As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen trends come and go, bull runs and bear markets alike. The recent developments in Bitcoin and Ethereum ETFs have piqued my interest, given the contrasting trajectories they are currently on.

As someone who has closely followed the cryptocurrency market for several years now, I have to say that this week’s developments are particularly noteworthy. Bitcoin ETFs have started off on a positive note, which is encouraging given my own experiences with the volatility of the crypto market. However, it is concerning to see spot Ether ETFs experiencing negative flows for the third consecutive trading day. I have seen similar patterns before, and history has shown that such trends can be indicative of larger market movements. It will be interesting to see how this unfolds in the coming days.

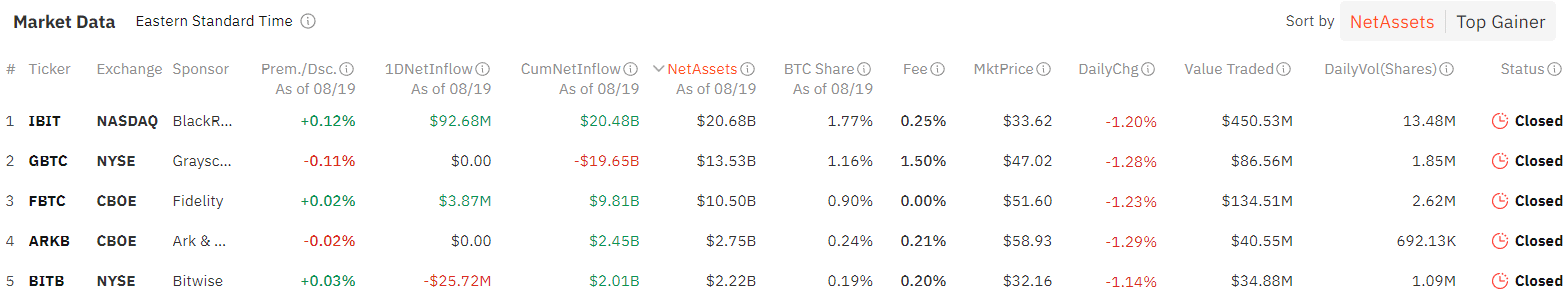

According to SoSoValue’s data, there was an inflow of approximately $61.98 million into the twelve U.S.-listed Bitcoin exchange-traded funds on August 19, which is a 72% rise compared to the net inflows of around $36.01 million recorded on the same day.

In a recent update, it was BlackRock’s IBIT that took the lead with an impressive $92.7 million inflow, raising its total since launch to a staggering $20.48 billion. Trailing closely behind was Fidelity’s FBTC, reporting modest additional funds of $3.9 million. Interestingly, these two were the sole investment funds that reported consecutive days of increased investments.

On August 19th, Bitwise’s BITB and Invesco Galaxy’s BTCO experienced net withdrawals worth approximately $25.7 million and $8.8 million respectively, partially reversing the growth they had previously achieved. Meanwhile, Grayscale’s GBTC saw no inflows or outflows for the day, which is a first since it began operation. Over time, this investment product has seen significant continuous outflows amounting to a staggering $19.64 billion since its inception.

Here are two possible ways to rephrase the given sentence in natural and easy-to-read language:

As a researcher, I’ve found some intriguing figures from crypto.news – over the past 24 hours, the global cryptocurrency market capitalization has experienced a significant boost of approximately 2.4%, currently sitting at an impressive $2.24 trillion. Moreover, the total trading volume for that same period has shown a substantial increase, reaching roughly $79.5 billion. At the time of my analysis, Bitcoin (BTC) was on the rise, having surged by 4.2% to trade at $60,937.

Ether ETFs record $13.5m in outflows

Instead, let me rephrase that for you: On August 19th, a total of $13.52 million was withdrawn from the nine Ethereum ETFs, marking the third straight day these funds experienced withdrawals.

In summary, Grayscale’s ETHE had the largest outflows at $20.3 million on a single day, adding to a total outflow of approximately $2.43 billion since it began. Conversely, only Grayscale Bitcoin Mini Trust and Bitwise’s ETHW recorded inflows of $4.9 million and $1.9 million respectively for the day. The remaining six Ethereum ETFs experienced no activity that day.

Trading volume for Ether ETFs dropped to $124 million, significantly lower than the $185 million seen the previous trading day. These funds have experienced a cumulative net outflow of $433.62 million to date. As of press time, Ethereum (ETH) soared by 2.3%, trading at $2,673.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- PUBG Mobile heads back to Riyadh for EWC 2025

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Arknights celebrates fifth anniversary in style with new limited-time event

- Mech Vs Aliens codes – Currently active promos (June 2025)

- USD CNY PREDICTION

- Every Upcoming Zac Efron Movie And TV Show

- Superman: DCU Movie Has Already Broken 3 Box Office Records

2024-08-20 11:52