- Ah, the profound mystery of whale accumulation and the faint glimmer of bullish chart patterns, like whispers of a possible 35% breakout hanging in the air.

- On-chain metrics, like harbingers of truth, complemented by dwindling exchange reserves, strengthen the bullish outlook for our dear LINK.

Behold, a minor tragedy unfolds as a formidable Chainlink [LINK] whale has re-entered the market, spending a staggering $2 million to secure 139,860 LINK at a modest price of $14.3. Yes, dear reader, this wallet now holds a veritable treasure trove of 147,553 LINK, a bold accumulation move that would make even the most stoic investor raise an eyebrow. 🧐

What curious irony lies within this tale! It happens that this very whale had once reaped a princely sum of $161K from prior trades, their conviction so profound it could rival a Dostoevskian hero’s existential crisis.

The timing and size of this investment hint at more than mere fortune; rather, it awakens the specter of a strategic buildup, as if preparing for an ominous phase in the market, especially when LINK exhibits signs of a most captivating technical compression.

The Haunting Possibility: A Technical Breakout or Another Rejection? 🐋

As fate would have it, at the time of this scribbling, LINK traded at a somber $13.43, reflecting a decline of 4.27% over the past 24 hours. The price meandered through a symmetrical triangle and a descending wedge—metaphors for the human condition, teetering on the brink of destiny.

A breakout above the $15.68 resistance could potentially set forth a grand target of around $18.18, a delightful 35% surge. Yet, the persistent rejections near the whale’s entry zone at $14.3 underscore the formidable overhead pressure that our bullish protagonists must brave.

Beware! Should the price descend below the fated $12.57 support, it would invalidate our bullish aspirations and hasten a deeper correction. Thus, this zone emerges as a critical determinant for LINK’s impending trend, a reflection of life’s cruel whims.

Is the Low MVRV Ratio the Key to Ascendancy? 🔑

The MVRV Z-score for LINK stood at a humble 3.09 at press time—lower than those feverish heights above 7 witnessed in the tumult of late 2024. This metric suggests that most holders, alas, are not basking in excessive unrealized profits, thus diminishing the likelihood of a mass exodus into the arms of profit-taking.

Historically, Z-scores in the 2–3 range have heralded potent accumulation zones, often marking the emergence of price rallies. Hence, the current MVRV level reflects a tantalizing risk-reward setup, like a beautiful deception.

Nevertheless, it implores LINK to entice fresh demand to liberate itself from this accumulation phase and muster the momentum toward elusive higher price targets.

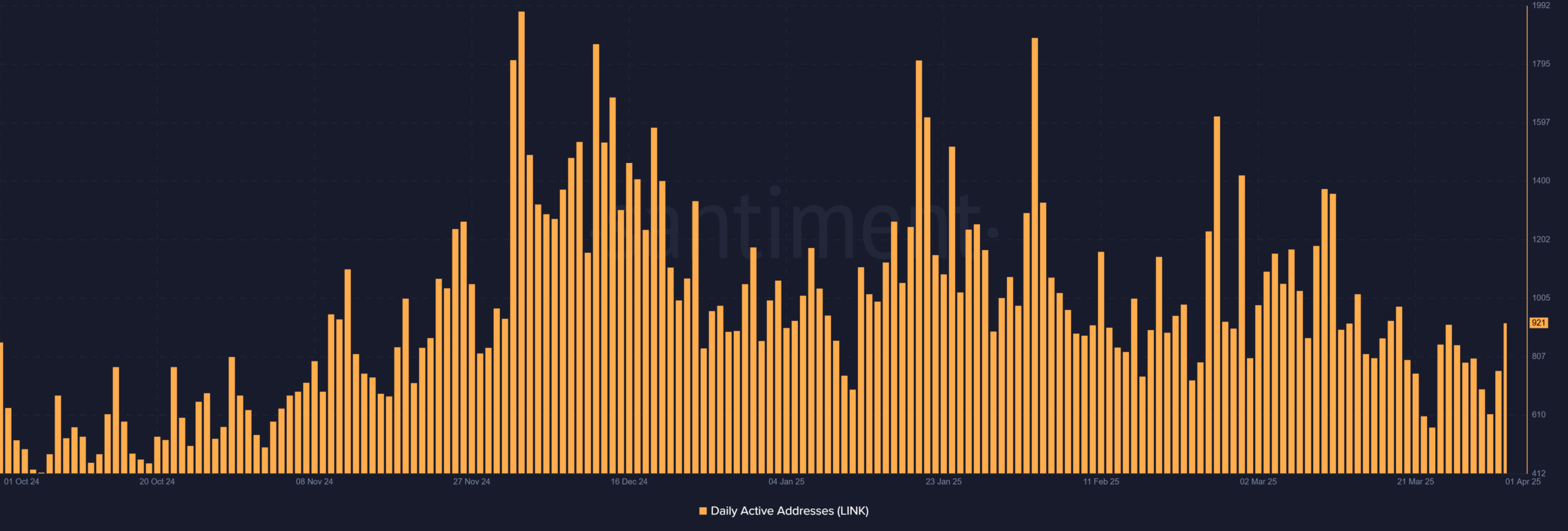

Are Users Gradually Returning? The Human Element. 🤔

In a moment of whimsical intrigue, daily active addresses have exhibited a moderate increase, with 921 recorded while our tale unfolds. Though this number lags behind the bustling activity of late 2024, it reflects a steady recovery from the abyss of March lows.

