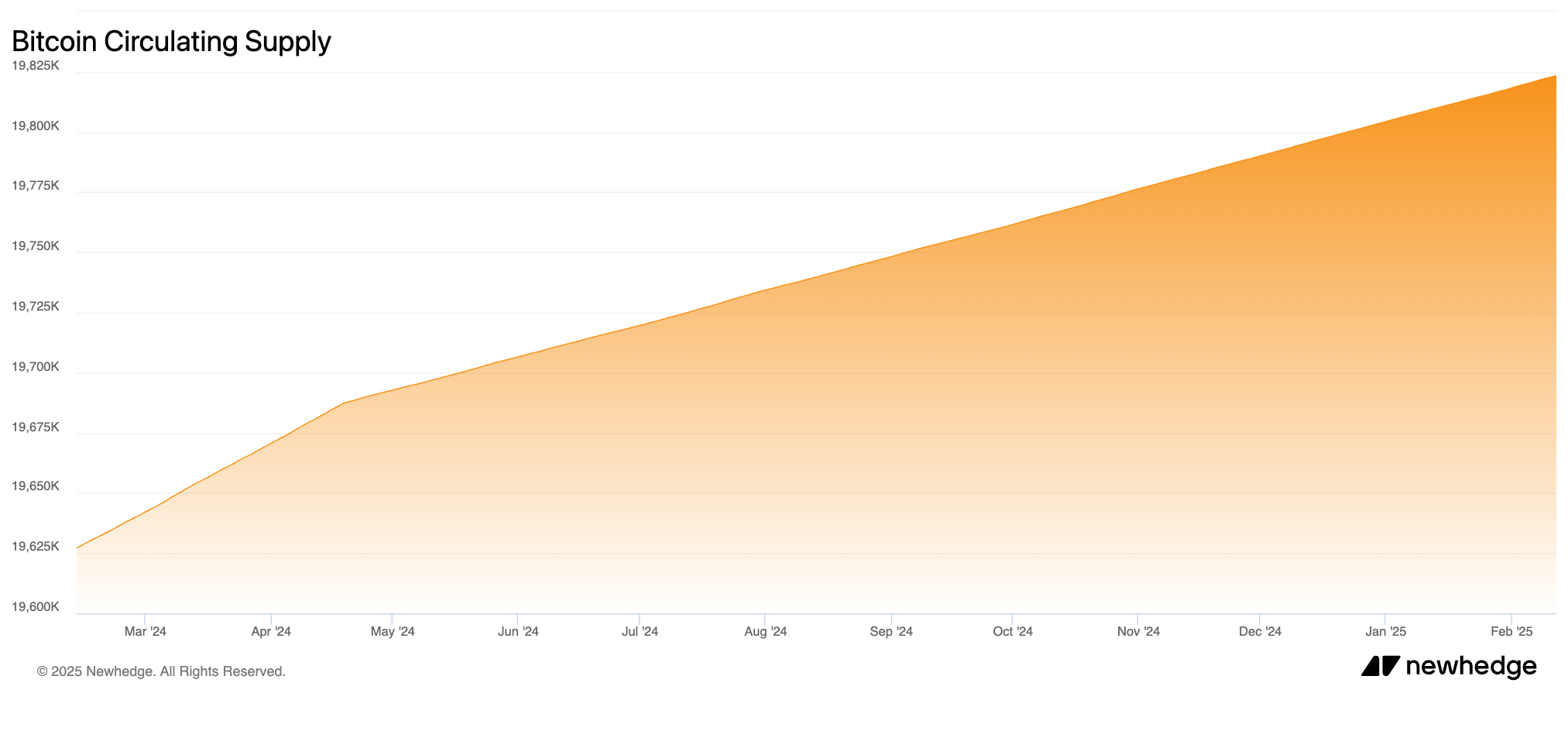

Ah, dear reader! Gather ’round as we embark on a most curious tale of Bitcoin, a digital treasure that has recently crossed the remarkable threshold of 19.96 million coins! Yes, indeed, over 95% of this elusive currency has been unearthed, and it seems we are on the brink of a scarcity that would make even the most seasoned gold miner weep with envy. With the swift withdrawals from exchanges, one might wonder if Bitcoin is playing a game of hide-and-seek! 🤔

