In the vast, unforgiving expanse of the digital wilderness, Bitcoin’s computational might has swelled, relentless as the Siberian winter gale. The hashrate—a cruel, indifferent measure of toil—has shattered all records, pressing onward to 1 sextillion hashes per second. One might think miners sang a hymn of victory, yet the truth is far grimmer: their coffers grow lighter even as their machines roar louder.

On the fifth dawn of April, data from the omnipresent BitInfoCharts confirmed what all suspected but few dared proclaim aloud: the miners’ engines pounded with historic ferocity, yet this thunder failed to summon more gold from the ether. Profit margins shrank like hope in a gulag, leaving miners caught in a cruel paradox—the harder they worked, the less they gained.

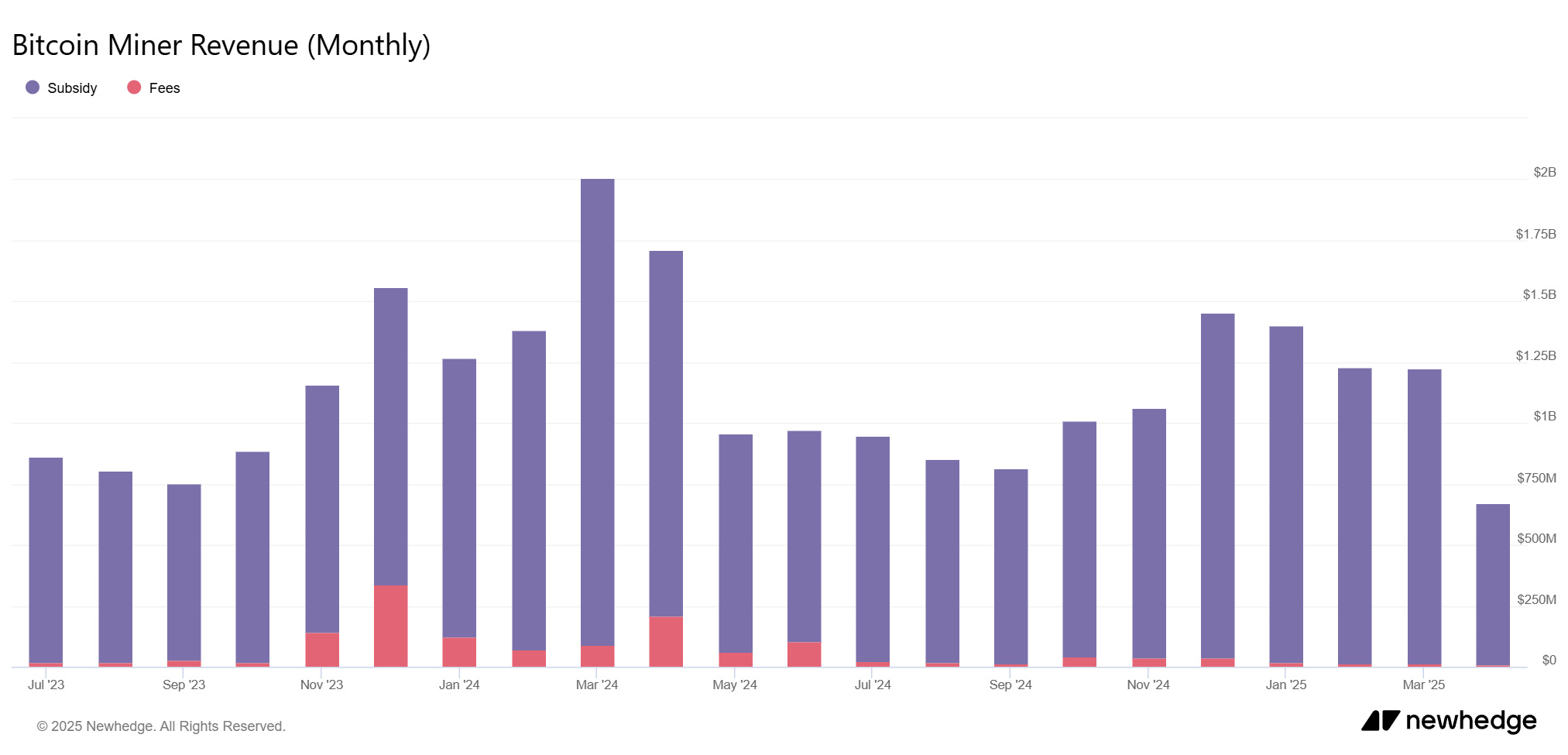

Indeed, while the hashrate climbed like an insatiable specter, the miners’ revenue in March took a nosedive, falling nearly 50% compared to the previous year, a paltry $1.2 billion. You might chuckle, imagining this as a lavish sum, but for those shackled to machines humming through endless nights, this is but a meager ration.

Rewards for their suffering come from two sources: the block subsidies and the faint trickle of transaction fees that dares to crawl forward in this cruel landscape. With the halving reducing rewards to a mere 3.125 BTC per block, miners clutch at fees like a dying man to his last cigarette. Yet the fees remain pitifully low; often the mined blocks lie barren—empty shells echoing the emptiness in miner wallets.