A consistent rise in active addresses often mirrors an awakening participation and fervent network usage, both of which are indispensable for shallowing price movements. Furthermore, this renewed user activity may bolster bullish narratives, especially when paired with the great machinations of favorable technical setups. Indeed, this uptick hints at rekindled interest in LINK, even if the flames languish as yet unkindled.

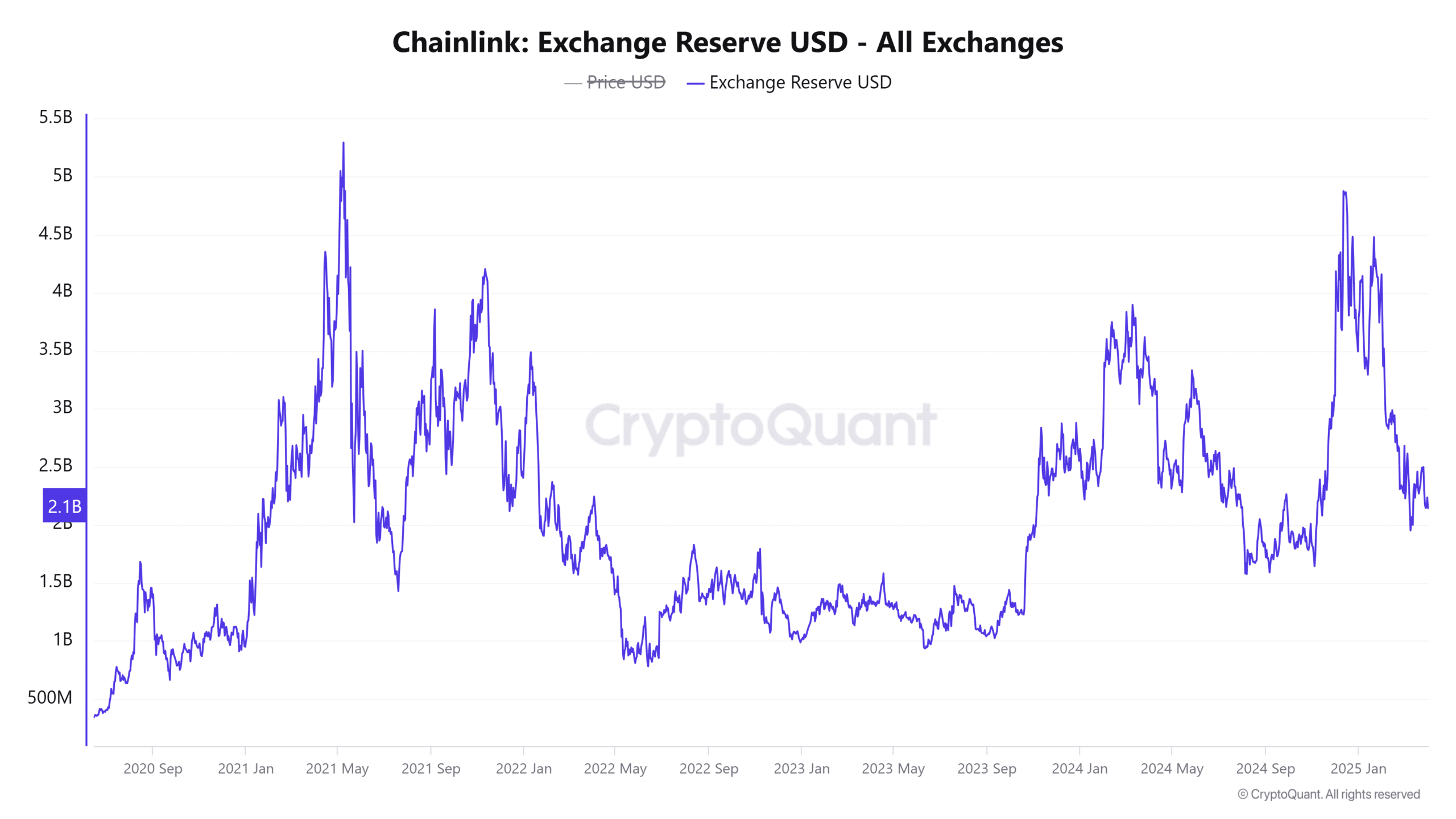

Are Exchange Reserves the Culprits of Accumulation? 🔍

Examination of exchange reserve data has borne fruit, revealing a 3.11% drop, with total reserve value now at a staggering $2.15 billion. This decline signals an intention to withdraw LINK from exchanges, a gesture indicating the desire to hold rather than hastily sell.

Moreover, declining reserves mitigate immediate sell pressure and frequently precede price rallies. Combined with the whale’s accumulation and the ebbs and flows of on-chain sentiment, this trend enforces our bullish narrative. Thus, the dance of exchange behavior aligns aptly with a long-term accumulation saga.

Conclusion: The Inevitable Unfolding 📈

Should LINK ascend above the fateful $15.68 with commendable volume, the prodigious 35% rally to $18.18 beckons like fate itself. Whale accumulation, a favorable MVRV risk, declining exchange reserves, and a steady user activity corroborate this possibility.

Alas, should we falter and fail to hold above $12.57, the narrative may flip with a merciless intensity. Thus, LINK’s breakout zone crystallizes as the ultimate catalyst for its next grand unfolding, a reminder of the capricious nature of fortune.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- Silver Rate Forecast

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Gold Rate Forecast

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

2025-04-03 08:12