As a seasoned researcher with years of experience in the crypto market, I’ve seen my fair share of price fluctuations and trends. The recent retreat of Tron (TRX) from its peak is not entirely unexpected, given the volatility inherent in this space. However, it’s important to note that Tron has shown remarkable resilience and growth in recent weeks, outperforming many other major coins.

Over the last eight days, I’ve noticed a pullback in Tron’s price as the initial momentum within its ecosystem started to slow down.

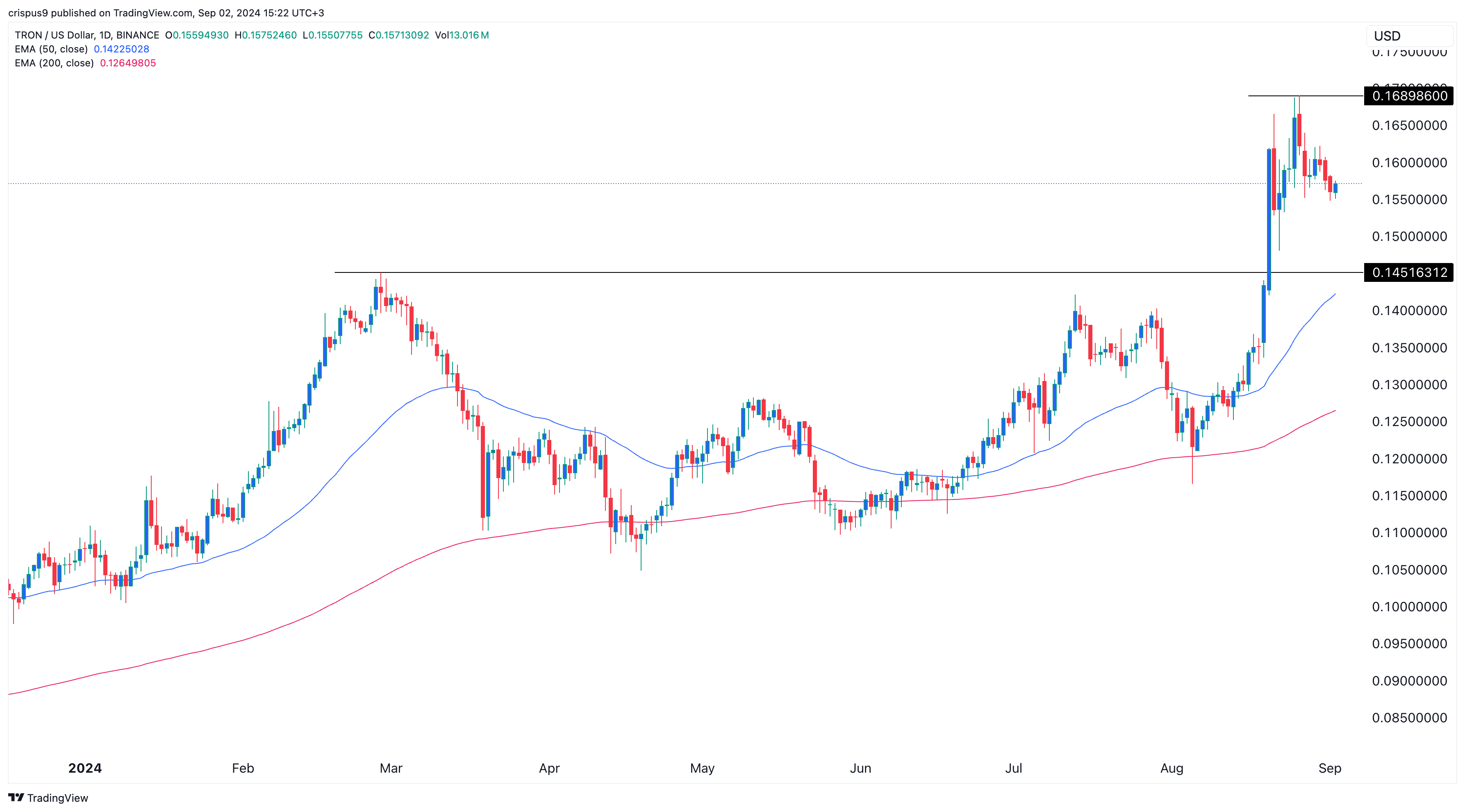

On September 2nd, the value of Tron (TRX) was approximately $0.1565, marking a decrease of more than 7% from its highest price point in 2020. As a result, its market capitalization now exceeds $13.5 billion.

Tron’s key metrics are falling

Nonetheless, Tron stands out as one of the top performing significant cryptocurrencies in recent times, skyrocketing by approximately 44% since its August low. Moreover, it recently peaked at an all-time high of $0.1690.

During the past month, the token showed strong performance after several significant occurrences, with the standout event being the debut of SunPump – our network’s meme coin generator. In just under three weeks, this launch sparked the creation of thousands of memes, resulting in approximately $50 million in transaction fees. The total market cap for all meme coins within the ecosystem now surpasses $493 million.

Lately, it seems the Tron ecosystem may be slowing down a bit. Take Sundog (SUNDOG) for instance, which is the largest meme coin within this system – it’s currently down more than 24% from its peak in August.

Additionally, other tokens such as Suncat, SunWukong, FoFar, and Dragon Sun have fallen by more than half within the past week.

Additional data shows that Tron’s total value locked in its decentralized exchange network has dropped by 8% in the past seven days to over $8.1 billion. The volume of tokens traded in Tron’s decentralized exchanges has fallen by over 21% in the last seven days.

Additionally, it’s worth noting that Tron’s engagement in the futures market has been steadily decreasing. On September 2, this figure dropped to more than $141 million, a significant decrease from its peak of around $234 million in August.

Nonetheless, Tron remains one of the leading blockchains within the sector. This year alone, its network has generated approximately $1.1 billion in earnings, placing it as the second most profitable blockchain in the industry. Moreover, it boasts a significant amount of around $59 billion in stablecoins and maintains 2.24 million active addresses.

Tron price rally has eased

Since hitting its low point in 2021, Tron’s price trajectory has deviated more from Bitcoin (BTC), demonstrating reduced correlation with other digital currencies. It peaked at a new high of $0.1690 just last month but has since dipped back to around $0.155.

Tron currently hovers above both its 50-day and 200-day Exponential Moving Averages (EMA), and it’s also close to a significant resistance level at $0.1451, which marks its highest peak in February.

It’s possible that the value of the token could dip down to approximately $0.15, but if it does, it might then continue its upward momentum. A stronger bullish trend will be indicated if the token manages to surpass its highest point this year, which is currently at $0.1690.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Silver Rate Forecast

- USD CNY PREDICTION

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-09-02 15:48