- Canada, the land of maple syrup and Solana ETFs—what a combination!

- A Bloomberg analyst dares to suggest that XRP ETFs could steal the spotlight from Solana’s debut. How audacious!

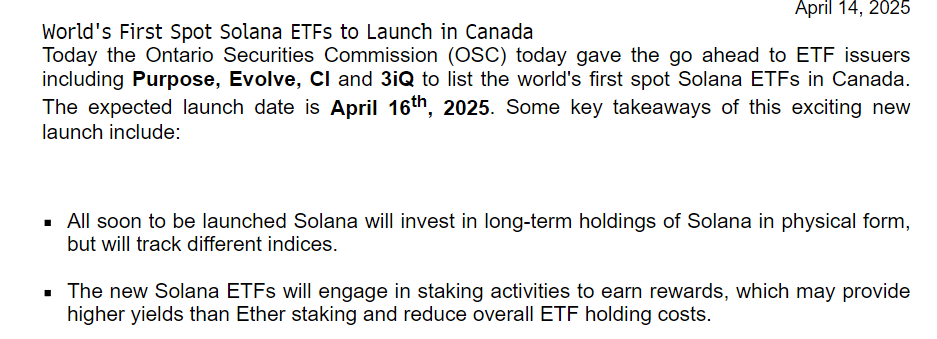

Ah, the great spectacle that is the Solana [SOL] ETF—soon to be unleashed upon the Canadian financial landscape this very week on April 16th, according to the ever-so-reliable Bloomberg senior analyst, Eric Balchunas. With a wink and a nod, he shared the exciting tidbit in an April 14th post on X (formerly known as Twitter, for those still living under a rock).

The analyst’s cheerful proclamation read as such:

“Canada is preparing to roll out spot Solana ETFs this week after the regulators gave a thumbs-up to a whole host of issuers, including Purpose, Evolve, CI, and 3iQ. And, just to spice things up, these ETFs will include staking via TD.”

The Clash of the Titans: SOL vs. XRP ETFs

Oh, but wait—there’s more! Not only will these ETFs grace Canada’s financial ecosystem, but they will also carry the magical lure of staking provisions. How marvelous!

