As a researcher with a background in financial markets and a keen interest in digital currencies, I find the recent trend of consistent positive inflows into spot Bitcoin ETFs in the U.S. intriguing. The data from Farside Investors indicates that investors have collectively poured $105.1 million into these products during the past week, with the majority going to Fidelity’s offering. This trend has been ongoing since May 10, with only one day of zero net inflows.

In the United States, Bitcoin (BTC) exchange-traded funds (ETFs) have reported weekly increases for the fourth straight time. Meanwhile, Bitcoin is currently holding steady.

As a researcher analyzing data from Farside Investors, I’ve discovered that on June 3, investors poured in $105.1 million into spot Bitcoin ETFs based in the United States. This marks the beginning of the fourth consecutive week where such investments have seen an increase.

Approximately seven times the total inflow came from Fidelity Wise Origin Bitcoin Fund, amounting to $77 million. Bitwise Bitcoin ETF and ARK 21Shares Bitcoin ETF recorded inflows of around $14.3 million and $10.7 million respectively.

Additionally, the VanEck Bitcoin Trust ETF (HODL) and WisdomTree Bitcoin Fund (BTCW) experienced less significant inflows, with approximately $2 million and $1.1 million in net investments, respectively.

Since its debut in the United States, iShares Bitcoin Trust (IBIT) has attracted over $16.65 billion in investments. On June 3rd, however, this largest Bitcoin ETF maintained a neutral stance. Similarly, Grayscale Bitcoin Trust (GBTC) reported no net inflows or outflows during the same period.

Significantly, there has been a consistent inflow of funds into Bitcoin ETFs starting from May 10, with just one exception on May 27 when no money was added.

The current positive streak for Bitcoin ETFs in the United States is the second longest on record, lasting 16 days. Previously, these financial products experienced an uninterrupted period of investment inflows for a total of 18 days between January 26 and February 20.

Bitcoin’s reaction

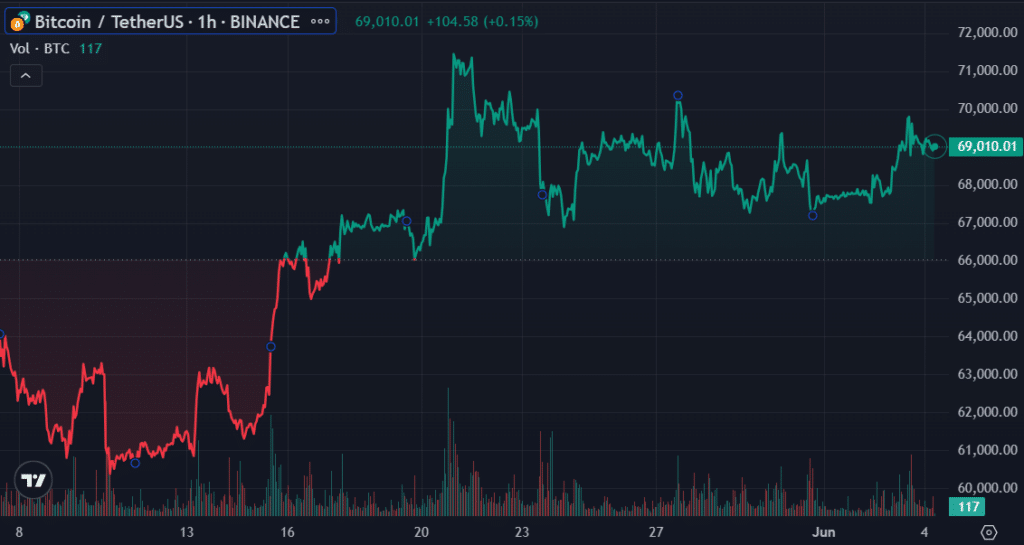

Over the past 24 hours, Bitcoin has primarily hovered between $68,800 and $69,300. At approximately 13:50 UTC on June 3, it reached a new seven-day peak of $70,230.

I’ve analyzed the data and found that Bitcoin’s price dipped by 0.11 percent in the last 24 hours, currently hovering around $69,020. The digital currency’s market capitalization stands tall at a staggering $1.36 trillion. With approximately 50.4% of the total cryptocurrency market share, Bitcoin remains the undisputed leader in the realm.

Data shows that Bitcoin’s daily trading volume surged by 30%, reaching $29.5 billion.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Castle Duels tier list – Best Legendary and Epic cards

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-06-04 10:56