Based on a recent S&P analysis, a proposed bipartisan legislation for stablecoins could potentially grant banks a competitive edge in the digital asset custody industry, thereby fostering rivalry among various institutions.

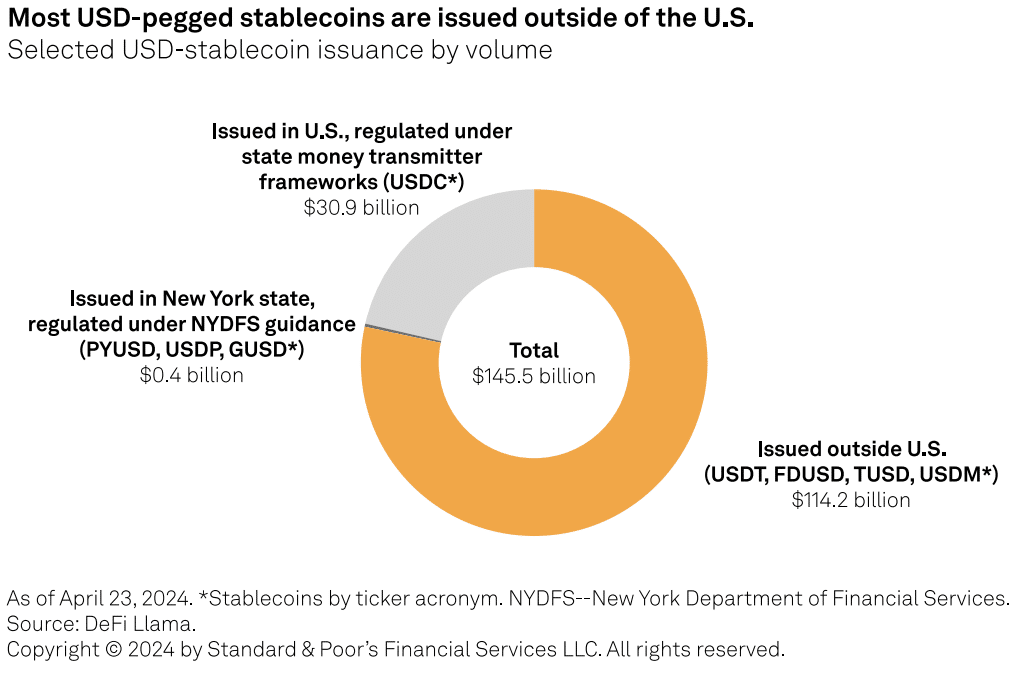

If passed, the Lummis-Gillibrand Stablecoin Act introduced on April 17 appears poised to bring regulatory certainty to the $157 billion stablecoin sector, now largely controlled by Tether (USDT).

Stablecoins represent a type of cryptocurrency that maintains a consistent value by being linked to traditional currencies, such as the US dollar, in an unpredictable digital financial market. Coins like Circle’s USD Coin (USDC) function as bridges, allowing easy conversion between cryptocurrencies and fiat money.

The proposed legislation allows US banks to create digital tokens backed by the value of fiat currency, without any minimum requirements. However, companies providing related services, but not holding a banking license, must ensure their token market capitalization remains below $10 billion.

Based on Andrew O’Neil’s perspective as Managing Director and Co-Chair of S&P Global’s Digital Assets Research Labs, the regulatory framework is expected to benefit banks by providing them an advantage over other market participants and encouraging the adoption of blockchain technology in the financial sector. This can be achieved through the tokenization of assets and digital bond issuance.

O’Neil pointed out that on-chain payment infrastructure enables swift and productive transactions, using BlackRock’s Ethereum-based fund as a case in point.

Blackrock’s investment group BUIDL has an innovative example using the Ethereum blockchain. This tokenized fund, investing in U.S. treasuries, features a USDC stablecoin-denominated liquidity pool. Investors can quickly and around-the-clock redeem their share tokens for USDC through smart contracts.

Andrew O’Neil, Managing Director and Co-Chair of S&P Global’s Digital Assets Research Labs

The Lummis-Gillibrand bill won’t affect American companies such as PayPal using USD, but it doesn’t allow for offshore entities like Tether to operate within its framework. This could potentially affect Tether’s market presence, but O’Neil pointed out that most of Tether’s transactions and volume take place outside the US.

Furthermore, regulations do not apply to decentralized stablecoins such as DAI from Maker and FRAX from Frax Finance. Policymakers generally prefer centralized options like USDC because they resemble traditional financial systems, according to O’Neil.

The S&P forecast indicated that there would be an increase in new entrants in the digital asset custody sector, following SEC rule changes which exempted custodians from reporting cryptocurrencies on their financial statements. crypto.news contacted O’Neil and the S&P for more information about the legislation and its potential consequences.

The new policy for digital asset custody sets it apart from the standard treatment of most financial assets kept in safekeeping, which are typically not reflected on balance sheets. This difference introduces a capital requirement that might deter U.S. financial institutions from offering digital asset custody services. By removing this hurdle, the new rules could stimulate more competition within the industry.

Andrew O’Neil, Managing Director and Co-Chair of S&P Global’s Digital Assets Research Labs

Read More

- 10 Most Anticipated Anime of 2025

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- USD CNY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Castle Duels tier list – Best Legendary and Epic cards

- Maiden Academy tier list

- Cookie Run Kingdom: Lemon Cookie Toppings and Beascuits guide

- Silver Rate Forecast

- USD MXN PREDICTION

2024-04-24 23:34