As a seasoned analyst with over two decades of experience in the financial markets, I must say that the recent trends in Bitcoin and Ethereum ETFs are intriguing. The consistent inflows into spot Bitcoin ETFs, particularly the leadership shown by BlackRock’s IBIT, is reminiscent of a well-orchestrated bull run in traditional stocks. However, the contrasting outflows from spot Ethereum ETFs suggests a more cautious approach to the world’s second-largest cryptocurrency.

Over the past six days, Bitcoin ETFs have consistently experienced an increase in investments, while Ethereum ETFs have been facing a series of withdrawals, marking their sixth straight day of decreased investment.

Based on figures from SoSoValue, Bitcoin exchange-traded funds occupying the 12th position experienced a significant surge in net investments on August 22, amounting to approximately $64.91 million. This is a notable increase of around 65% compared to the $39.42 million in net inflows recorded on August 21.

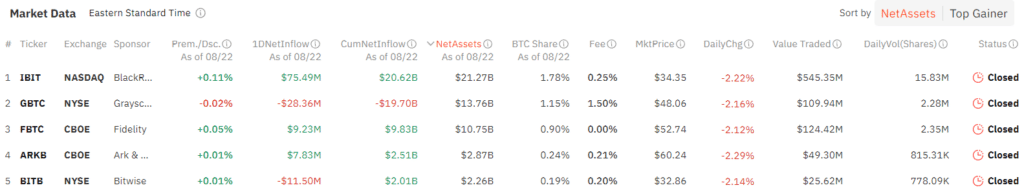

The Bitcoin ETF managed by BlackRock’s IBIT, the largest in this category by total assets, saw investments of approximately $75.5 million last week, adding to its previous total of around $20.6 billion. Fidelity’s and ARK 21Shares’s Bitcoin ETFs came next with inflows of $9.2 million and $7.8 million respectively.

Over the past nine days, both WisdomTree’s BTCW and VanEck’s HODL saw smaller investments totaling $4.8 million and $3.4 million respectively, indicating less activity compared to previous periods.

Grayscale’s GBTC recorded withdrawals of $28.4 million, adding up to a total of $19.69 billion since its launch. On the other hand, Grayscale’s smaller Bitcoin trust ETF attracted investments worth $4 million. Similarly, Bitwise’s BITB saw outflows amounting to $11.5 million. The remaining four Bitcoin ETFs maintained a balanced position.

Trading volume for BTC ETFs dropped to $899.6 million on Aug. 22, significantly lower than the $1.42 billion seen on Aug. 21. These funds have recorded a cumulative net inflow of $17.62 billion since inception. At the time of writing, Bitcoin (BTC) was up 0.3% over the past day, trading at $61,058, per data from crypto.news.

Over the past six days, there’s been a steady decrease in investments from the group of Ethereum ETFs, with a total withdrawal of approximately $874,610 recorded on August 22.

Again, Grayscale’s ETHE fund experienced outflows, this time amounting to approximately $19.8 million. This brings its total outflow since launch (July 23) to a whopping $2.52 billion. Conversely, Fidelity’s FETH, Grayscale’s ETH, and VanEck’s ETHV were the only Ethereum ETFs to experience inflows on this day – with Fidelity’s FETH recording the largest at $14.3 million, followed by Grayscale’s ETH at $3.7 million, and VanEck’s ETHV at $1 million. The remaining five Ethereum ETFs saw no activity on this particular day.

On August 22nd, the daily trading volume for these investment instruments decreased significantly to approximately $93.8 million compared to the previous day. Moreover, Ether exchange-traded funds (ETFs) have collectively experienced a net outflow of about $458.95 million since their inception. At the time this information was published, Ethereum (ETH) was also experiencing an increase of 1.4%, with each unit being traded at around $2,669.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- USD CNY PREDICTION

- Castle Duels tier list – Best Legendary and Epic cards

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- Maiden Academy tier list

- Cookie Run Kingdom: Lemon Cookie Toppings and Beascuits guide

- USD MXN PREDICTION

2024-08-23 11:30