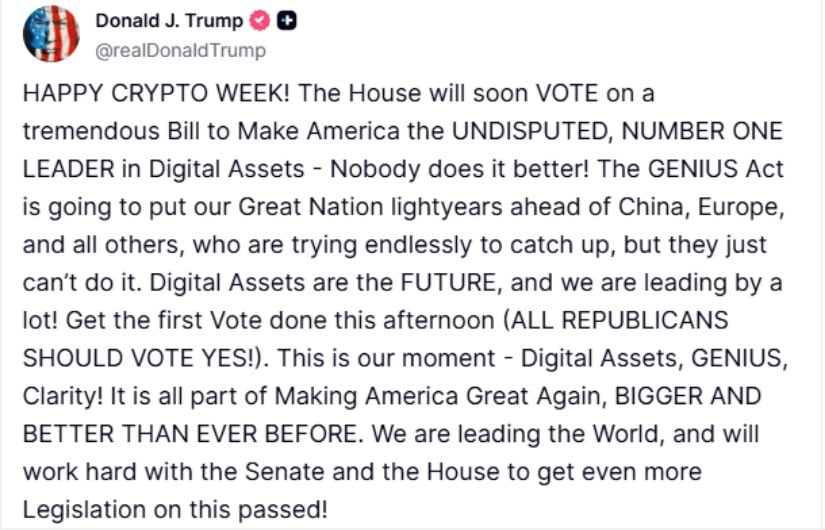

Well, now, if you can believe it, the one and only Donald Trump has taken to his Truth Social soapbox to push the Republicans into voting for the GENIUS Act. He posted, “Happy Crypto Week! The House will soon VOTE on a tremendous Bill to Make America the UNDISPUTED, NUMBER ONE LEADER in Digital Assets – Nobody does it better!” And just to make sure everyone’s on the same page, he added, “ALL REPUBLICANS SHOULD VOTE YES!” 🚀

The bill, which has already waltzed through the Senate with a bipartisan bow, now needs a nod from the House to land on Trump’s desk. If signed, it would be the first major federal cryptocurrency regulation in U.S. history. Imagine that! 🤯

Some House Republicans Block Crypto Bills Despite Trump’s Push

But here’s where the fun begins. Despite the former President’s enthusiastic cheerleading, the procedural vote crumbled like a house of cards when twelve conservative Republicans decided to play the spoiler. They cited concerns about the bill’s structure, which is a polite way of saying they didn’t like how it was written. This little hiccup brought the House proceedings to a screeching halt, leaving Speaker Mike Johnson and the Republican leadership looking a bit flustered. 🤦♂️

The vote ended in a 196-223 defeat, failing to secure the required majority and effectively putting the kibosh on debate and final votes on the GENIUS Act and two other crypto-focused bills. The list of naysayers includes Representatives Ann Paulina Luna, Scott Perry, Chip Roy, Victoria Spartz, Michael Cloud, Andrew Clyde, Eli Crane, Andy Harris, Marjorie Taylor Greene, Tim Burchett, Keith Self, and Andy Biggs. Quite the rogue’s gallery, wouldn’t you say? 😂

Speaker Mike Johnson, ever the optimist, has hinted that the House will give it another go later today. Fingers crossed! 🤞

What the GENIUS Act Would Do

The GENIUS Act, or the Guiding and Establishing National Innovation for U.S. Stablecoins Act of 2025, aims to create a comprehensive set of federal rules for stablecoins—those cryptocurrencies pegged to the U.S. dollar. The legislation targets the $238 billion stablecoin market and requires issuers to maintain full reserves with a 1:1 backing ratio using U.S. currency or Treasury securities. 📊

Under the new rules, only approved companies could issue stablecoins: subsidiaries of insured banks, federal-qualified nonbank issuers, and state-qualified issuers. Companies with more than $10 billion in circulation would face mandatory federal oversight. It’s like putting a sheriff in the Wild West of digital assets. 🤠

The bill also includes strong consumer protections. Coin holders would get priority if a company goes belly up, and issuers must conduct monthly audits to prove they have enough money backing their coins. It’s all about trust, folks! 🤝

Strong Republican Support in Congress

Several top Republicans have rallied behind Trump’s call for support. Senate Banking Committee Chairman Tim Scott (R-SC) declared, “Today is a bold step forward – not just for financial innovation, but for American leadership, consumer protection, and economic opportunity.” 🎉

Lead sponsor Senator Bill Hagerty (R-TN) proclaimed, “The GENIUS Act establishes a clear, pro-growth, and secure regulatory framework to modernize our payments system and cement U.S. dollar dominance.” 🇺🇸

Senator Cynthia Lummis (R-WY), who leads the Digital Assets Subcommittee, called the bill “a huge victory for the digital asset industry and a critical step in securing our nation’s financial future.” 🌟

House Speaker Mike Johnson (R-LA) also voiced strong support, saying House Republicans are taking steps to deliver Trump’s digital assets agenda. It’s a team effort, after all! 🏆

Senate Already Passed the Bill

The Senate passed the GENIUS Act on June 17, 2025, with a strong bipartisan vote of 68-30. Eighteen Democrats joined all Republicans (except three who voted against) in supporting the measure. The bipartisan support came after months of negotiations between Republicans, Democrats, and the White House. The bill initially failed in early May when Democratic senators changed their position, but extensive talks produced a compromise version that gained the needed support. 🤝

Trump’s Financial Interest Raises Questions

Now, here’s where things get a bit sticky. Trump’s financial disclosure revealed he earned at least $57 million in 2024 from crypto ventures, including World Liberty Financial. Critics are quick to point out that this creates significant conflicts of interest. 🤔

Senator Elizabeth Warren warned the bill creates problems for corruption, noting that while the legislation stops members of Congress from profiting from stablecoins, it doesn’t include the president. The PBS reported that “Senate passes crypto bill ‘GENIUS Act’ without addressing Trump’s investments” despite these concerns being raised during debate. 📰

Industry Investment Pays Off

The cryptocurrency industry spent about $250 million in the 2024 election cycle to elect the most pro-crypto Congress in U.S. history. This massive political investment appears to be paying off with the GENIUS Act’s progress. Trump has transformed from a crypto skeptic to an advocate, now positioning himself to make America the “crypto capital of the world.” This shift aligns with his broader business interests in the digital asset space. 🤑

What Happens Next

If the House passes the bill, it would go directly to Trump for his signature. Treasury Secretary Scott Bessent has endorsed the legislation and estimates the stablecoin market could grow to $3.7 trillion by 2030. The regulatory framework would legitimize stablecoins for mainstream payments, with major corporations like Amazon and Walmart reportedly preparing their own stablecoin offerings. It’s a brave new world, indeed! 🌍

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Arknights celebrates fifth anniversary in style with new limited-time event

- Grimguard Tactics tier list – Ranking the main classes

- Gods & Demons codes (January 2025)

- Maiden Academy tier list

- PUBG Mobile heads back to Riyadh for EWC 2025

2025-07-16 12:29