And lo! What is this? Our very own U.S. President, Donald Trump, has taken a fancy to this digital gold! His grand plan for a Strategic Bitcoin Reserve is akin to a peasant discovering a hidden stash of rubles under his floorboards. With institutional adoption and the rollout of Layer 2 protocols, the demand for this digital asset could soon rival that of a freshly baked pirozhki! 🥟

Table of Contents

Bitcoin scarcity and BTC demand drivers

Since the fateful announcement of the U.S. Presidential election results in November 2024, the supply of Bitcoin on exchanges has plummeted by nearly 15%! Meanwhile, the supply outside these digital marketplaces has swelled from 17.99 million to 18.3 million, as if the coins were multiplying like rabbits! 🐇

Traditionally, a decline in exchange supply coupled with an increase in Bitcoin hoarding is a sign of bullishness, much like a farmer anticipating a bountiful harvest. The volume of Bitcoin on exchanges has reached its lowest level in three and a half years, which is about as rare as finding a well-behaved cat in a room full of mice! 🐱

Matthew Sigel, the sage of digital assets at VanEck, has analyzed 20 state-level Bitcoin reserve bills. He predicts that if these bills come to fruition, Bitcoin traders might see a demand surge of $23 billion! That’s enough to make even the most stoic banker do a little jig! 💃

We analyzed 20 state-level Bitcoin reserve bills.

If enacted, they could drive $23 billion in buying, or 247k BTC.

This sum is independent of any pension fund allocations, likely to rise if legislators move forward.— matthew sigel, recovering CFA (@matthew_sigel) February 12, 2025

According to the wise folks at Bitbo.io, only 1.039 million BTC tokens remain to be mined. Over 95% of mined Bitcoin is either circulating or hoarded by large wallet investors, much like a miser clutching his gold coins. Institutional demand could very well be the driving force behind Bitcoin’s price in 2025! 💰

U.S. Strategic Bitcoin Reserve progress and Trump’s plan for Bitcoin

Our illustrious President Trump has proposed the creation of a Strategic Bitcoin Reserve, a notion that could turn the crypto world upside down! Just as nations hoard gold and oil, the U.S. might soon be hoarding Bitcoin like a squirrel preparing for winter! 🐿️

The government currently possesses nearly 200,000 Bitcoins, seized from the clutches of nefarious criminals. It seems that even in the world of Bitcoin, the law has its way of turning the tables! According to a recent report, while the government has sold its BTC holdings in the past, it appears less likely to do so under the current administration. After all, who would want to part with such a shiny asset? 💎

As President Trump champions Bitcoin, institutional investors are scratching their heads, pondering the feasibility of adding this digital asset to their balance sheets. His Crypto and AI Tsar, David Sacks, has declared, “One of the first things we’re going to look at is the feasibility of a bitcoin reserve.” Sounds like a plan, doesn’t it? 🤷♂️

Bitcoin Layer 2 protocols

Kevin Liu, the mastermind behind GOAT Network, has shared his insights on the technological advancements of Bitcoin. He suggests that it only makes sense to provide various avenues for the growing number of users to engage with Bitcoin. After all, who doesn’t love options? 🍽️

“It only makes sense to offer numerous ways for that growing number of users to engage (with Bitcoin). Most Bitcoin Layer 2 networks rely on Bitcoin to fuel their economies, whereas most Ethereum Layer 2 lean on Ether. Different options for different users.

I do think Bitcoin L2s are well positioned, because Bitcoin is the undisputed king of cryptocurrencies, by market cap, mindshare, and pretty much any other major metric. Since Bitcoin L2s are such a new concept, there’s also a lot more room for growth and novel use cases than the more mature Ethereum L2 and alt-L1 markets.”

Liu also noted that both institutions and individual users are reluctant to sell their Bitcoin. Instead, they wish to put it to work, earning real BTC yield. It’s like having your cake and eating it too! 🎂

“Both institutions and individual users don’t want to sell their Bitcoin. They want to put it to work, earning real BTC yield. They can then use that yield to, say, pay for capital gains, or just everyday expenses. If the BTC yield is large enough, there may even be room to pay for day-to-day requirements and grow their overall stack.”