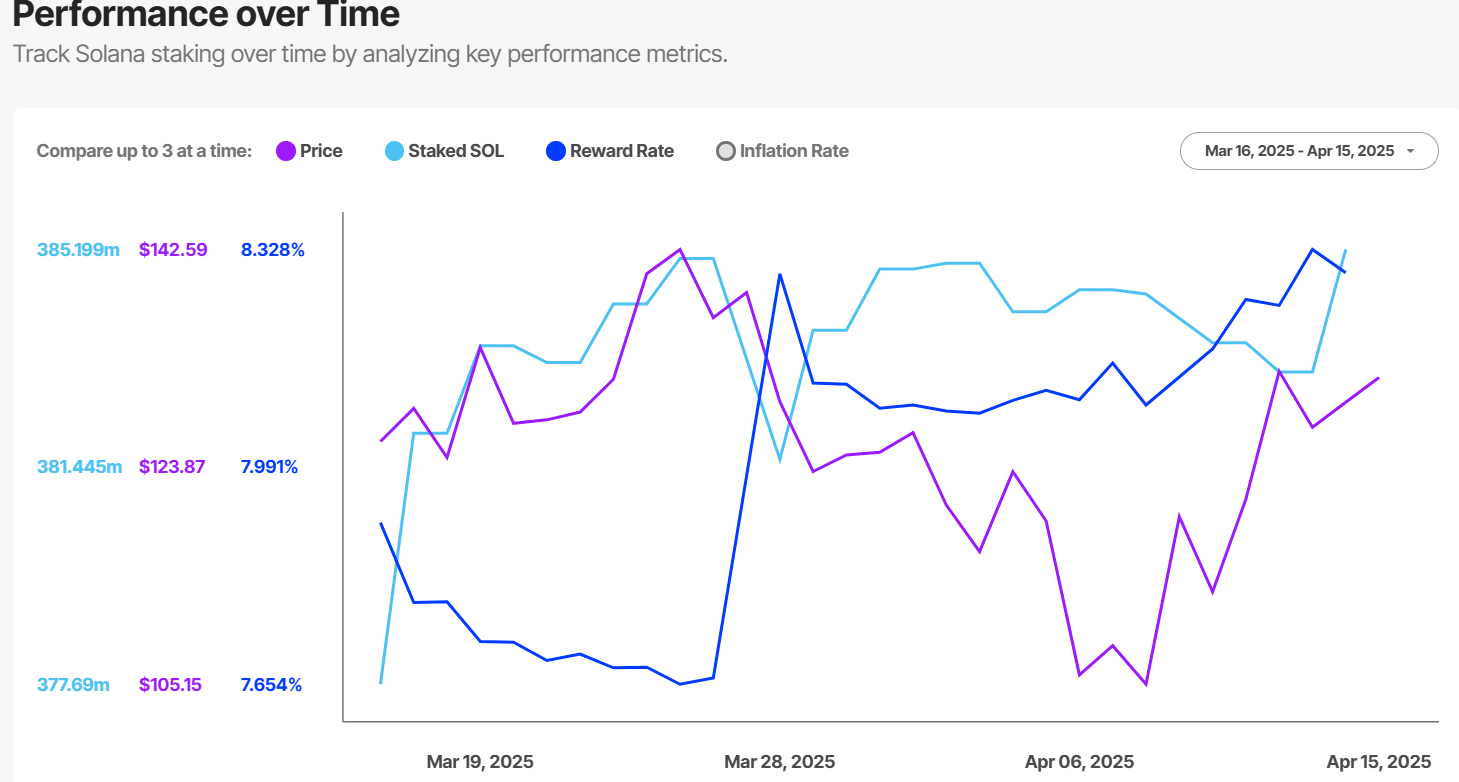

As of this moment in time, Solana’s staking yields a juicy 8% annualized reward—nearly three times the humble rewards that Ethereum offers. A tantalizing prospect for those looking to live the dream of passive income. But, will staking really spark the enthusiasm needed to drive product demand? Only time—and perhaps a bit of divine intervention—will tell.

However, let’s not get too carried away in this crypto carnival. Balchunas, ever the realist, threw some cold water on the fiery expectations. His analysis pointed out that the U.S.-based Solana ETFs—tracking futures and not exactly the golden standard of ETFs—have hardly set the world on fire. In fact, their AUM (Assets Under Management) could barely light a match. Meanwhile, the XRP ETFs have already surpassed Solana’s, despite making their grand entrance long after.

“Just saying, the two Solana ETFs in the U.S. (which track futures, so they’re not a perfect test subject) haven’t done much. Very little in AUM. The two XRP ETFs, on the other hand, already have more AUM than the Solana ETFs, and they came out later.”

Not one to leave things hanging, he also offered a nugget of wisdom:

“Don’t read too much into this, but it’s our first real look at the race of altcoins.”

Meanwhile, there’s a smattering of hope for the U.S.-based SOL ETFs, with issuers like Grayscale setting their sights on a spot SOL ETF. The SEC has until between May and October 2025 to make a decision. That’s a lot of waiting—such is life in the cryptosphere.

