As a seasoned crypto investor with over a decade of experience in navigating the digital asset market, I can’t help but feel a mix of relief and apprehension upon hearing about the U.S. Federal Trade Commission’s new ban on fake reviews and recommendations. Relief because it signals a commitment to upholding fairness and transparency in the crypto space, something that has been sorely lacking for far too long. But apprehension, because as we all know, where there are rules, there will always be those looking to bend or break them.

As a analyst, I find myself interpreting the U.S. Federal Trade Commission’s decision to prohibit fraudulent reviews and endorsements as having potential implications for the cryptocurrency market. This ruling may instill a sense of trust and transparency within the sector, potentially attracting more investors who value authenticity and reliability in their investment choices. However, it is crucial to closely monitor how this development unfolds and its impact on various players within the crypto industry, as well as any potential regulatory responses or adjustments that may follow.

Table of Contents

Based on the recent updates, the new decision imposes financial and organizational limitations on people involved in the trade of bogus social media influence metrics.

The top brass at the Federal Trade Commission (FTC) has collectively endorsed the implementation of fresh regulations. These regulations will become enforceable exactly 60 days following their publication in the Federal Register.

Misleading reviews, instead of just being a waste of people’s time and resources, contaminate the marketplace, misguide consumers, and steer business away from genuine competitors.

Lina M. Khan, FTC chair

Under the new regulations, crypto enthusiasts are included. The recent prohibition means that deceptive practices to amplify a social media account or platform can result in penalties and disciplinary action by the regulatory bodies. Moreover, the FTC will prevent the utilization of AI-based tools for these unscrupulous activities.

In other words, this ban pertains exclusively to instances where the account holder intentionally requested or made arrangements for such a service. Additionally, it’s important to note that penalties will be enforced if these methods are utilized to secure advantages for business-related objectives.

Social media investment scams continue to grow

Lately, the Federal Trade Commission (FTC) has observed a significant surge in investment scams through social media, particularly those involving cryptocurrencies. The deceitful tactics involve misleading messages that promise substantial profits with minimal or no risk.

According to FTC expert Andrew Raio, it’s become common for swindlers to focus their schemes on social media users across popular platforms, offering deceitful investment chances, particularly in the realm of cryptocurrencies.

Should you respond, the con artist might claim they’ve earned substantial profits from Bitcoin or another digital currency investment. They will then offer an exclusive chance promising high returns with minimal or no risk. However, these claims are fabricated to deceive you and secure your funds.

As a crypto investor, I found myself lured into a convincing but fraudulent platform, believing it to be a lucrative opportunity for my investments. However, this phony site or app seemed too good to be true and indeed, it was. The scammer skillfully drained my account of as much money as possible before vanishing without a trace, leaving me with an empty wallet and a bitter lesson learned.

Crypto romance scams

Additionally, the Federal Trade Commission (FTC) has issued a caution regarding fraudsters who pose as romantic interests while providing misleading investment advice about cryptocurrencies.

Scammers often develop a personal bond with their targets, which increases the likelihood that you’ll trust them as knowledgeable advisors on cryptocurrency investments.

As an analyst, I’d put it this way: Often, my encounters with fraudsters start through unexpected messages on social media. They meticulously examine my profile to create a sense of familiarity and rapport. Once they’ve gained my trust, our conversations shift towards investment opportunities. They present themselves as champions of financial security, aiming to protect mine specifically.

More restrictions for the crypto sphere are coming

Besides crypto influencers, betting platforms have also faced examination by U.S. regulatory bodies in the past.

In August, the U.S. Congress urged the Commodity Futures Trading Commission to prohibit wagers related to politics, as these could potentially impact the results of the upcoming U.S. presidential election.

A group consisting of five senators and three representatives from the House of Representatives penned an open missive to Chair Rostin Behnam of the Commodity Futures Trading Commission (CFTC). In this letter, they expressed their concern that these mechanisms might potentially erode public trust in the electoral process.

