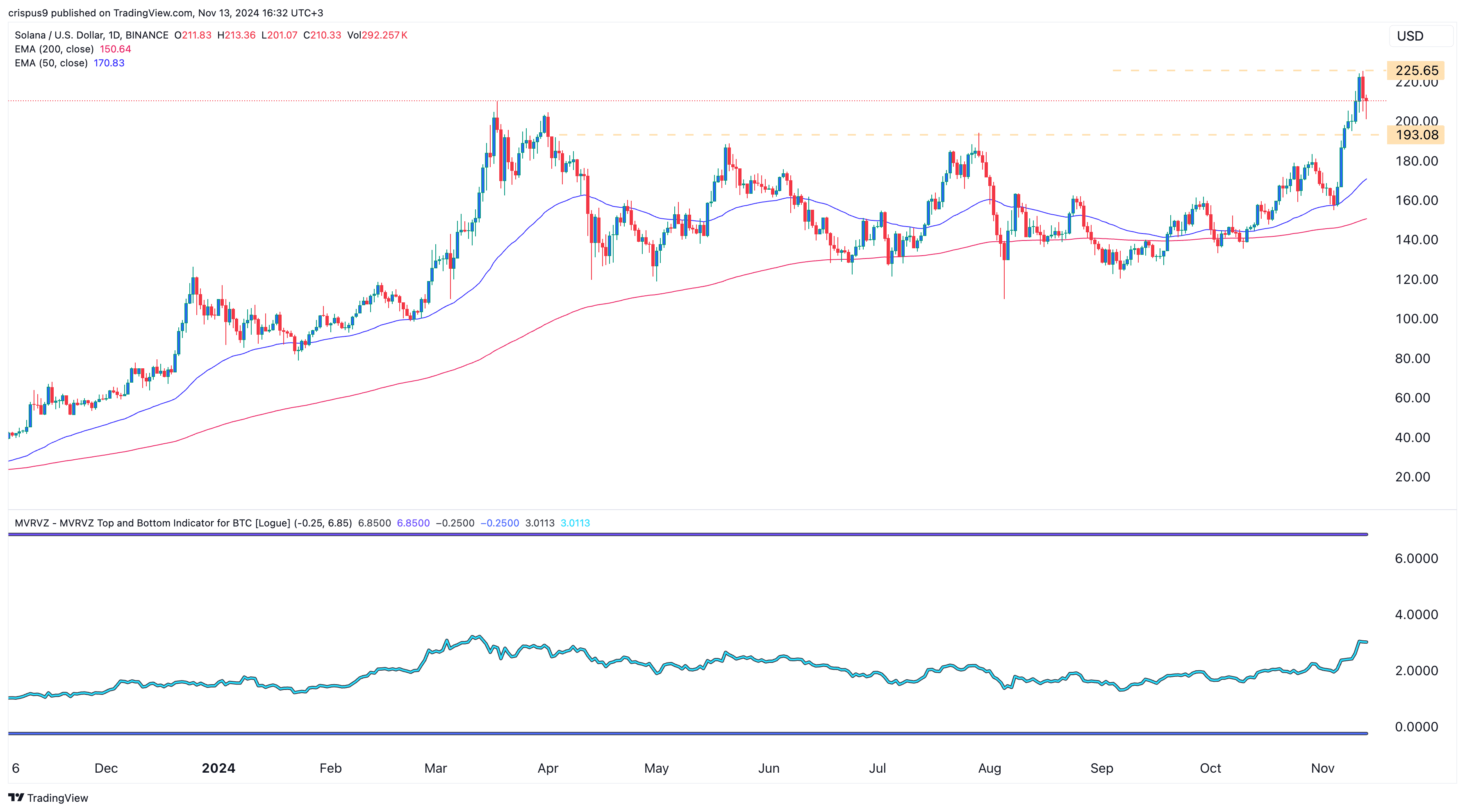

Today’s graph indicates that the Solana price dropped following its surge to $225 on Tuesday. However, it continues to stay above both its 50-day and 200-day average lines, a positive sign for the bulls. Additionally, the MVRVZ indicator has leveled off after reaching its highest point since March.

Primarily, Solana seems poised to develop a break-and-retest pattern by approaching its crucial support at $193, a level it reached on June 29th. A break-and-retest occurs when an asset climbs above a critical threshold, then retreats to retest it before continuing its upward trend. If this analysis holds true, there’s a strong possibility that Solana could bounce back and revisit the $250 level in the short term.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- USD CNY PREDICTION

- Silver Rate Forecast

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Maiden Academy tier list

2024-11-13 17:32