As a seasoned crypto investor with a knack for spotting promising projects and a keen eye for technical analysis, I find myself intrigued by SUI‘s recent surge. Having navigated through the crypto market’s rollercoaster ride since its inception, I’ve learned to read between the lines of price movements, trading volume, and various technical indicators.

SUI made progress in regaining its record peak, surging more than 10% during the previous day, fueled by advancements within its ecosystem.

As a researcher, I’m observing an intriguing turnaround in the performance of SUI. After four consecutive days in a downtrend, its value surged from $1.62 to $2.08, elevating its market capitalization to approximately $5.7 million. The increased interest from investors significantly boosted its trading volume by 35% on October 30, reaching $1.76 billion. Notably, the trading volume more than doubled on October 29 compared to the previous day.

Primarily fueling the recent surge was enthusiasm for the debut of an NFT collectibles platform themed around Major League Soccer, called MLS Quest, which launched on Sui in collaboration with crypto startup Sweet. This platform enables soccer fans to amass digital medallions showcasing highlights from actual league matches and earn incentives.

After partnering with MLS, there was a significant increase in funds flowing into SUI, reaching the greatest amount compared to all other chains on October 29, as reported by community member ToreroRomero. This influx of funds serves to strengthen the ongoing upward trend in SUI’s rally.

🚨 BREAKING: @SUINETWORK HITS HIGHEST NET INFLOWS AMONG ALL CHAINS. $SUI

— ToreroRomero (@Torero_Romero) October 29, 2024

According to CoinGlass’s data, the value of open interests in the SUI futures market has grown by 13.5%, going from $450 million to $511 million over the last four days. This increase in open interest, especially when paired with higher trading volumes, often signals increased trader activity and hints that the market anticipates further price increases.

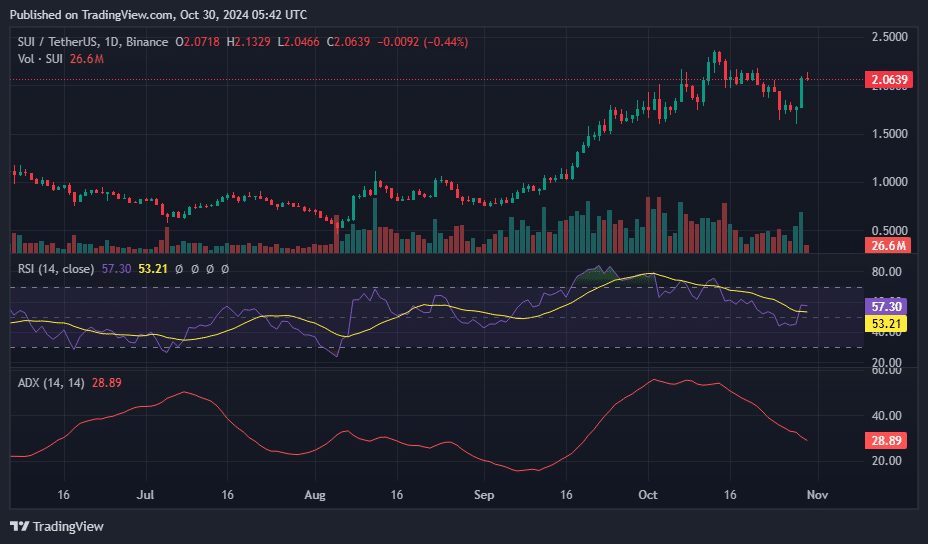

On the one-day SUI/USDT chart, the Relative Strength Index is nearly at the midpoint (57), hinting at a neutral state. Simultaneously, the Average Directional Index stands at 28, suggesting a moderate trend strength. However, its recent decline implies that the current trend may be weakening. In light of these indicators, it appears that SUI might exhibit a period of sideways movement in the near future.

SUI forms a cup and handle pattern

Yet, one analyst predicts that SUI could reach as high as $6.9 in the coming months.

On October 28th, analyst Alex Grey pointed out in a post on X that Sui had surpassed the upper line (neckline) of a “Cup and Handle” chart formation, which is often interpreted as a sign of an upcoming bullish trend in technical analysis.

As per Grey’s analysis, SUI is currently in a phase where it has passed a positive retest, increasing the chance for further growth. He has established an initial goal at around $6.9, which represents a rise of 235% from its current price point and also signifies the level where the handle of the chart breaks out. If the bullish trend continues, the price might climb higher to reach the maximum target of the Cup and Handle pattern, which is approximately $9.6.

At press time, SUI was down 12% from its all-time high of $2.35 hit earlier this month.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Castle Duels tier list – Best Legendary and Epic cards

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-10-30 10:02