What you need to know (or not, but hey, it’s a great excuse for coffee):

- The GENIUS Act is trying its best to babysit the $260-billion stablecoin playground by shoving it into the U.S. financial system’s daycare.

- Word on the street is that clearinghouses could make stablecoins feel safe — like a warm hug from your grandma after a bad breakup.

- Big banks, probably suffering from FOMO, are eyeing stablecoin issuance, because nothing says “I’m smart” like leveraging their clearing house experience, right?

Looks like the GENIUS Act is about to pull a rabbit out of a regulatory hat, just in time to turn our friend the $260-billion stablecoin market into a well-behaved regular at the bar of U.S. finance!

Now, they want to jazz it up a bit by inviting clearinghouses to the party — think of them as the bouncers ensuring nobody gets too rowdy with their tokenized cash. 🎉

Why clearing is like having a safety net with a little pizzazz

So, these clearinghouses — or as I like to call them, the “grown-up babysitters” — are here to save the day by acting as a buffer between buyers and sellers. They collect, net, and occasionally offer a shoulder to cry on when members default. Mundane stuff until it isn’t—just like life! 😀

And now, we introduce stablecoins to this soiree! They promise delightful dollar-for-dollar redemption but will dance on borderless blockchains, where liquidity can vanish quicker than your diet during the holidays. 🎈

Currently, each stablecoin issuer is a lone ranger battling redemption chaos. If only they had pooling systems to manage risks and some high-tech regulators waving their magic wands around. 🪄

Critics may scream, “Decentralization is dead!” but fear not, the GENIUS Act is waving a big bat of hope for the stablecoin industry to follow suit. 🦇

Why Congress is giving us a gentle shove

Hidden in Section 104 of the GENIUS Act, which no one reads, is a “green light” for central clearing: stablecoin reserves can only include Treasury repo if it plays nice in a centrally cleared sandbox. 🏖️

This little nugget could germinate big ideas! Once issuers start holding a clearinghouse’s hand for collateral management, extending that model to tokens should be a hop, skip, and a jump away — especially as the transaction windows shrink to the size of a Post-it note. 📝

Wall Street sees dollar signs & maybe sparkles!

The DTCC, or the “super utility” processing a staggering $3.7 quadrillion (yes, you read that right) annually, is eyeing the launch of its own stablecoin. As for the big bank club, they’re putting on their best outfits for a joint stablecoin venture — they’re hip and they know it! 💃

As they step into this wacky race, the strategies they bring might just set the gold standard — or at least a decent aluminum one! (Let’s not kid ourselves, Bank of America and Citi are all-in to create their own token, too.)

Exciting governance models — because why not?!

The Bank for International Settlements recently had a few things to say, suggesting stablecoins might just be rattling the “sound money” cages without the right safety nets. If a giant player goes belly-up, taxpayers might end up asking, “Where’s my bail-out?” Oh, joy! 🎠

How a stablecoin clearinghouse could work (spoiler: it’s like organized chaos)

- Membership & capital – Issuers, who may or may not be sporting capes, will join the clearinghouse by posting top-notch collateral like it’s a middle school talent show!

- Netting & settling – The clearinghouse will turn participants’ transactions into a nicely wrapped gift and settle them once everyone agrees it’s Christmas! 🎁

- Redemption windows – If queues get crazier than a Black Friday sale, the utility could impose fair payouts or do a good old-fashioned auction — sell, sell, sell, before the panic sets in!

- Transparency & data – Every token gala transfer will be at the clearinghouse’s fingertips, resulting in one consolidated ledger — something long overdue in today’s wild-west. 🤠

Congress is writing the rules, Wall Street’s flexing its muscle, and global rulers are prepping their playbooks. Sounds like a recipe for comedy gold! 🍿

Expect to see niche uses making a splash — like giving institutions a lifeline and the Fed a cute little safety net. Unless crypto consortiums leap in, we may witness the rise of good old TradFi-style clearinghouses! 🏦

Disclaimer: The opinions here are totally mine (gold star for transparency) and don’t reflect the views of CoinDesk or their entire family of products. 🍕

The Protocol: Layer-2 Eclipse’s Airdrop Goes Live (yes, it’s more exciting than a trip to the DMV)

NEAR surges 8% as Altcoins Turn Bullish (thank heavens for small victories!)

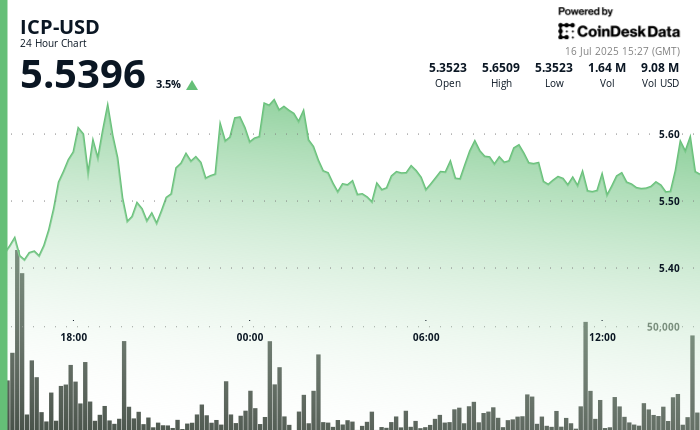

ICP Climbs With Broader Crypto Rally, Holds Gains Above $5.50 (a rollercoaster we all love to ride!)

ATOM Surges 4% as Cosmos Abandons EVM Strategy for Interoperability Focus (because why not mix things up?)

It’s Time to Promote the Correct Crypto Allocation (like a pizza party, but for your wallet!)

Bank of America Joins Stablecoin Rush as CEO Moynihan Says Work Already Underway (let me just sip my coffee and assess the madness!)

Cantor Equity Partners 1 Gains 25% on $3.5B Bitcoin Deal With Adam Back (they must be laughing all the way to the bank!)

Altcoin Season Returns? Bitcoin Consolidates With ETH, SUI, SEI Among Those Taking Charge (it’s like every coin is putting on its best dress to impress!)

PayPal Blockchain Lead José Fernández da Ponte Joins Stellar (join the dance party, everyone is invited!)

Peter Thiel Reveals 9.1% Stake in Tom Lee’s ETH-Focused Bitmine Immersion Technologies (the stakes just got higher, folks!)

Crypto Trading Technology Firm Talos to Buy Data Platform Coin Metrics for Over $100M: Source (it’s raining dollars, hallelujah!)

Arbitrum’s ARB Surges After Appearing Among Supported Chains for PayPal’s $850M PYUSD Stablecoin (what a time to be alive and possibly broke!)

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- Maiden Academy tier list

- PUBG Mobile heads back to Riyadh for EWC 2025

2025-07-16 21:06