As we find Bitcoin swaying merrily above the not-so-innocent threshold of $118,000, those charming long-term investors have suddenly taken a palpable interest in the currency’s most attractive feature—scarcity, or as some might say, the art of being difficult to find. Who knew a coin could play hard to get? Prominent voices in the marketplace assure us that this elusive quality, coupled with the braided chaos of monetary debasement, might propel Bitcoin into a thrilling rally over the next ten years, much like a persistent cup of herbal tea that refuses to be fully brewed.

A Market So Steady, It Could Get a Job as a Rock

The latest technical analysis shows our dear Bitcoin dancing a delicate tango between $116,000 and $120,000—an artistic display of consolidation. Analysts are reading the market’s moves like a fortune teller gazing into a crystal ball, suggesting this might merely be a delightful pause before the real performance begins.

The RSI indicator graces us with a reading of 65, still flirting in the bullish territory. But beware! The MACD has recently donned a glum expression, advising a dash of caution over the soon-to-be thrilling spectacle.

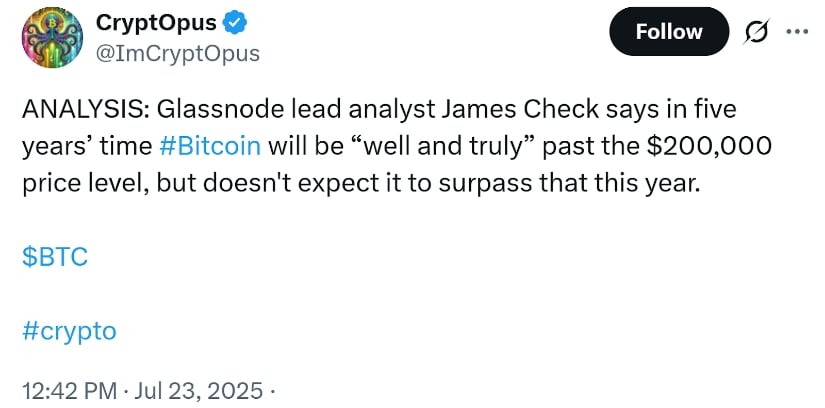

Our wise seer from Glassnode, James Check, pointed out that Bitcoin might just find the coveted $200,000 mark to be rather elusive this year. The playful little creature known as weak buying volume frolics in the fields of caution. According to him, a significant stir in market participation is requisite for him to dip his toe in the water of additional risk.

The Enigma of Scarcity: A Spirited Tale

Now, let us consider the bold assertion that Bitcoin might tease us with a rise to $1 million. This wild dream rests heavily on its fixed supply of 21 million coins, and the stark realization that far fewer ever see the light of day thanks to forgotten wallets and long-term holders playing hide and seek.

Investor Fred Krueger, a name that certainly evokes esteemed dreams and horror films alike, emphasized that elevating Bitcoin to the $1 million stratosphere would require merely $1 trillion in capital—an amount that he audaciously deems trivial in comparison to the dragon known as global money supply, rumored to be doubling from $100 trillion to $200 trillion by 2035. Thus, with the grand devaluation of fiat currency looming, Bitcoin’s charm grows ever stronger.

Data from River, a platform solely devoted to our beloved Bitcoin, reveals that those who hung onto their BTC since July 2024 have outperformed fiat currency returns, oh, tenfold. It seems Bitcoin has captured the glittering crown as the inflation hedge par excellence.

Additionally, the M2-per-Bitcoin ratio, a rather complex theme that relates global money supply to the total BTC supply, has reached a striking 12-year high of $5.7 million, all while the fiat currency expands like a balloon at a child’s birthday party.

Experts on the Road to Wealth: From $200K to $1M

Although the notion of a $1M Bitcoin appears to be an enticing mirage on the horizon, several esteemed analysts predict that $200,000 might grace us by the end of 2025. Bitwise CIO Matt Hougan, blessed with remarkable foresight, alongside Bernstein Research and the ever-intriguing analyst apsk32, foresee a growing cocktail of institutional demand and supply shocks concocted by the Bitcoin halving of 2025 alongside the influx of ETF investments.

“Expecting $200,000+ Bitcoin in Q4,” declares apsk32, as though he were announcing the arrival of a rare comet, backed by historical patterns and the infamous power curve trendline model.

While JPMorgan and other industry giants continue to explore crypto-backed financial products, corporate treasuries are busily stacking BTC like a child hoarding candy. This activity lends weight to the notion of Bitcoin as a reserve asset—quite the compliment for a digital currency.

Yet, amid this sea of optimism, the ever-watchful James Check sounds a note of caution: that rapid gains may swiftly meet with rapid falls if not supported by solid structure. “You need follow-through; otherwise, you’re trading through air,” he quips, illuminating the need for reality.

A Look at What Lies Ahead: Is the $1M Bitcoin Just Around the Corner or a Fable? 🪙

The long-term forecast for Bitcoin remains tinged with bullish hues, bolstered by shifts in the grand macroeconomic tapestry, a swelling interest from institutions, and Bitcoin’s clever trick of being scarce. Even though short-term struggles and the sour taste of volume weakness linger as legitimate concerns, many investors seem oddly unbothered, focusing instead on the grand tableau.

In the amusing words of early Bitcoin advocate Davinci Jeremie, the once-preposterous notion of “buying $1 of Bitcoin” has spiraled into a wider discourse: Bitcoin’s path to $1 million may no longer be a distant fantasy. It’s possibly just a matter of time or perhaps an elaborate prank set to unfold.

As the market wades into this new phase, all eyes will be glued to the charts, the institutions, and the calendar, eagerly anticipating the fateful Bitcoin halving of 2025. Let the games begin! 🎲

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- PUBG Mobile heads back to Riyadh for EWC 2025

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Arknights celebrates fifth anniversary in style with new limited-time event

- Mech Vs Aliens codes – Currently active promos (June 2025)

- USD CNY PREDICTION

- Every Upcoming Zac Efron Movie And TV Show

- Superman: DCU Movie Has Already Broken 3 Box Office Records

2025-07-23 19:22