Ah, the crypto market – a splendidly volatile concoction where confusion reigns supreme. The total market cap has decided to plummet, sliding 1.83% to a modest $3.28 trillion, and the trading volumes, bless their hearts, have dwindled by 7.63% to a meagre $123.25 billion. Investor confidence? Well, it’s about as reliable as a weather forecast in England: shifting, fickle, and thoroughly undecided. The Crypto Fear & Greed Index currently sits at a demure 48, marking the market as ‘Neutral,’ which in the most charitable sense, translates to ‘nervously cautious.’ Essentially, investors seem to be torn between being paranoid or pretending to be confident. What a spectacle! 🎢

But of course, what’s a market without a bit of external turmoil? Geopolitical instability and macroeconomic uncertainties have entered the fray, like an unwelcome guest at a tea party. Trump’s tariff threats, the Israel-Iran conflict, and the ongoing debate on US stablecoin regulation are the latest ingredients in this complex brew of market uncertainty. Oh, and let’s not forget Bitcoin’s dominance, which has cleverly slipped to 64%, while Ethereum hovers around 9.3%. The Altcoin Season Index is a downright sad 23/100, confirming that altcoins are, as expected, having a minor existential crisis of their own. 🙄

Liquidations Galore: The Tragedy of the Overleveraged

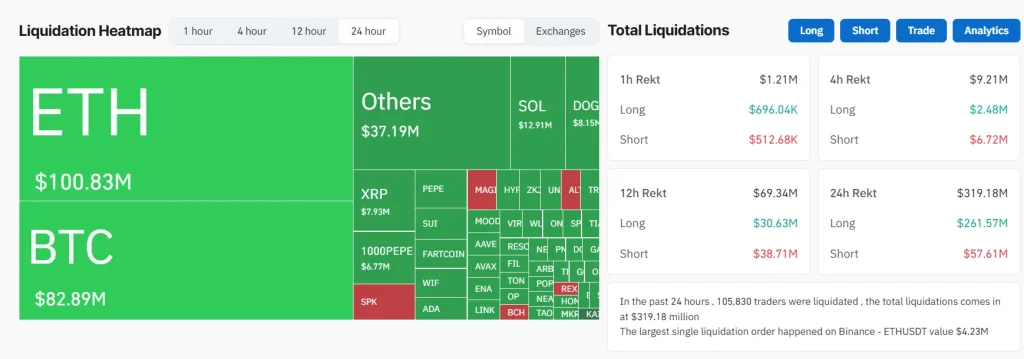

According to CoinGlass, a mere 24 hours ago, over 105,830 traders were swept off their feet, as their positions were liquidated to the tune of a staggering $319.18 million. ETH traders, naturally, took the brunt of this with $100.83M in liquidations, closely followed by BTC’s $82.89M. The carnage, as it were, seems to stem from surprise market shifts and an increase in volatility, which is as unpleasant as stepping on a Lego in the dark. 😬

The largest liquidation, naturally, occurred on Binance’s ETH/USDT pair, a cool $4.23 million. These numbers scream ‘don’t use leverage in a volatile market,’ which, frankly, is the financial equivalent of ‘don’t stick your hand in the cookie jar if you can’t handle the crumbs.’ It’s a rough market out there, folks. 😅

The Fear & Greed Index: A Mirror of Our Collective Anxiety

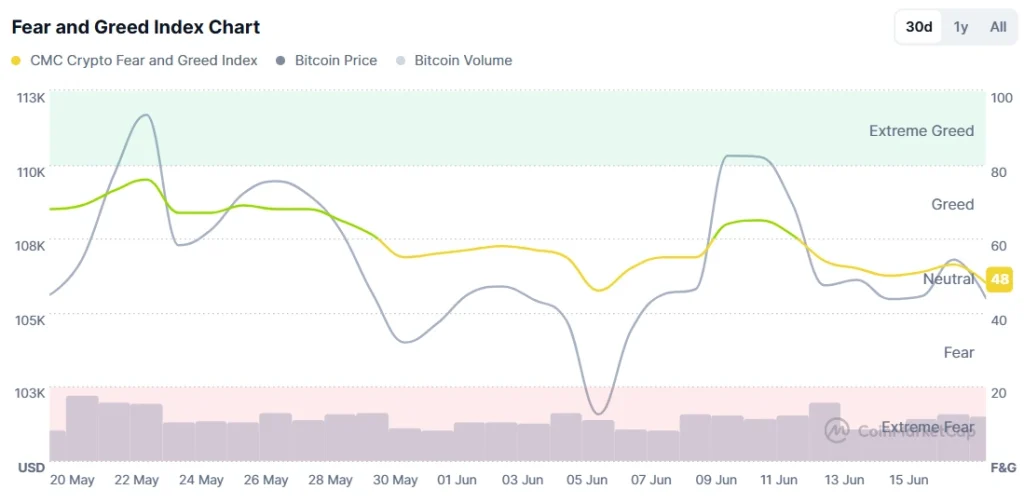

The Fear & Greed Index, in all its glory, has taken a dip from its once proud position in the ‘Greed’ zone, now sitting in ‘Neutral’ territory at a mere 48. Bitcoin, poor thing, retraced its steps from a dizzying high of $111k to a more humble low of $105k over the last two weeks. And yes, there was that fleeting moment around June 5th when the index briefly dipped below ‘Neutral’—a small yet poignant cry of despair from the market. It continued to hesitate around June 13–15, like a hesitant guest at a party unsure of which drink to choose. 🍸

While Bitcoin’s volume stayed relatively consistent, the sentiment remains trapped in the ‘Neutral’ zone. This uneasy calm, combined with the rising tide of liquidations, paints a rather unattractive picture of a market awaiting a catalyst—preferably one that doesn’t involve geopolitical strife. 🧐

Curious where Bitcoin will end the year? Well, aren’t we all. Check out our Bitcoin (BTC) Price Prediction for 2025, 2026–2030, though I wouldn’t hold my breath. 😏

FAQs

What does a Fear & Greed Index of 48 indicate?

A 48 reading reflects a neutral sentiment, which essentially means investors are as confused as a deer in headlights. Neither too scared nor too greedy. Middle ground it is. 🦌

Why were there massive liquidations recently?

The liquidations were the result of high-leverage positions being obliterated by unexpected price movements—courtesy of the wonderful world of geopolitical instability. Traders didn’t know what hit them, much like someone who leaves their umbrella at home during a monsoon. 🌧️

Why is the crypto market down today?

Well, between Trump’s tariff threats, the Israel-Iran mess, the Stablecoin Bill, and, let’s face it, rampant liquidation, the crypto market seems to be having an existential crisis of its own. We’ve all been there, right? 😅

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- USD CNY PREDICTION

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Castle Duels tier list – Best Legendary and Epic cards

- Mech Vs Aliens codes – Currently active promos (June 2025)

2025-06-18 10:45