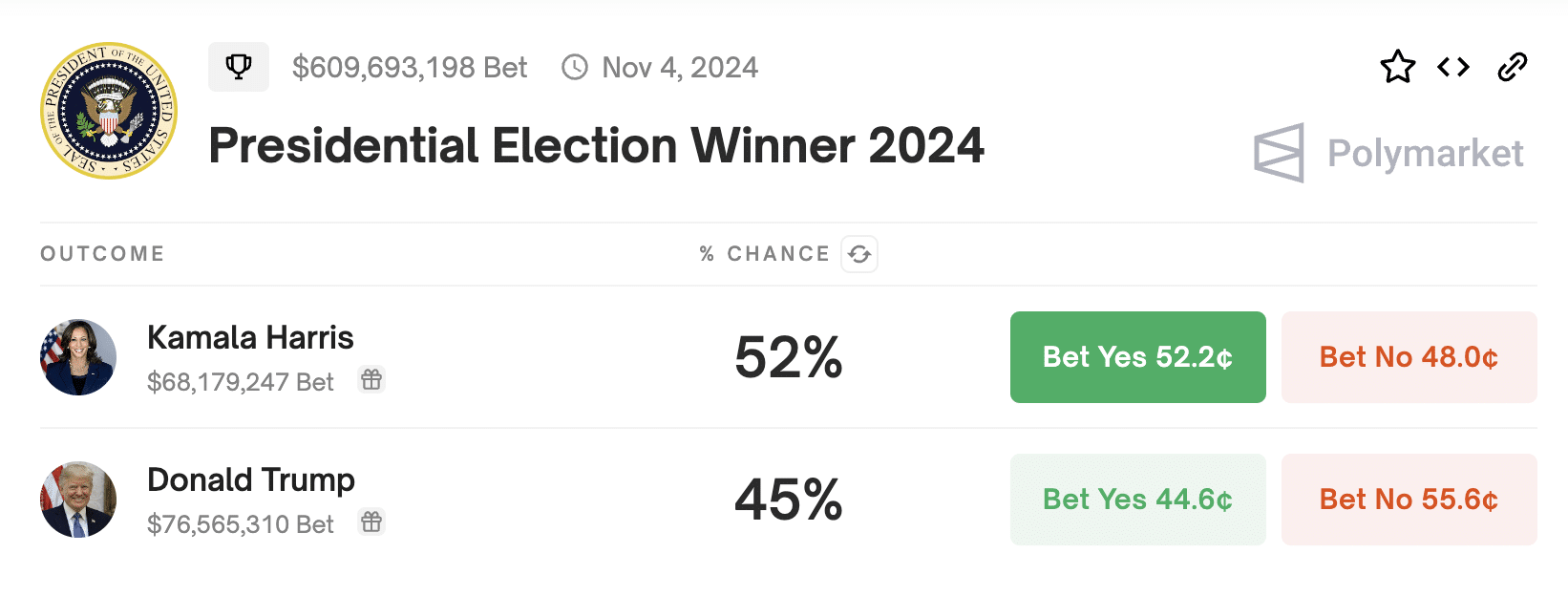

The initiative targets the Polymarket prediction platform, where crypto enthusiasts wager on the outcome of the presidential election. As per recent reports, the total amount wagered has surpassed $606 million. Currently, Vice President Kamala Harris is favored to win, with users predicting a 53% chance of victory for her. Interestingly, 44% of those who have made bets are betting on Donald Trump’s success in the election.

Simultaneously, the political segment on this platform accumulates over a billion dollars in funding, while numerous participants wager on various happenings hosted by Polymarket.

U.S. politicians have suddenly fallen in love with cryptocurrencies

Regardless of what individual regulators or government officials might say, there’s been a growing fascination among politicians towards cryptocurrencies as the presidential elections approach. For instance, Trump, who once ordered the U.S. Treasury to phase out Bitcoin (BTC) in 2018, and more recently in 2021, labeled it as a scam and advocated for tighter regulation within the industry.

While the Democrats haven’t openly endorsed digital assets, they haven’t advocated for stricter regulations or a ban in recent times. Furthermore, if given the green light, the Securities and Exchange Commission could have approved at least one proposal for an Ethereum-based ETF.

It’s clear that American politicians have developed a supportive stance towards cryptocurrencies.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Maiden Academy tier list

2024-08-16 22:21