As a seasoned crypto investor with a keen interest in following the strategies of venture capital funds, I find this recent wave of activity intriguing. The data presented shows that top VC funds have been adjusting their portfolios, making strategic buys and sells based on their analysis of market trends and asset performance.

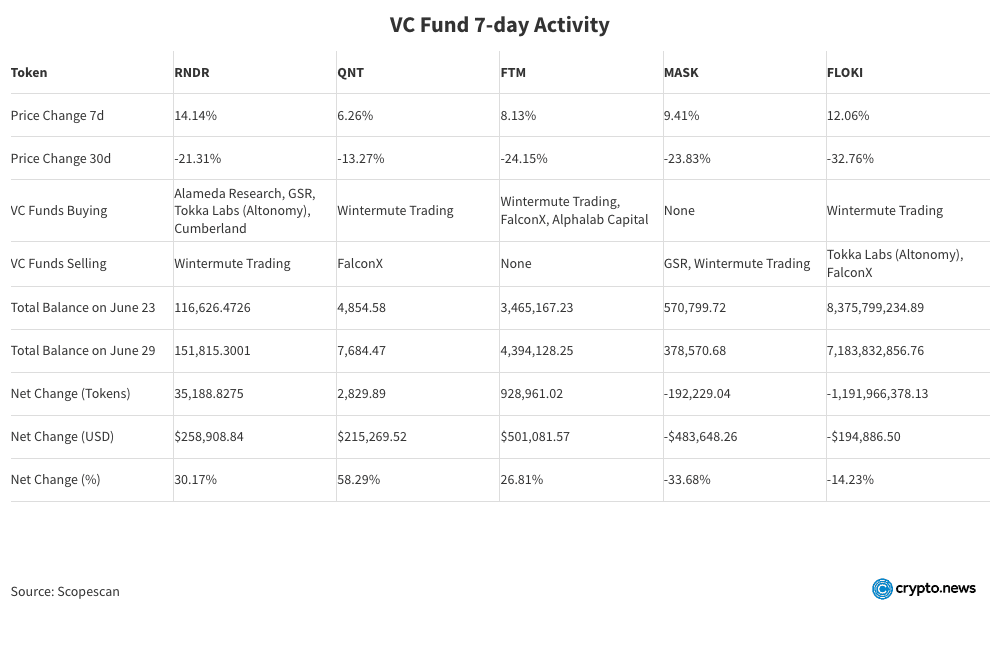

As a crypto investor, I’ve been keeping a close eye on the recent adjustments made by top venture capital funds to their portfolios, based on data from Scopescan analyzed between June 23 and June 29. I noticed that they boosted their investments in RNDR, QNT, and FTM, while trimming down their positions in MASK and FLOKI. These decisions came after significant price drops for these assets over the past month.

Table of Contents

Major Buys

VC firms like Alameda Research, GSR, Tokka Labs (Altonomy), and Cumberland have boosted their RNDR holdings significantly. This action resulted in an inflow of 35,188.83 tokens and $258,908.84 in USD, marking a 30.17% growth. Wintermute Trading demonstrated substantial backing for QNT, acquiring 2,829.89 tokens and increasing its worth by $215,269.52, signifying a robust 58.29% surge. Meanwhile, FTM received investments from Wintermute Trading, FalconX, and Alphalab Capital, resulting in a net gain of 928,961.02 tokens and $501,081.57, representing a noteworthy 26.81% rise.

Investors, including venture capitalists (VCs), may have seized opportunities presented by price downturns in assets like RNDR, QNT, and FTM during the previous month. These declines, amounting to -21%, -13%, and -24% respectively, potentially made for advantageous buying moments. The VCs’ rationale appears to be that these assets, currently deemed undervalued, will eventually recover and increase in value. In essence, the investors are betting on future rebounds and seeking substantial returns over the long term.

Major Sell-offs

MASK and FLOKI experienced significant token sell-offs. Wintermute Trading and GSR disposed of $483,648.26 worth of MASK tokens, representing a 33.68% decrease in value. Similarly, FLOKI saw substantial sales from Tokka Labs (Altonomy) and FalconX, leading to a loss of 1,191,966.37 tokens and $194,886.50 in value, equivalent to a 14.23% reduction.

As an analyst, I find it intriguing to delve into the motivations behind venture capital funds selling off their tokens in MASK and FLOKI despite recent price fluctuations. Over the past 30 days, MASK suffered a significant setback with a decline of 23.83%, whereas FLOKi experienced an even more pronounced drop at -32.76%. However, over the last week, both tokens displayed some positive momentum, with MASK gaining 9.41% and FLOKi recording a 12.06% increase.

The Rationale Behind VC Fund Activities

As a seasoned crypto investor, I understand that interpreting venture capital (VC) fund transactions solely based on buys and sells can be misleading. VC firms make these decisions for various strategic reasons which go beyond just being bullish or bearish. For instance, they might buy into a project to support its growth, gain a seat at the table, or diversify their portfolio. Conversely, selling assets could be due to realizing profits, exiting a losing position, or rebalancing their portfolio. It’s essential to consider these nuances when evaluating VC fund activity in the crypto space.

Reasons for Buying or Selling:

- Portfolio Rebalancing: Adjusting the portfolio’s composition to maintain a desired risk profile or capitalize on new opportunities.

- Profit Realization: Locking in gains after a period of price appreciation to ensure investment returns.

- Risk Mitigation: Reducing exposure to assets perceived as high risk to protect the overall portfolio from potential downturns.

- Liquidity Requirements: Generating cash flow for operational needs or funding new investment opportunities.

- Regulatory Considerations: Anticipating changes in the regulatory environment that could impact the value of holdings.

- Tax Optimization: Selling assets to optimize tax outcomes, such as offsetting gains with losses elsewhere in the portfolio.

- Macroeconomic Factors: Reacting to global economic trends that suggest better returns might be available in other markets.

- Diversification: Ensuring the portfolio remains diversified across various asset classes to reduce risk.

Reflecting on the past week’s market developments, my investments in RNDR, QNT, and FTM have shown positive returns. On the other hand, I sold off my positions in MASK and FLOKI which are currently performing well. This situation leaves me pondering over the long-term implications of the venture capitalists’ strategic moves. Will the profits from RNDR, QNT, and FTM maintain their superiority over MASK and FLOKI? Or, will cutting down my holdings in MASK and FLOKI turn out to be a less fruitful choice in the long run? The answer lies in the unfolding of events.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- Maiden Academy tier list

- All New and Upcoming Characters in Zenless Zone Zero Explained

2024-07-01 13:44