As a seasoned crypto investor with over a decade of experience in this ever-evolving market, I find myself increasingly drawn to Sui (SUI). Its impressive performance and strategic partnerships have caught my attention, making it one of my top picks for 2025.

With a surge of almost 20% at the last check on Saturday, SUI’s price standing at around $5.13 is just the beginning. Its meteoric rise from its lowest point in 2023, a staggering 1,312%, has not only brought it to the 13th spot among the biggest cryptocurrencies but also garnered a market cap of over $15 billion.

The growth of Sui’s ecosystem, particularly its Decentralized Finance (DeFi) sector, is truly remarkable. With total value locked in its DeFi ecosystem soaring to a record high of $1.96 billion, the presence of key players like Suilend Protocol, NAVI Protocol, Cetus, Scallop Lend, and Aftermath Finance adds credibility to its success.

The strategic partnerships with heavyweights such as VanEck, Grayscale, and Franklin Templeton further solidify Sui’s position in the market. The launch of the Sui Trust by Grayscale, which has accumulated over $14 million in assets, is a testament to its growing appeal. If the Securities and Exchange Commission (SEC) under Paul Atkins changes its view on crypto ETFs, we might just see a SUI ETF application from Grayscale in 2025!

The incorporation of stablecoins like USD Coin, AUSD, FDUSD, and USDY, each with a combined market cap of over $406 million, and the launch of Deepbook V3, its native onchain order book, whose trading volume jumped to over $1 billion, are further indicators of Sui’s robustness.

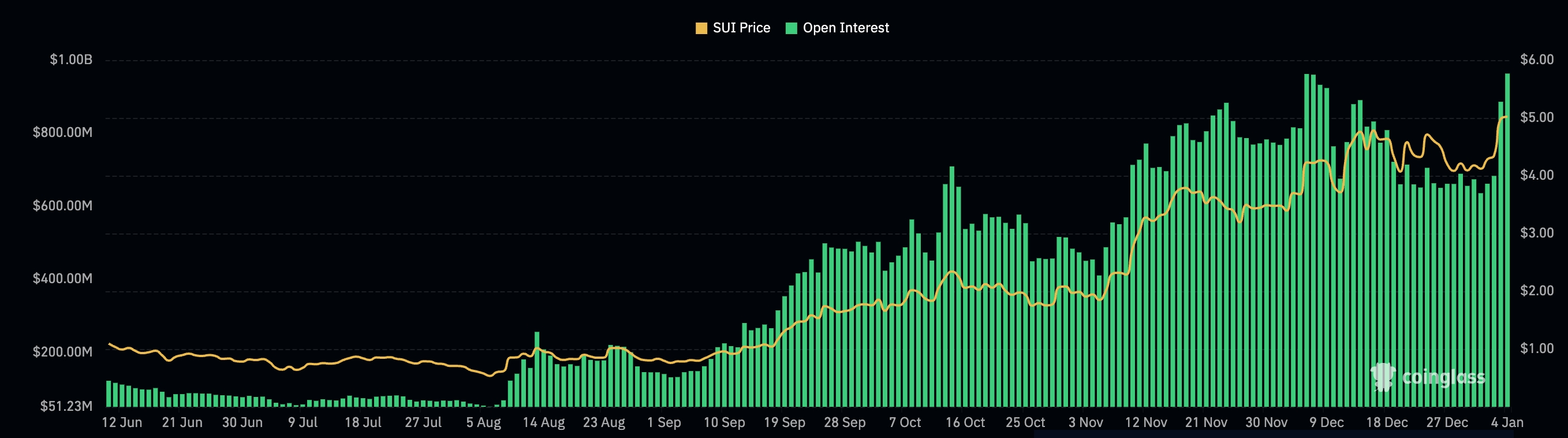

The booming DEX ecosystem handling over $46 billion in volume since its inception and the soaring futures open interest of $963 million are signs that SUI’s token is gaining traction among investors.

Technically, the daily chart suggests a bullish trend for SUI this year, with the price rising for four straight days and flipping the resistance at $5 into support. The 50-day moving average has also provided steady support since September last year. Given its current cheap valuation, as indicated by the Z-score of the Market Value to Realized Value falling to 2.7, I believe the SUI price will continue to rise, potentially reaching the extreme overshoot of the Murrey Math Lines at $5.50, and beyond to $10 if it can break that level.

In a market as unpredictable as crypto, my advice would be: “Never invest more than you can afford to lose, but always keep an eye on the Sui moon!”

After a robust surge, the price of Sui climbed approximately 20%. As of the latest check on Saturday, it was trading near $5.13.

In simple terms, SUI, a well-known layer-2 platform, has shown exceptional growth among cryptocurrencies, rising more than 1,312% from its record low in the year 2023.

This performance has boosted its market value to more than $15 billion, placing it as the 13th largest cryptocurrency within the sector.

Sui’s rise occurred hand-in-hand with the ongoing expansion of its DeFi ecosystem, reaching an all-time peak of $1.96 billion in total value locked within it.

In the decentralized finance (DeFi) environment, Suilend Protocol, NAVI Protocol, Cetus, Scallop Lend, and Aftermath Finance are among the largest participants.

Sui partnerships

Additionally, Sui experienced growth following strategic collaborations with leading firms such as VanEck, Grayscale, and Franklin Templeton. For instance, Grayscale established the Sui Trust, amassing over $14 million in assets. Should the Securities and Exchange Commission shift its stance on crypto ETFs under Paul Atkins, this could indicate that the company may file for a Sui ETF in 2025.

Additionally, Sui has experienced numerous achievements that have catapulted it to an all-time high. It currently supports four stablecoins, including the USD Coin, AUD Stablecoin, Floating USD Stablecoin, and USDY, which together boast a market capitalization exceeding $406 million.

As a proud crypto investor, I’ve seen some incredible milestones recently. One such achievement is the launch of their third version, Deepbook V3, an onchain order book native to the platform. The trading volume for this innovative tool has skyrocketed, reaching an impressive $1 billion. Additionally, the market value of their DEEP token has soared, surpassing the $375 million mark. This growth is a testament to the potential and promise that this project holds.

Currently, Sui’s Decentralized Exchange (DEX) system is experiencing a surge in growth, processing transactions worth more than $46 billion since it began operations.

The available data suggests that the open interest for Sui’s futures has reached an unprecedented peak of $963 million, which represents a substantial rise from the weekly low of $650 million. This surge indicates that the SUI token is becoming increasingly popular among investors, demonstrating growing interest.

Sui price forecast

The daily graph indicates that the SUI token has been on an upward trend this year, increasing for four consecutive days and transforming the former resistance level of $5 into a new resistance. This action disproved the risky double-top pattern, whose upper boundary was at $4. A double-top is a commonly observed reversal signal in financial markets.

For some time now, Sui’s price has been stabilized around its 50-day moving average without dropping below this point since last September. Additionally, Sui is currently considered affordable as its Market Value to Realized Value Z-score stands at 2.7. Generally, a cryptocurrency becomes quite expensive when its Z-score reaches 3.8, so Sui is significantly cheaper than that.

Consequently, based on technical analysis, the SUI price seems likely to escalate towards the excessive peak of the Murray Math Lines around $5.50. Crossing this threshold could enhance the likelihood of further growth towards the subsequent significant level at $10.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Maiden Academy tier list

2025-01-04 20:10