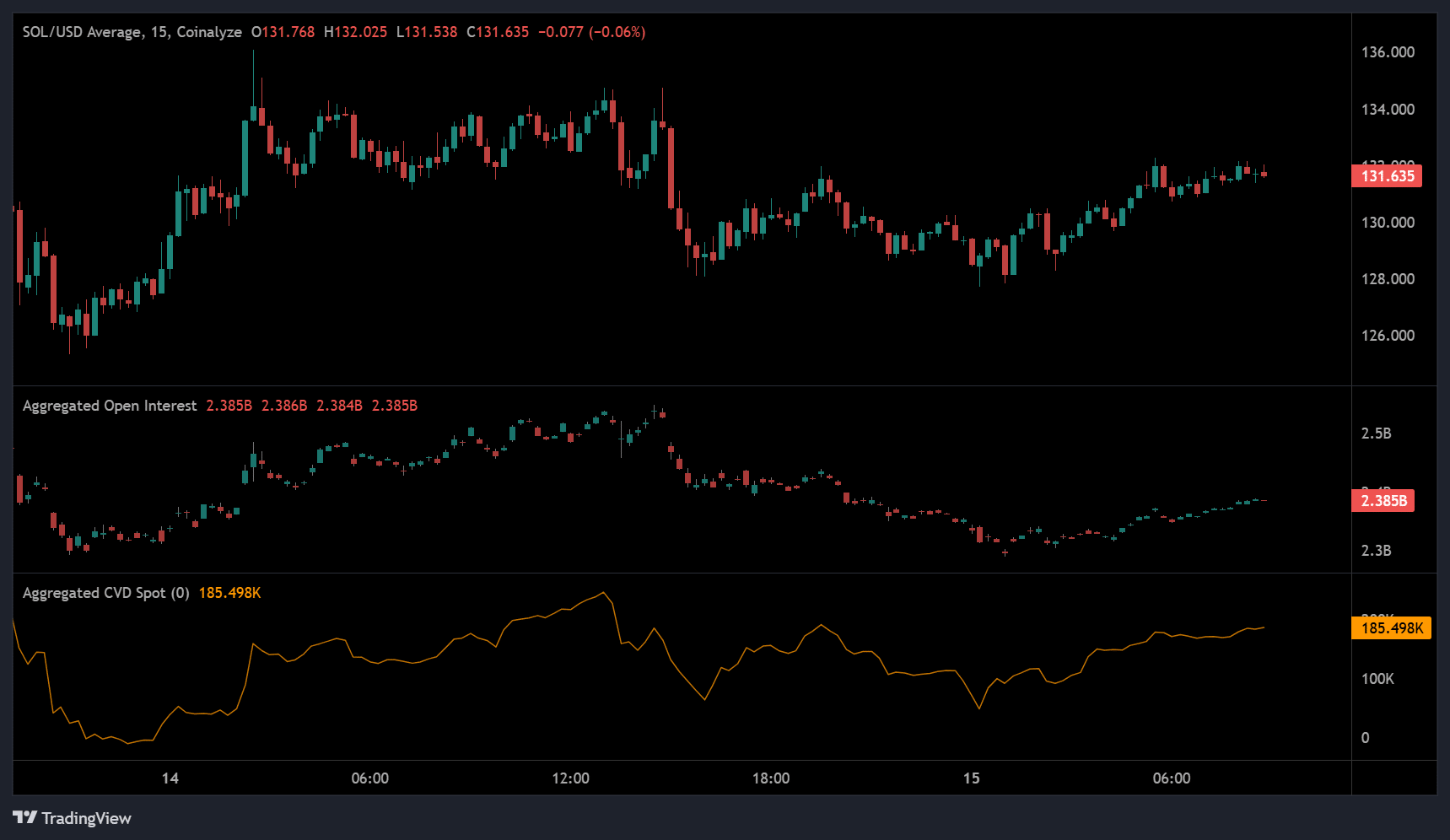

The ETF news did manage to bump spot demand ever so slightly, evidenced by a gentle surge in the Cumulative Volume Delta (CVD). There was also a modest uptick in Open Interest (OI), rising from $2.30 billion to $2.38 billion. But don’t get too excited—speculative interest in derivatives remained rather tepid after the update.

