As a seasoned researcher with a keen eye for financial trends and a knack for deciphering market movements, I find the recent developments in the Bitcoin and Ethereum ETF markets quite intriguing. The net outflows from Bitcoin ETFs, particularly the significant outflow from ARK 21Shares’ ARKB, suggest a cautious approach by investors. However, the collective net inflows of $17.95 billion since January indicate a broader confidence in these investment vehicles.

On August 28, U.S.-based Bitcoin exchange-traded funds experienced a combined withdrawal of approximately $127.05 million, with the majority of these outflows coming from ARK 21Shares’ ARKB fund.

As a crypto investor, I noticed that the data from SoSoValue revealed a shift in the trend for the 12 U.S. spot Bitcoin exchange-traded funds on August 28. This marked a break in an eight-day streak of positive inflows we had been experiencing. During this optimistic eight-day period, these funds successfully accumulated a total of $756 million.

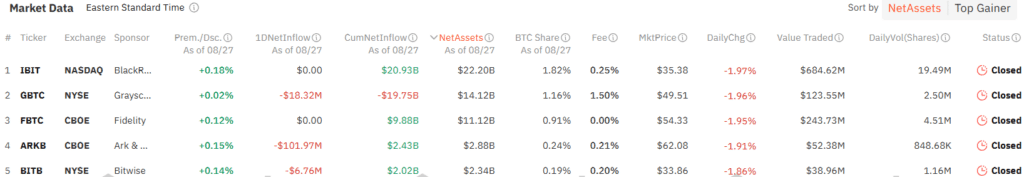

On Tuesday, there were net withdrawals totaling $127.05 million from U.S. Bitcoin investment funds. Standing out among these was ARK 21Shares’ ARKB with a record-breaking outflow of $101.97 million – the largest ever for this fund, as per data from SoSoValue. Grayscale’s GBTC also reported withdrawals worth $18.32 million, while Bitwise’s BITB experienced $6.76 million in outflows. At the time of writing, Valkyrie’s BRRR did not have updated figures available.

During that specific day, eight more funds, including BlackRock’s IBIT, experienced no new investments. Excluding BRRR, the combined trading volume of U.S. Bitcoin spot funds amounted to approximately $1.2 billion. Since January, these funds have collectively received net inflows worth about $17.95 billion.

At the same time, the broader market is seeing developments that could impact investor behavior.

The Nasdaq has applied for permission from the U.S. Securities and Exchange Commission to introduce Bitcoin Index Options. These options will follow Bitcoin’s price changes based on the CME CF Bitcoin Real-Time Index. If approved, this move aims to enhance market transparency and provide investors with more effective tools for managing and safeguarding their cryptocurrency investments.

As a researcher, I’m excited to note that CME Group is considering the introduction of smaller Bitcoin futures contracts. This move could potentially attract a larger number of retail investors like myself who might find these smaller contracts more accessible and manageable in terms of investment.

Currently as I’m typing this, Bitcoin (BTC) had experienced a decrease of approximately 5.8% over the previous 24 hours, with its price standing at around $59,160 according to information from crypto news sources.

Ether ETFs continue to record outflows

Over the past nine days, there has been a steady decline in investments from Ethereum ETFs, totaling approximately $3.45 million on August 28. This marks the ninth straight day of investors withdrawing their funds.

As a researcher studying the flow of funds in Ethereum ETFs, I observed yet another outflow led by Grayscale’s ETHE, with an amount of $9.2 million exiting the fund. This marks a total outflow of $2.55 billion since its debut on July 23. Interestingly, Fidelity’s FETH and Bitwise’s ETHW were the only ones to report inflows, with $3.9 million and $1.9 million respectively, for the day. The remaining six Ethereum ETFs did not see any flows.

On August 28th, the trading volume for these investment instruments surged to a daily total of approximately $129.9 million, marking an uptick compared to the previous day. Meanwhile, the Ethereum-focused ETFs have collectively witnessed a net outflow amounting to about $481.32 million since their inception. As for Ethereum (ETH), at the time of writing, it was experiencing a 8% decrease, with trades being made at roughly $2,463.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Castle Duels tier list – Best Legendary and Epic cards

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-08-28 10:30