Whales and institutions don’t want to sell Bitcoin, what to expect

Ah, the wise sages at Santiment have predicted an incoming capitulation in Bitcoin. In the world of crypto, capitulation is when investors, in a fit of panic, sell their assets, fearing a price drop. It’s like a flock of birds taking flight at the slightest hint of danger! 🕊️

They have observed a decline in the number of non-empty wallets on the Bitcoin blockchain, indicating that retail traders are likely dumping their holdings while the whales continue to feast on the remaining BTC. In the last three weeks, the number of non-empty wallets has dropped by 277,240, a significant decline indeed! 📉

Bitcoin price forecast for February 2025

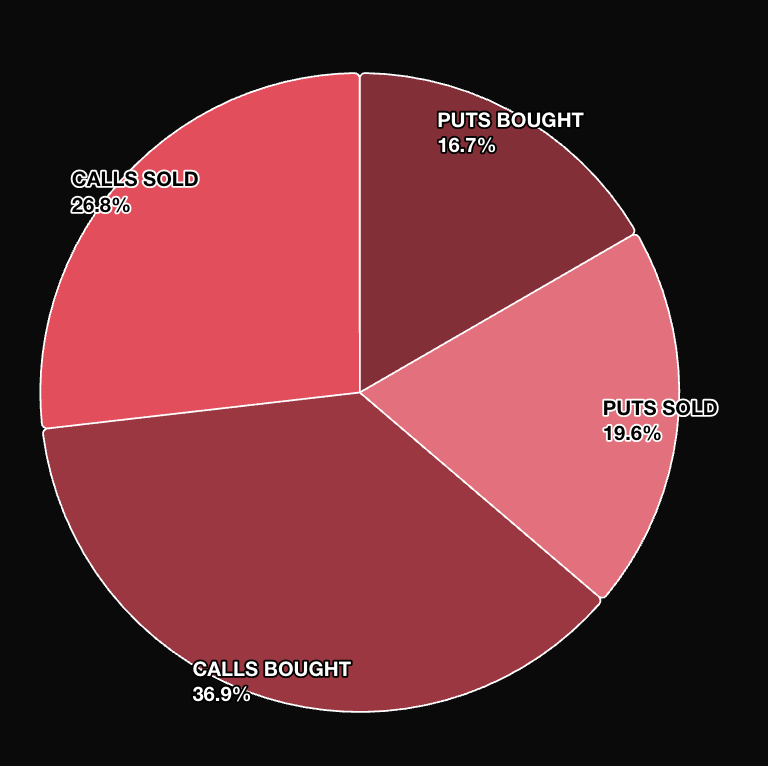

As we peer into the crystal ball of the derivatives market on Derive.xyz, we find that 47.3% of all premiums were calls sold, while 24.4% were calls bought. Traders seem to expect some upside, albeit with a cap on potential gains. It’s like hoping for a bountiful harvest but preparing for a meager yield! 🌾

Dr. Sean Dawson, the oracle of research at Derive.xyz, has shared his thoughts:

“We’re experiencing a temporary lull in volatility as the market recovers from last week’s turbulence caused by Trump’s tariff announcements.

BTC At-the-Money (ATM) 7-day Implied Volatility (IV) dropped 7 percentage points – from 47% to 40% over the last 24 hours and BTC’s chance of hitting $125,000 by June 27 has improved to 44.4%, up from 41.9%.”