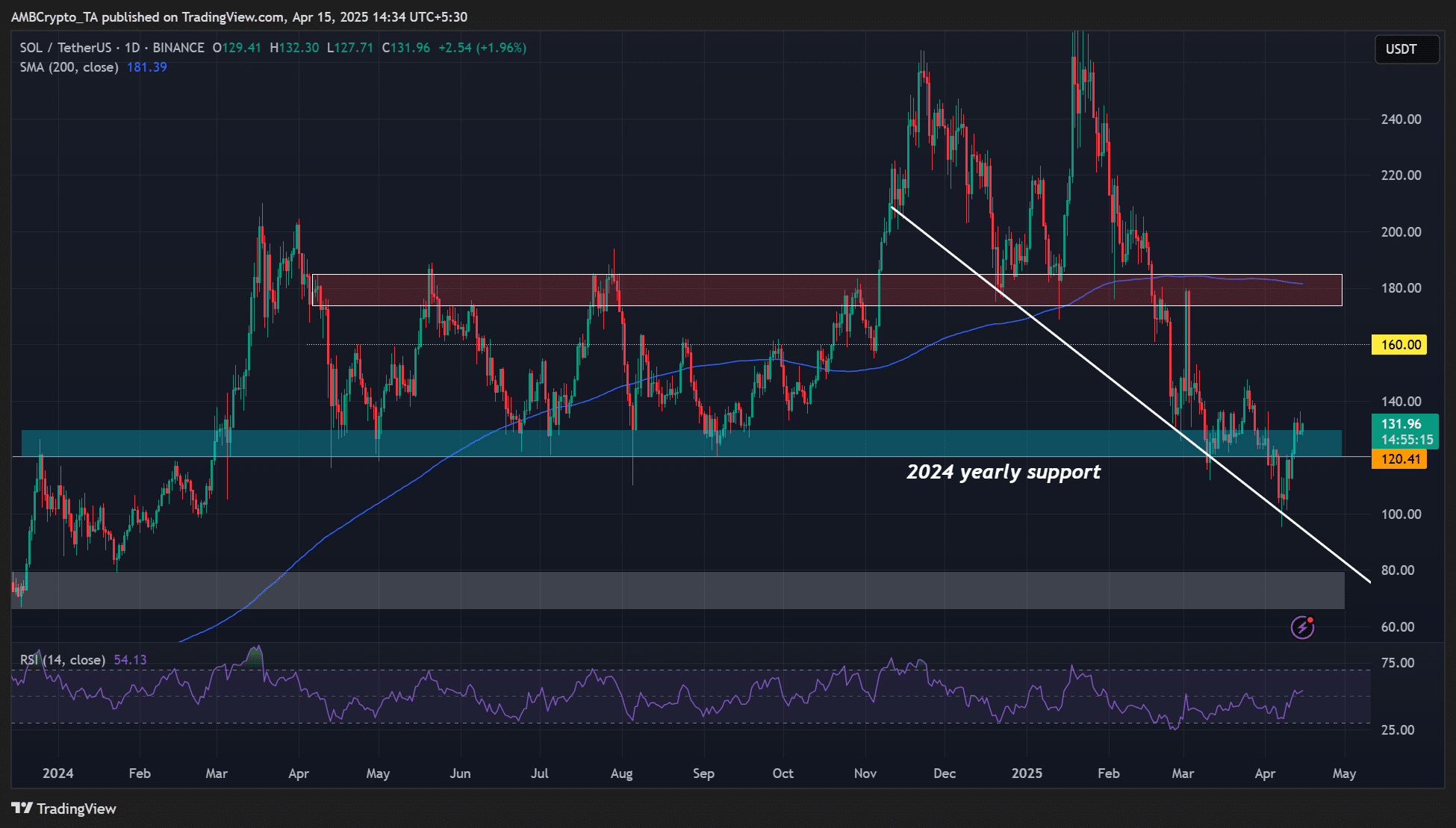

And yet, Solana’s price somehow clawed its way back above its 2024 yearly support of $120. If this support holds—who knows? Perhaps Solana could reach the lofty heights of $140 or even $160. Or perhaps not. In the crypto world, anything is possible… or nothing at all.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Castle Duels tier list – Best Legendary and Epic cards

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

2025-04-15 21:18