- Bitcoin’s fear and greed index jumped from 37% (yeah, actual fear) to 47%, which is apparently ‘neutral’—because, sure, why not?

- Technical and fundamental analysis claim the market’s gonna get bullish. Cue the collective eye-roll.

Bitcoin (BTC) decided to do the impossible—leading the altcoins up like it actually cares, gaining 5% in 24 hours and flirting with $91.3k. First time since March 4, which means the selloff was so last season.

The altcoins joined the party, boosting total crypto market cap by over 3% to around $2.95 trillion. Meanwhile, $348 million in shorts got liquidated. That’s right: lots of people betting against the party and losing their shirts. Classic.

Why Is Bitcoin Suddenly Playing Motivational Speaker?

Whales Got Hungry Again

Gold hit a record high ($3.5k/oz), so apparently whales took a break from their underwater caves to remember Bitcoin exists. These finicky giants threw some serious cash around, making the market feel like a kid in a candy store.

And those U.S. spot BTC ETF folks? They just poured in $381 million, probably after a long, dry Netflix binge waiting for a sign.

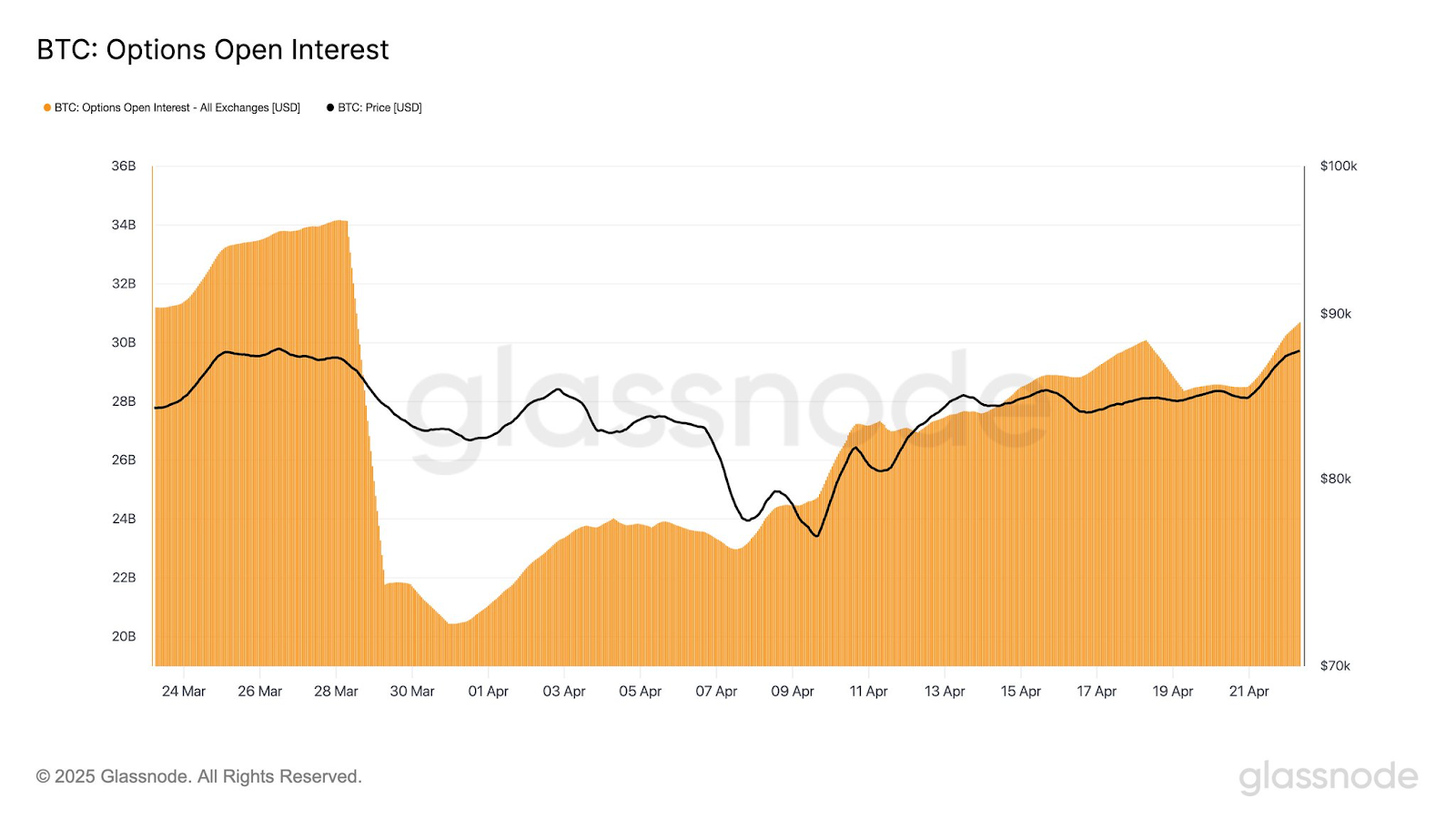

Open Interest (OI) Is Open and Interested

Coinglass says total crypto Open Futures jumped 13%, getting cozy around $120 billion. Bitcoin alone got a 16% bump in OI, sitting at $69 billion—because who doesn’t want to keep the suspense going?

Macroeconomic Breeze or Just Hot Air?

Stocks went up (Dow, S&P 500, NASDAQ all got a 2% glow-up), so crypto decided to tag along. Blame “improving” trade talks, which somehow made everyone optimistic for a minute.

What Now? Should We Buy the Dip or Just Dip?

Technically, BTC could shoot for some ridiculous new all-time high if the Fed keeps acting all “independent” and mysterious. Geoff Kendrick from Standard Chartered thinks it might actually happen, which is either hopeful or a setup for more drama. Grab your popcorn.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- PUBG Mobile heads back to Riyadh for EWC 2025

- USD CNY PREDICTION

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Arknights celebrates fifth anniversary in style with new limited-time event

- Hero Tale best builds – One for melee, one for ranged characters

- Every Upcoming Zac Efron Movie And TV Show

- Grimguard Tactics tier list – Ranking the main classes

2025-04-22 21:52