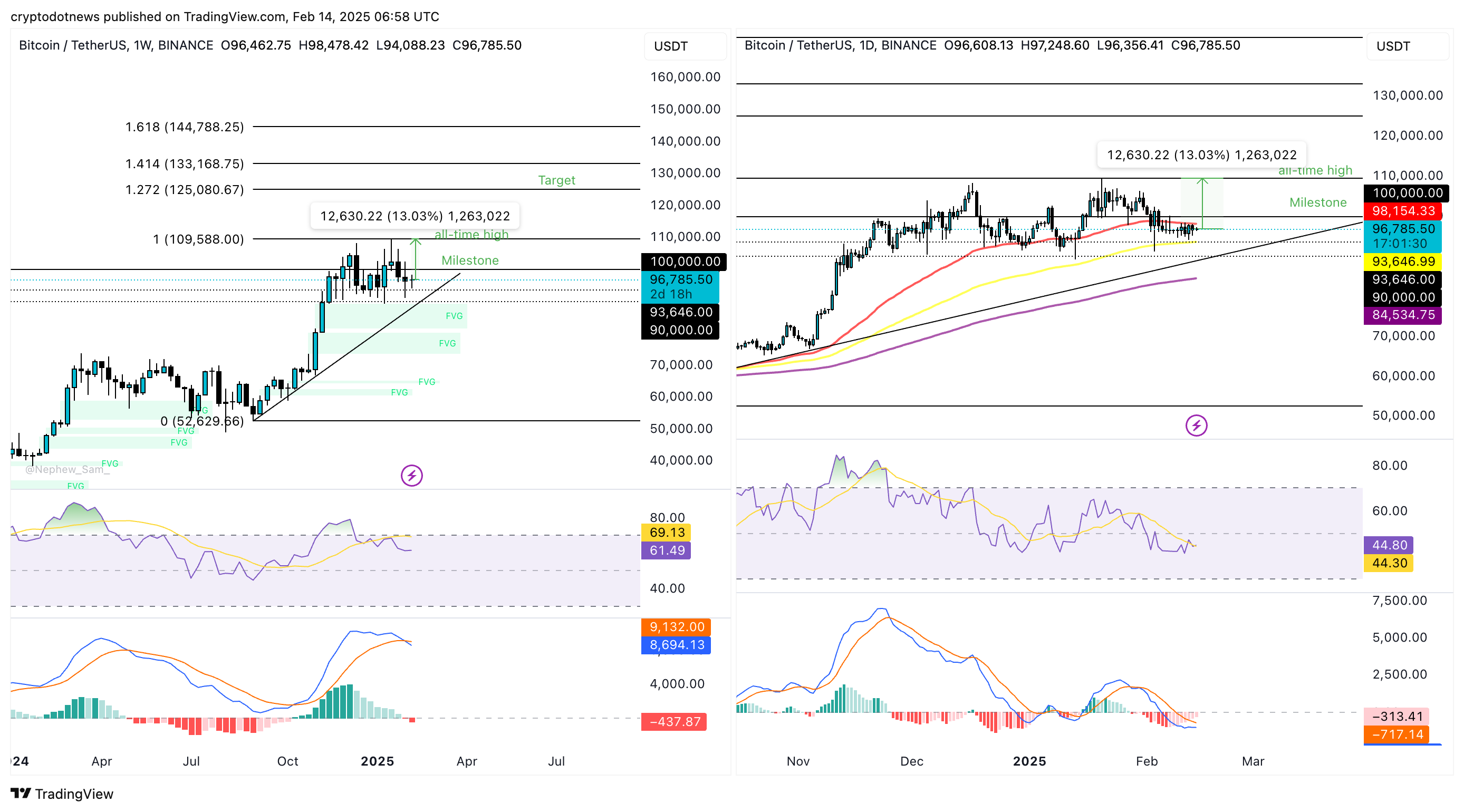

Dr. Dawson maintains an optimistic outlook on Bitcoin’s price, both in the near and long term. As we analyze the weekly and daily price charts for BTC/USDT, we find technical indicators supporting a bullish thesis and a likely return to test the all-time high of $109,588. It’s like waiting for the sun to rise after a long, dark night! 🌅

However, traders must remain vigilant, as Bitcoin could face resistance at the $100,000 milestone, with support at $93,646 and $90,000. The three EMAs indicate that $98,154 is a resistance level to watch, while the $84,534 level serves as key support. It’s a treacherous path, dear reader, but one worth navigating! 🧭

Read More

- 10 Most Anticipated Anime of 2025

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- USD CNY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Castle Duels tier list – Best Legendary and Epic cards

- Maiden Academy tier list

- Cookie Run Kingdom: Lemon Cookie Toppings and Beascuits guide

- Silver Rate Forecast

- USD MXN PREDICTION

2025-02-14 14:21