In the hush of Sunday’s dawn, Bitcoin bowed beneath the once-mighty $80,000 threshold, as if the market itself had suddenly lost its noble resolve. Traders, who mere days ago were toasting to fortunes untold, now clutched their ledgers with trembling hands. An avalanche of liquidations thundered through the crypto realm, claiming an astounding $590 million. How thoughtful of the market to keep everyone on their toes! 😏

Meanwhile, an air of trepidation hung over risk assets like a thick cloud, all thanks to former President Donald Trump’s rather creative tariff designs and global tensions that escalate faster than a toddler discovering crayons on a white wall. The crowd, it seems, can’t resist a good drama. 💃

More Traders are Shorting Bitcoin After the Worst Q1 In a Decade

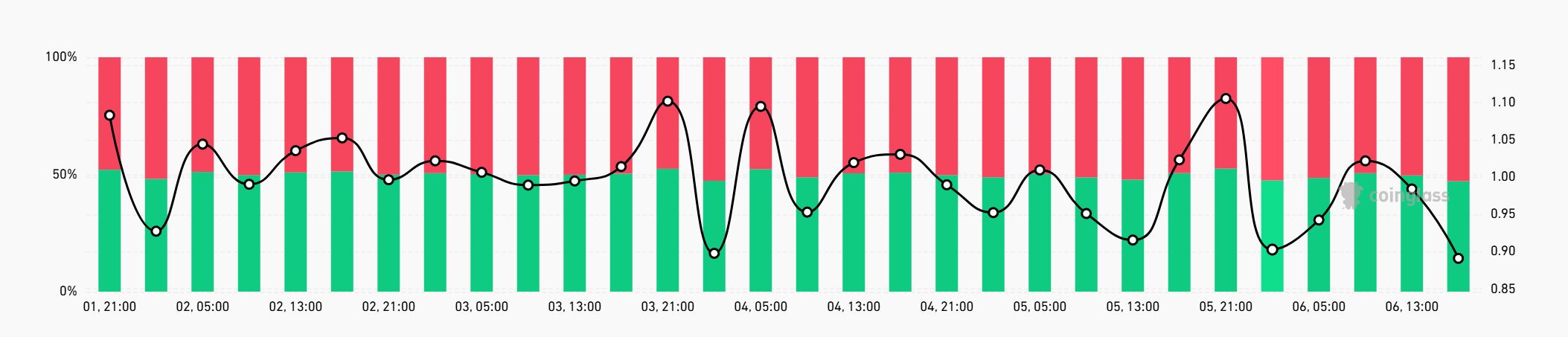

Rumor has it that the long-short ratio for Bitcoin tumbled to 0.89, transforming many once-hopeful believers into short-selling cynics. With short positions inching past 53%, one almost wonders if the market has swapped idealism for a healthy dose of grim humor. 🤷♂️

Not to be outdone, traditional markets chose to join the symphony of gloom. The Nasdaq 100, S&P 500, and Dow Jones all convened in correction territory, delivering their most impressive weekly tumble since 2020. Bravo! 👏

And so ended the first quarter for Bitcoin, posting an 11.7% loss—its feeblest Q1 since 2014. The broader crypto domain shed 2.45% on Sunday, trimming its total market capitalization to $2.59 trillion. Bitcoin still commands a respectable 62% share, followed by Ethereum, holding tight to its modest 8% slice of the pie.

Sunday’s rather theatrical decline unleashed $252.79 million in crypto derivatives liquidations, with loyal long positions accounting for a lion’s share of $207 million. Ethereum traders, not to be left out, tallied up about $72 million in long liquidations. It seems no one wanted to miss the weekend’s liquidation extravaganza. 🎉

As the waves of global liquidity ebb and flow, so too does Bitcoin’s fate. With the U.S. markets bracing for the Monday bell, restless speculation suggests volatility ahead. Perhaps the morning coffee will serve some solace—or at least a teaspoon of comfort. ☕

Federal Reserve Chair Jerome Powell decided it was the perfect moment to warn that Trump’s tariff schemes might pump inflation higher while dousing economic growth, thus gifting us the delightful possibility of stagflation. In such a scenario, policy tools morph into comically ineffective instruments, fumbling between controlling prices and stimulating the economy—akin to trying to pedal a bicycle uphill in flip-flops. 😬

Read More

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Gold Rate Forecast

- Silver Rate Forecast

- Gods & Demons codes (January 2025)

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- Superman: DCU Movie Has Already Broken 3 Box Office Records

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- USD CNY PREDICTION

- Every Upcoming Zac Efron Movie And TV Show

- Maiden Academy tier list

2025-04-06 23:11