As a seasoned researcher with extensive experience in the cryptocurrency market, I find the recent surge in net inflows for spot Bitcoin ETFs from July 15 to July 19, 2024, particularly noteworthy. With a total inflow of $17.08 billion during this period, it is an unmistakable sign of renewed investor confidence and market optimism in the world’s largest cryptocurrency.

From July 15 to July 19, 2024, a total of $17.08 billion flowed into bitcoin spot ETFs in the form of net purchases.

FBTC registers largest inflow

As a researcher studying the Bitcoin (BTC) Exchange-Traded Fund (ETF) market, I’ve observed significant inflows on two occasions in July. Specifically, on July 19, investors poured in $383.6 million, which represents the second largest daily inflow for the month. Previously, on July 16, an even larger sum of $422.9 million flowed into these funds.

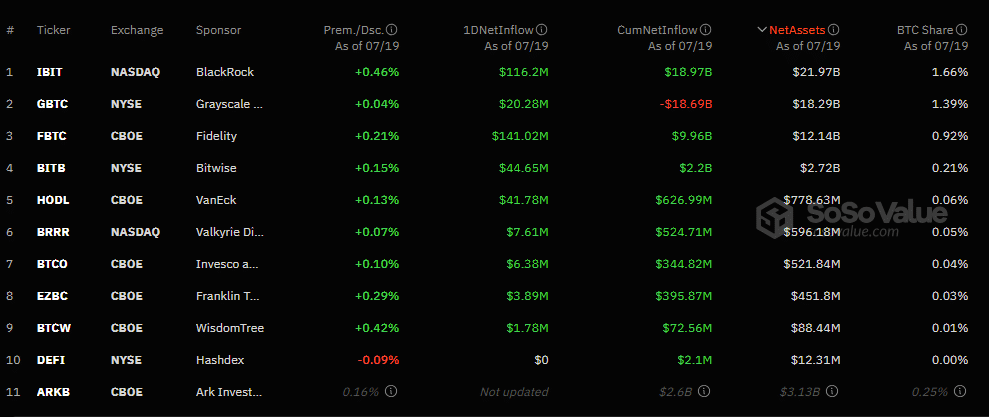

According to SoSoValue’s data, the Fidelity Wise Origin Bitcoin Fund (FBTC) and BlackRock’s iShares Bitcoin Trust (IBIT) were the top two attractors of investment, with inflows of $141 million and $116.2 million respectively.

Bitcoin ETFs like the Bitwise Bitcoin ETF (BITB) and the VanEck Bitcoin Trust ETF (HODL) experienced modest yet notable inflows, indicative of growing investor enthusiasm towards these products.

The inflow for Bitwise’s BITB was the third largest at $44.6 million, while VanEck’s HODL came in a close second with a contribution of $41.8 million to the overall daily intake.

Despite a series of successive outflows, Grayscale’s GBTC managed to attract $20.3 million and continued to hold significance in the market with a net asset value of $18.29 billion.

In other parts, the CoinShares Valkyrie Bitcoin Fund ETF (BRRR) and Invesco’s BTCO had managing amounts of $7.6 million and $6.4 million each.

As an analyst, I’ve observed that ARK’s AKB fund remained unchanged during yesterday’s trading session, whereas Franklin Templeton’s EZBC and WisdomTree’s BTCW recorded inflows of $3.9 million and $1.8 million respectively to conclude the day’s transactions.

Good week for spot Bitcoin ETFs

During the past week, the Bitcoin ETF market experienced a significant increase in investments, reaching a six-week peak. This surge was primarily fueled by restored investor faith and market positivity. Notable inflows were reported by Farside Investors and SoSoValue, totaling approximately $422.5 million by July 16th.

Although crypto.news reported concerns about midweek corrections, and there was a significant 87% decrease in ETF inflows following a record-breaking day, the general mood among investors stayed optimistic.

It’s intriguing that the significant rise in the adoption of BTC spot ETFs coincided with Bitcoin’s enhanced performance. In just the previous day, Bitcoin experienced a 5% growth, while over the last week, its value surged by an impressive 14.4%.

As I pen this down, Bitcoin was transacting at a price of $66,541, resulting in a total market value of approximately $1.3 trillion. Despite the current cost being around 9.5% below its record high, Bitcoin has managed to surpass the overall growth of the cryptocurrency sector, which has risen by 10.50% based on data from CoinGecko.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- Gold Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Maiden Academy tier list

- Hero Tale best builds – One for melee, one for ranged characters

2024-07-20 17:36