As a seasoned researcher with years of experience in the volatile world of cryptocurrencies, I’ve seen my fair share of market swings and liquidations. Today’s $553 million crypto liquidation is a stark reminder of the rollercoaster ride that is the crypto market.

As an analyst, I’ve observed a staggering $500 million worth of cryptocurrency liquidations in a single day, following a dip in Bitcoin‘s price, which reached its lowest point in the last seven days.

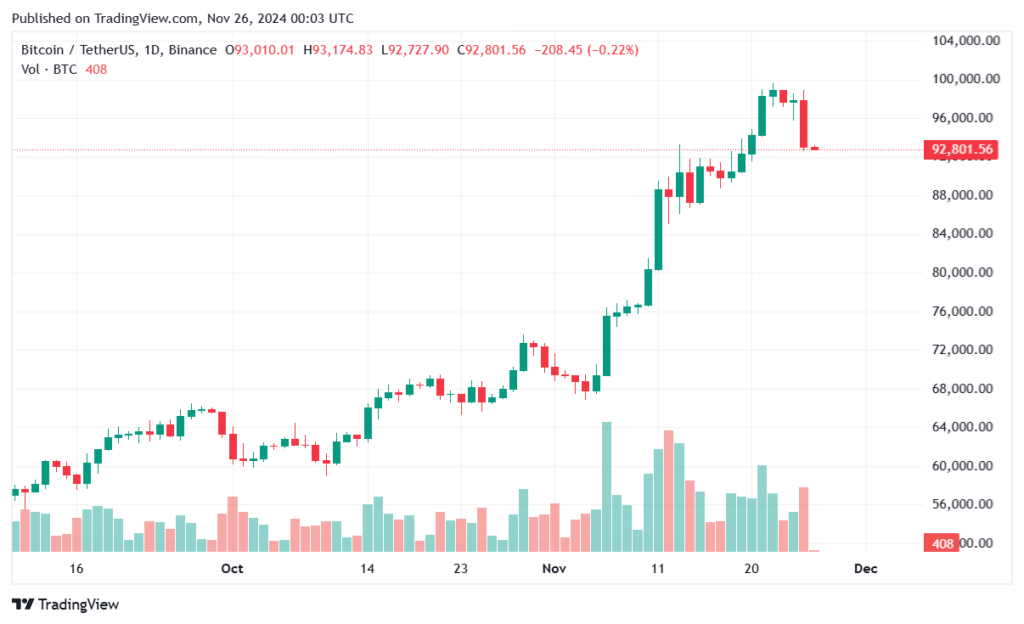

Based on data from Coinglass, crypto traders experienced a significant liquidation totaling approximately $553 million over the past 24 hours. Traders holding long positions accounted for about $413 million of this figure as the price of Bitcoin dipped to around $92k, marking a nearly 5% decrease within a day.

Over the past 12 hours and 4 hours, there has been significant crypto liquidation resulting in a loss of approximately $344 million and $140 million respectively for long positions. Additionally, the value of short positions over the last day has reached triple digits at around $138 million.

In simple terms, Bitcoin (BTC) and Ethereum (ETH) play a crucial role in the cryptocurrency market’s liquidation events. As of this moment, Bitcoin has a liquidation value of approximately $24 million distributed across both long and short positions. On the other hand, Ethereum shows a liquidation value of around $11 million in the long positions and an impressive $3 million in the short positions.

Approximately 169,879 individuals involved in cryptocurrency trading saw their positions closed within the last 24 hours, and those on the Binance platform accounted for the largest number of such closures, totaling around $4.67 million in trades involving BTC/USDT.

The crypto market capitalization in amount also dropped almost 3% to $3.23 trillion, and the trading volume is around $240 billion.

Crypto liquidations continue

The lesser-valued cryptocurrencies, or altcoins, have experienced a substantial effect as a result of crypto liquidations, leading to approximately $100 million in losses within the market. On November 24th alone, a total of $494 million was liquidated.

In simpler terms, this recent downturn in the cryptocurrency market following Bitcoin’s surge over the past month is often seen as typical market behavior. As per CoinMarketCap’s latest update, Bitcoin continues to be the leading player in the market with a 57.4% share, and the crypto fear-greed index currently stands at 82 points, suggesting that the market is exhibiting extreme greed.

The force of this wave could additionally spark optimism for a bull run, given the favorable economic outlook, particularly in the U.S., for cryptocurrencies. This positive mood might also influence the surge in alternative cryptocurrencies, following a decline in Bitcoin’s dominance.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- USD CNY PREDICTION

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Castle Duels tier list – Best Legendary and Epic cards

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-11-26 03:44