As a seasoned crypto investor with a knack for spotting promising projects, I’ve been closely watching Sui (SUI) and its meteoric rise. Having witnessed the crypto market’s volatility over the years, I must admit that SUI’s recovery from last month’s lows to a six-month high is nothing short of impressive.

On October 8th, Sui, frequently referred to as Solana’s competitor, saw further growth due to an unprecedented increase in its futures trading market.

On October 8th, SUI reached a peak of $2.14, marking its highest price in six months and a surge of 181% from its lowest point last month. This impressive recovery made it the top performer among the top 100 cryptocurrencies ranked by market capitalization that day.

currently, the total value (market capitalization) of Sui is approximately $5.46 billion, and its daily trade volume has increased significantly to around $2.26 billion.

Key developments fuelling growth

“The main driving force behind Sui’s recovery has been the high demand observed in the futures market. According to CoinGlass data, open interest for Sui peaked at an unprecedented $564 million on October 8, surpassing its previous record of $502 million. This marked a steep increase from the low levels seen in September, where open interest remained below $140 million, implying a significant influx of speculative investments.

The amount of ongoing futures contracts, both buy and sell orders that haven’t been fulfilled yet, is measured by open interest. An increase in this value often indicates increased curiosity and trust from traders.

A significant portion of Sui’s future activities is primarily influenced by Bybit, with Binance and Bitget running a close second. It’s worth mentioning that Bybit’s move to add SUI to its Launchpool, which is a first for a non-Mantle token, has significantly boosted market activity.

In addition to its performance in the futures market, Sui’s underlying strengths are also strengthening. The combined value locked within Sui’s decentralized finance systems has significantly increased by more than 61.2% over the past month, reaching approximately $1.089 million. This places Sui among the top seven chains in terms of value, demonstrating its growing significance in the blockchain landscape.

Moreover, it’s worth noting that the Sui network has recently outpaced Solana in daily transaction volume, a significant indicator of network activity. Specifically, on October 8, Sui processed 58.37 million transactions compared to Solana’s 35.41 million, suggesting a growing user base and increasing adoption for the Sui network.

The introduction of Grayscale’s SUI Trust in September has given an extra boost to the token’s recent surge in value. This trust provides accredited investors with the opportunity to invest in the SUI token, which could be a significant factor in the token’s price increase as it expands its investment pool to institutional investors.

Technical indicators signal sustained bullish momentum

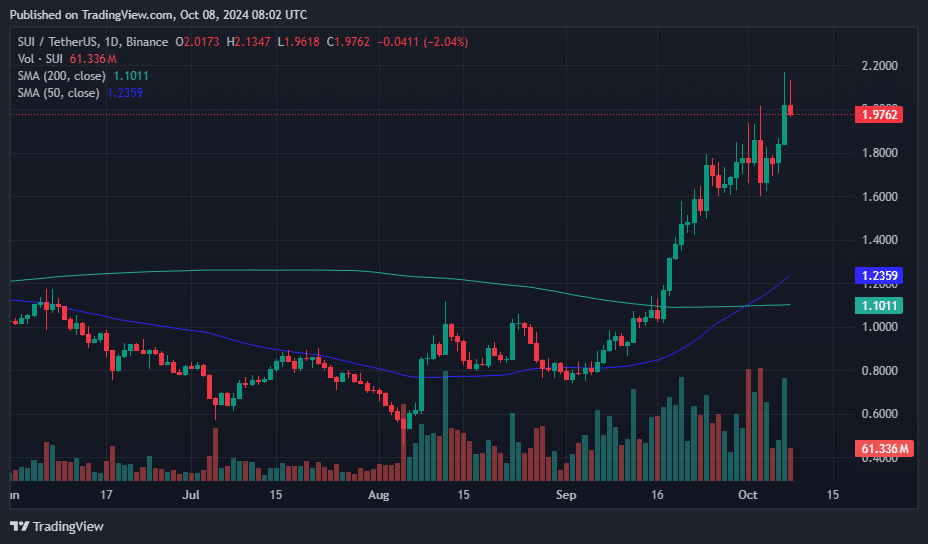

Technically speaking, Sui’s price trend indicates persistent growth. At present, the token is being traded above its 50-day and 200-day moving averages, which created a ‘golden cross’ on September 22 – a well-known bullish symbol. This pattern typically implies that the short-term direction has taken control over the long-term trend, frequently leading to more positive price movements.

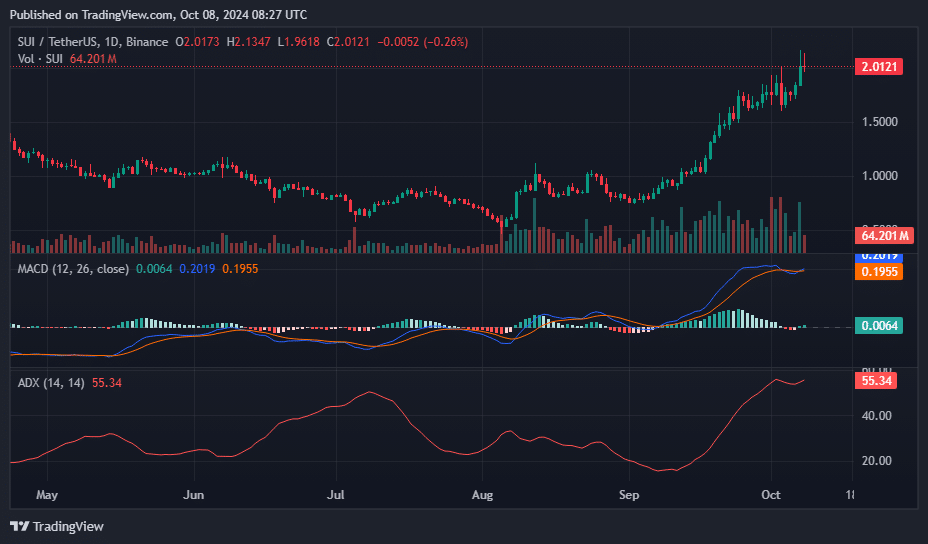

Option 1: In simpler terms, the Average Directional Index (ADI), a tool used to gauge the intensity of market trends, has climbed significantly, now standing at 55 – a level far beyond the 25 mark that indicates a robust trend. Additionally, the Moving Average Convergence Divergence (MACD) indicator is sending positive signs, as both the MACD line and its associated signal line are on an upward trajectory. This technical data implies that Sui’s price increase may not have reached its peak yet.

As Sui gets close to its old peak price of $2.17, this amount has become a significant hurdle. If the token manages to surpass this boundary, it might pave the way for more upward movement.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- USD CNY PREDICTION

- Silver Rate Forecast

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Castle Duels tier list – Best Legendary and Epic cards

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-10-08 12:20