As a researcher with a background in finance and experience in following the cryptocurrency market closely, I find Bitcoin’s (BTC) recent performance intriguing. After a bearish start to the week, BTC saw a remarkable recovery, staging three consecutive days of gains. This rebound coincided with positive news from the U.S. labor market report and bullish expectations it triggered.

This week, Bitcoin (BTC) is a noteworthy cryptocurrency to keep an eye on due to its modest price increase following a last-minute surge instigated by buyers.

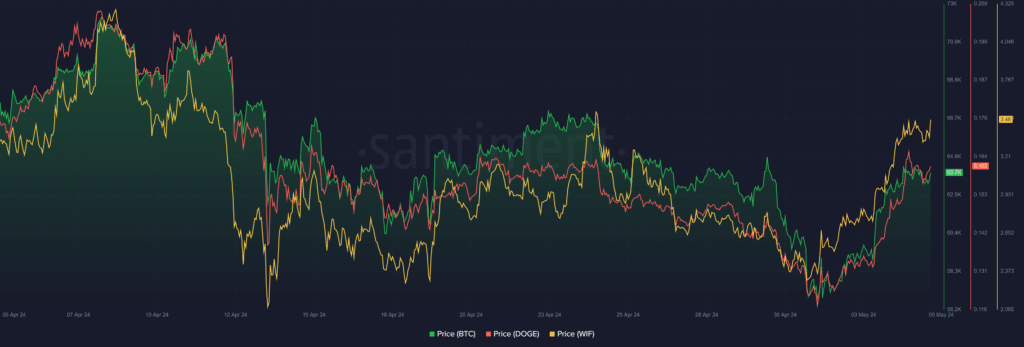

The echo of the rebound was felt strongly across the expansive crypto market. Notably, meme coins Dogewhiz (WIF) and Dogecoin (DOGE) experienced significant price surges.

During the volatile market conditions that affected all investments this past week, the total value of all cryptocurrencies stayed relatively steady with a dip to $2.11 trillion on May 1, followed by a rebound to $2.35 trillion as of the latest update.

As a researcher, I’ve compiled the trading performances of the leading cryptocurrencies over the last few days, with this week’s market figures showing little change.

Bitcoin closes above 20-day EMA

The opening of the week for Bitcoin was predominantly negative, with bears continuing to exert downward pressure following the selling spree from the previous week. Consequently, Bitcoin’s price, which started at $63,106, plummeted to a low of $56,500 on May 1, marking the first time it dipped below $57,000 since February 28.

As an analyst, I’ve observed a notable bearish trend in the market this week, which has been reflected in the performance of spot Bitcoin ETFs. Specifically, IBIT, managed by BlackRock, experienced no inflows for the fourth day in a row as investors continued to exhibit caution.

On May 1, BTC experienced a significant drop in value, reaching $56,500. As a result, IBIT recorded its initial outflow since inception, totaling $36.9 million that day. Notably, the ETF market reported a substantial exit of $563 million, marking the largest such withdrawal to date.

It’s intriguing that after experiencing a bearish trend, Bitcoin bounced back with three successive daily increases from May 2-4. This resulted in a 9.47% price surge, effectively offsetting much of the recent decrease.

The Bitcoin recovery occurred concurrently with the release of the U.S. labor market report on May 4, which strengthened the upward trend by generating optimistic outlooks based on the data. As a result, Bitcoin surpassed the $64,000 mark and went above its 20-day moving average for the first time in three weeks. Arthur Hayes, founder of BitMEX, anticipated a steady price recovery in the near future.

At present, Bitcoin is priced at $63,686, having managed to stay above its 20-day moving average ($63,351). The cryptocurrency is now hovering near the 50-day moving average ($63,892), which it has not yet surpassed. If Bitcoin breaks through the 50-day moving average, it may gain enough momentum for bulls to propel it towards the significant resistance level at $67,506 set by the Bollinger Band.

WIF among top gainers with 21% upsurge

This week, Dogwifhat stood out as a notable gainer amidst initial market turbulence. While WIF initially mirrored the broader market trend, it ultimately surpassed Bitcoin’s performance and outshone every crypto within the top 100 during the subsequent market rebound.

This week, the meme coin experienced a downturn, initiating after its price plummeted from the peak of $3.56 on April 24. In tandem with Bitcoin’s decline below $57,000 on May 1, the Dogwifhat coin reached a new low beneath the $2.27 threshold. However, it managed to end the day with a 4.34% increase, surpassing Bitcoin’s daily growth.

Dogwifhat experienced a notable surge in its recovery phase between May 1 and 4, registering a significant gain of over 31%. This upward trend enabled it to regain the $3 mark for the first time since April 26, ultimately surpassing the resistance level at the upper Bollinger Band ($3.3179) on May 4.

As an analyst, I’ve noticed that the resistance level at $3.4009 has emerged as a significant hindrance to the ongoing price surge in WIF. With the Bollinger Bands expanding, this level now poses a formidable challenge to the coin’s upward trajectory. To sustain its short-term bullish trend, WIF needs to break above this resistance and secure a closing price above it. The meme coin has registered a strong weekly performance with a gain of 21.82%.

DOGE ends nine-day losing streak

During the recent market slump, while other assets experienced on-again, off-again fluctuations, Dogecoin experienced uninterrupted losses that carried over into this week. Since the previous week, DOGE has endured a nine-day losing streak, extending from April 23 through May 2.

As a Dogecoin investor, I’ve experienced a significant setback during this timeframe. The cryptocurrency plummeted by approximately 20.86%, reaching a low of $0.1201 – the cheapest it has been since March.

Despite the losing streak, DOGE managed to bounce back during the market recovery and regained all its lost value. The cryptocurrency experienced a significant surge of 37% from its low of $0.12407 on May 2 to a peak of $0.1700 on May 4.

This surge enabled Dogecoin to break through its 50-day moving average ($0.1554) on May 4. As the market recovery started to weaken, DOGE has revisited its 50-day moving average in an attempt to utilize it as a launchpad for significant growth once the surge recovers. At present, Dogecoin is priced at $0.1613 and has experienced a 10% increase this week.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Castle Duels tier list – Best Legendary and Epic cards

- Maiden Academy tier list

- Silver Rate Forecast

- Cookie Run Kingdom: Lemon Cookie Toppings and Beascuits guide

- Pi Network (PI) Price Prediction for 2025

2024-05-05 18:06