As a seasoned researcher with over a decade of experience in the cryptosphere, I have witnessed countless market fluctuations, from soaring highs to crushing lows. The current performance of Tron (TRX) and its associated meme coins within its ecosystem, such as SunPump tokens, has piqued my interest yet again.

Tron price held steady on Saturday, Sep. 21 as most SunPump tokens retreated.

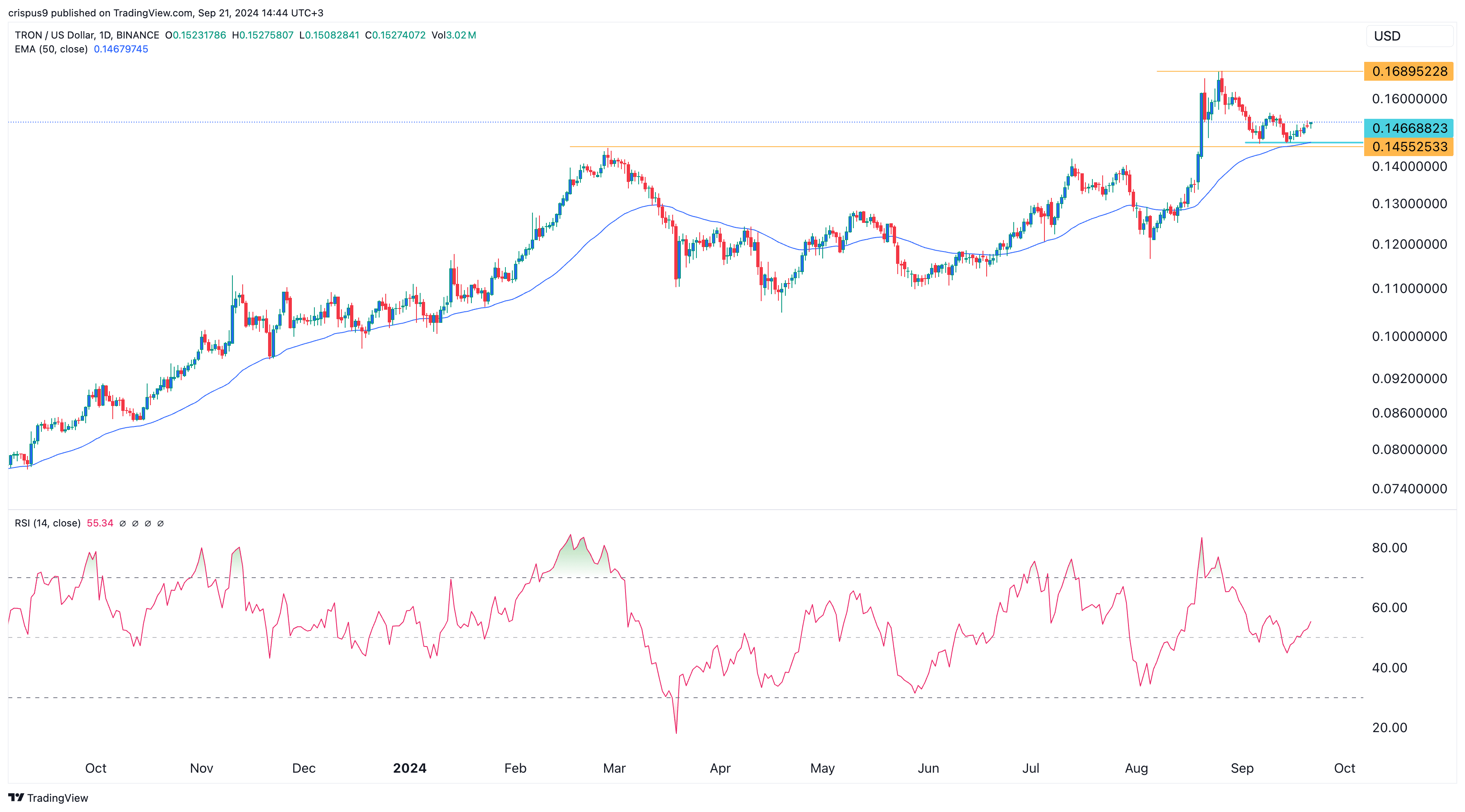

Tron (TRX) climbed up to $0.1520, slightly surpassing this week’s bottom at $0.1467, but currently sits 11% lower than its peak for the year.

SunPump tokens crash

Data by CoinGecko shows that most SunPump meme coins have retreated in the past few days.

-

Sundog (SUNDOG), the biggest coin in its ecosystem, has dropped by 11.1% in the past seven days to $0.30, bringing its market cap to $305 million.

Tron Bull retreated by 8%

Muncat, 35%,

SunWukong, 10%,

Suncat tokens, 37% in the same period.

As a researcher examining the Tron’s ecosystem, I’ve observed a decrease in the combined market capitalization of all meme coins. Initially, it was above $560 million; however, it has now dropped to approximately $514 million.

Over the past week, Tron’s DEX trading volume has decreased by approximately 10%, dropping to around $453.6 million. On the other hand, platforms like Solana (SOL), Binance Chain, and Sui have experienced an increase in their DEX volumes. Specifically, Solana saw a rise of 11%, Binance Chain surged by 22%, and Sui experienced a significant jump of 70% within this period.

On a optimistic note, the transaction count in Tron increased significantly as per Nansen’s data. The peak was reached on Saturday with more than 8.2 million transactions, which is the highest since August 27 and considerably higher than the monthly low of 6.14 million recorded this month.

Tron is also one of the most profitable networks in the crypto industry.

As a crypto investor, I’ve been tracking the network fees and it’s fascinating to see that my chosen platform’s fees this year have surpassed the $1.2 billion mark, making it the runner-up to Ethereum with its impressive $1.86 billion in fees.

SunPump tokens have generated over $44.8 million in fees since inception.

A noteworthy improvement is seen in the return on Tron’s staking, which has surged to 4.97%, a figure that exceeds last month’s lowest point of 4.35%. This uptick can be attributed to an increase in the rate of Tron burn and gas fees during the course of the month.

Tron’s technicals are supportive

In terms of technical analysis, there are some positive signs for Tron. During the period between August and September, it developed a double-bottom pattern, with prices reaching around $0.1466. This price point was slightly higher than its significant support level at $0.1455, marking its highest swing since February this year.

Tron’s value has consistently stayed above its 50-day moving average, and its Relative Strength Index (RSI) has climbed above 50. This suggests that it could potentially keep rising since investors, or “bulls,” are aiming for the year-to-date peak of $0.1690.

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- PUBG Mobile heads back to Riyadh for EWC 2025

- Maiden Academy tier list

2024-09-21 15:58