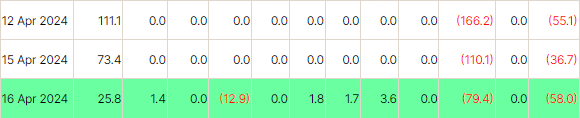

On Tuesday, April 16, there were withdrawals of $58 million from Bitcoin ETFs tracked by Farside Investors. This marks the third straight day of outflows, suggesting a decrease in market activity for Bitcoin ETFs.

In spite of the ongoing decrease, there are indications of progress. The Grayscale Bitcoin ETF GBTC recorded inflows of $79.4 million on April 16, bringing the total outflows to $16.46 billion. Moreover, ARK Invest’s Bitcoin ETF ARKB experienced withdrawals amounting to $13 million.

In recent times, the number of Bitcoins leaving Grayscale Bitcoin Trust (GBTC) has decreased, and the same trend is seen with investments in spot Bitcoin ETFs. On a notable day, BlackRock’s iShares Bitcoin Investment Trust (IBIT) recorded an impressive net inflow of $25.78 million, bringing its total inflows to over $15.3 billion.

According to Bloomberg ETF analyst James Seyffart, it’s normal for ETFs, including Bitcoin-focused ones, to experience days with no new investments. This phenomenon should not be interpreted as a negative sign.

In the world of ETFs, shares are generated or deleted in groups (creation units) as a response to differences in supply and demand, and trades will only be executed when the associated expenses are more advantageous than those of conventional trading methods.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Castle Duels tier list – Best Legendary and Epic cards

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-04-17 10:28