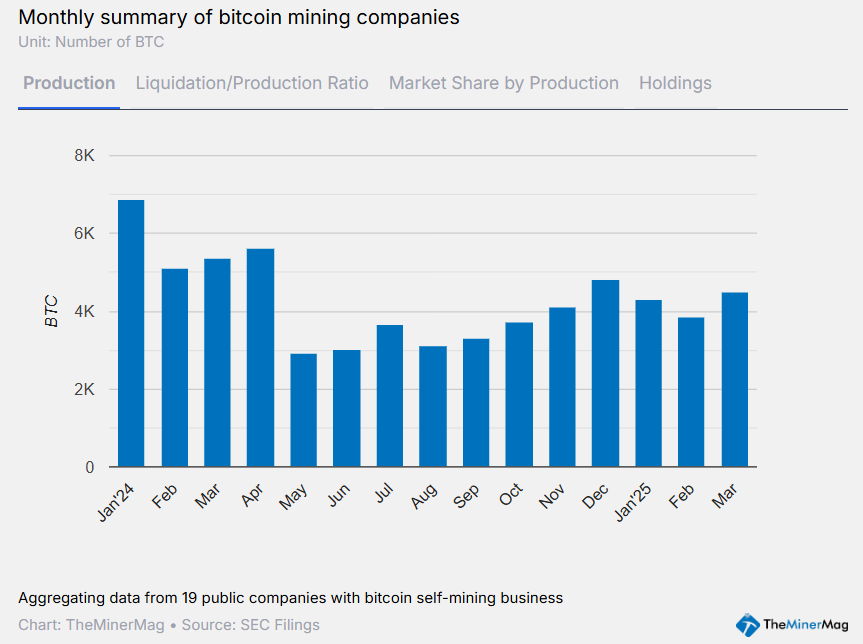

The publicly traded miners, those modern day laborers of digital fates, have taken desperate measures. In March alone, they sold over 40% of their newly minted Bitcoin—their highest sell-off since October. This frantic liquidation whispers of profit margins tightening under the iron fist of low hash prices and the shadow of ever-looming trade wars that chill the very air of commerce.

Some have gone beyond desperation to absurdity. HIVE, Bitfarms, Ionic Digital—names etched in the ledger of this digital calamity—sold more than 100% of what they mined in March. Imagine pawning your next paycheck before you even earn it. Others, like CleanSpark, are dutifully adjusting their strategies, presumably hoping for mercy in this merciless game.

So here we stand, comrades, at the crossroads of innovation and ruin, where the machinery sings and the wallets weep. If this is progress, one wonders: what tale will be told of the miners who mined not gold, but shadow?

Read More

- Grimguard Tactics tier list – Ranking the main classes

- USD CNY PREDICTION

- Silver Rate Forecast

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2025-04-17 14:45