As a seasoned analyst with over two decades of experience in the financial markets, I’ve witnessed countless trends and shifts that have shaped the economic landscape. The recent surge in Bitcoin demand from exchange-traded funds (ETFs) is undoubtedly one of the most intriguing developments I’ve encountered in my career.

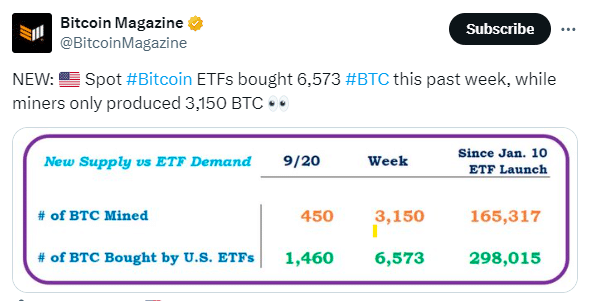

Over the past week, Bitcoin ETFs have acquired approximately 6,573 Bitcoins, whereas miners produced about 3,150. This significant discrepancy is serving to further increase the scarcity of an already limited Bitcoin supply.

Bitcoin has a maximum supply of only 21 million coins, with the final coin anticipated to be minted around 2140. In contrast to other emerging cryptocurrencies that often boast larger supplies, Bitcoin stands out for its scarcity.

The shortage of Bitcoins is becoming increasingly apparent as institutional investors jump into the market, particularly following the recent green light given to Spot Bitcoin ETFs within the U.S. This decision has attracted not only individual investors but also large institutions, significantly boosting the demand for Bitcoin.

Over the past week, Bitcoin’s value climbed approximately 9% to reach $64,518. Currently, its worth is estimated at $64,022.38, while its trading volume amounts to $25.85 billion and its market capitalization stands at a staggering $1.26 trillion. Experts predict that prices will continue to rise as ETF issuers are purchasing more Bitcoin than miners can produce.

Based on Bloomberg analyst Eric Balchunas’ predictions, significant issuers such as BlackRock could potentially have three times their current bitcoin holdings by the end of next year. When investors buy shares in these ETFs (Exchange Traded Funds), the issuers need to acquire an equivalent amount of Bitcoin, thereby increasing both the supply and demand for Bitcoin.

Given that institutional investors can take up to a year for their risk evaluations, it’s likely that these ETFs will receive additional funding in the near future due to ongoing interest. Such consistent demand could potentially lead to intriguing fluctuations in Bitcoin prices over the next while.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Silver Rate Forecast

- USD CNY PREDICTION

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-09-23 09:08