Ethereum experienced a surge, passing over the $3,400 barrier, with market movements being influenced by the approaching political changes ahead of a new president’s inauguration.

Over the course of a week, from January 11th to 17th, Ethereum (ETH) managed to break free from its downward trend, surpassing its previous resistance point of $3,400 and is currently being traded at $3,406.72 as we speak.

The high spirits in this market are fueled by anticipation that President-elect Donald Trump might issue an executive order concerning cryptocurrencies upon his inauguration on January 20th.

Talks are being held about incorporating an instruction into this order, which would require all federal departments to collaboratively reassess their cryptocurrency regulations, and potentially halt any active lawsuits against major industry players.

Yesterday, the SEC chose to resolve its dispute with Abra regarding unregistered cryptocurrency lending services, signaling a shift under new leadership. This action has sparked optimism throughout the crypto market, leading to a 3.54% surge in value over the past 24 hours, as reported by CoinMarketCap.

The supportive viewpoint toward cryptocurrencies from President Trump gains more ground as it’s announced that Representative Tom Emmer, a proponent of digital assets, has been appointed Vice Chair of the Digital Assets Subcommittee on January 15.

As an analyst, I’ve noticed that one significant factor contributing to ETH’s growth is the anticipated launch of its Pectra Upgrade in the Execution Layer Meeting 203. The Pectra upgrade is highly anticipated as it promises to address some of Ethereum’s most pressing challenges.

Over time, Ethereum has encountered issues with network congestion and high gas fees. The Pectra update intends to improve the underlying consensus mechanism, boost transaction speed and efficiency, and pave the way for effortless compatibility between Layer 2 solutions and the mainnet. This is particularly important for the future growth of blockchain technology.

Ethereum’s price could rise further

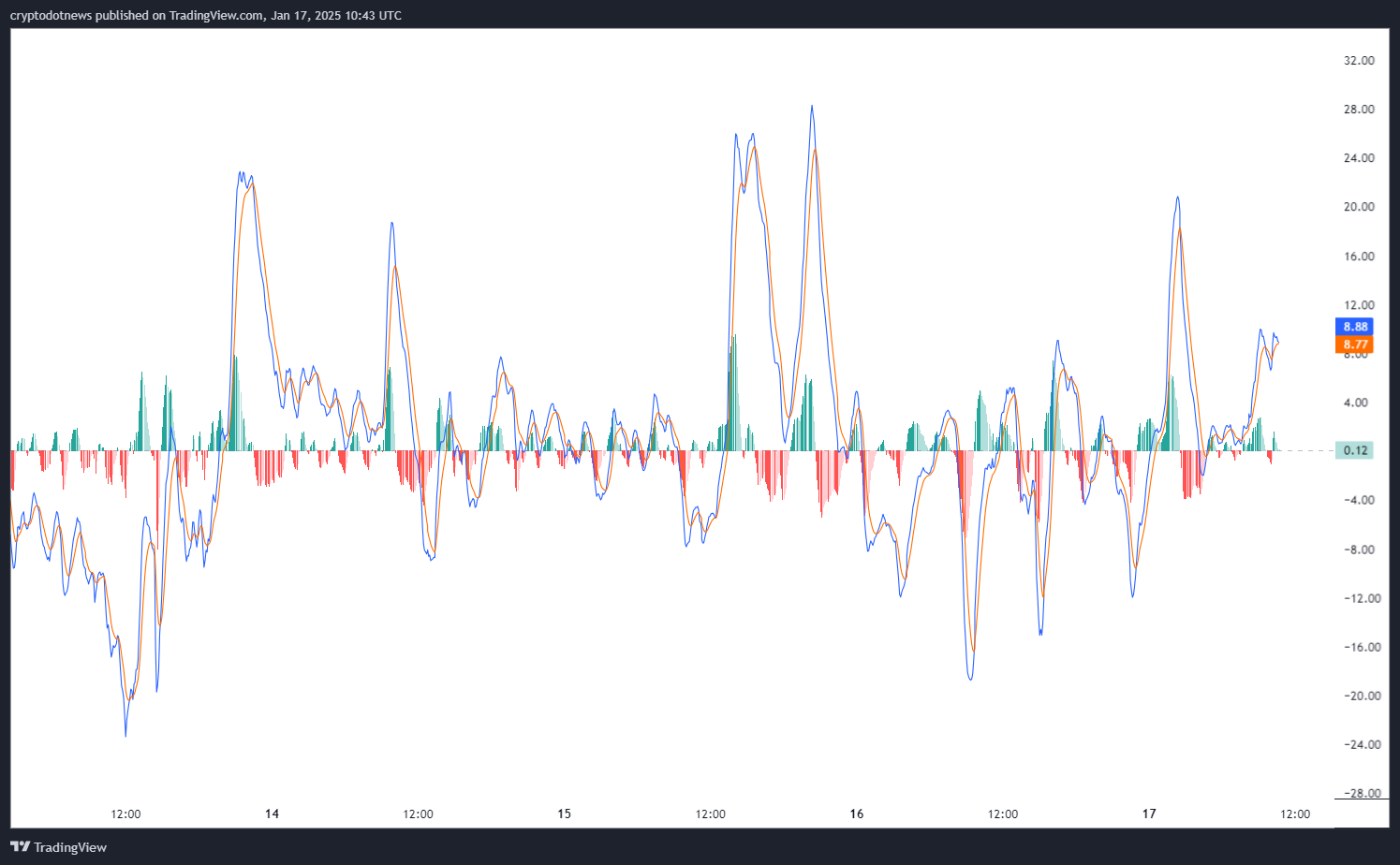

Based on the Moving Average Convergence Divergence (MACD) graph, Ethereum appears to be giving out buy signals. This suggests that there might be a short-term increase in its price due to an uptrend.

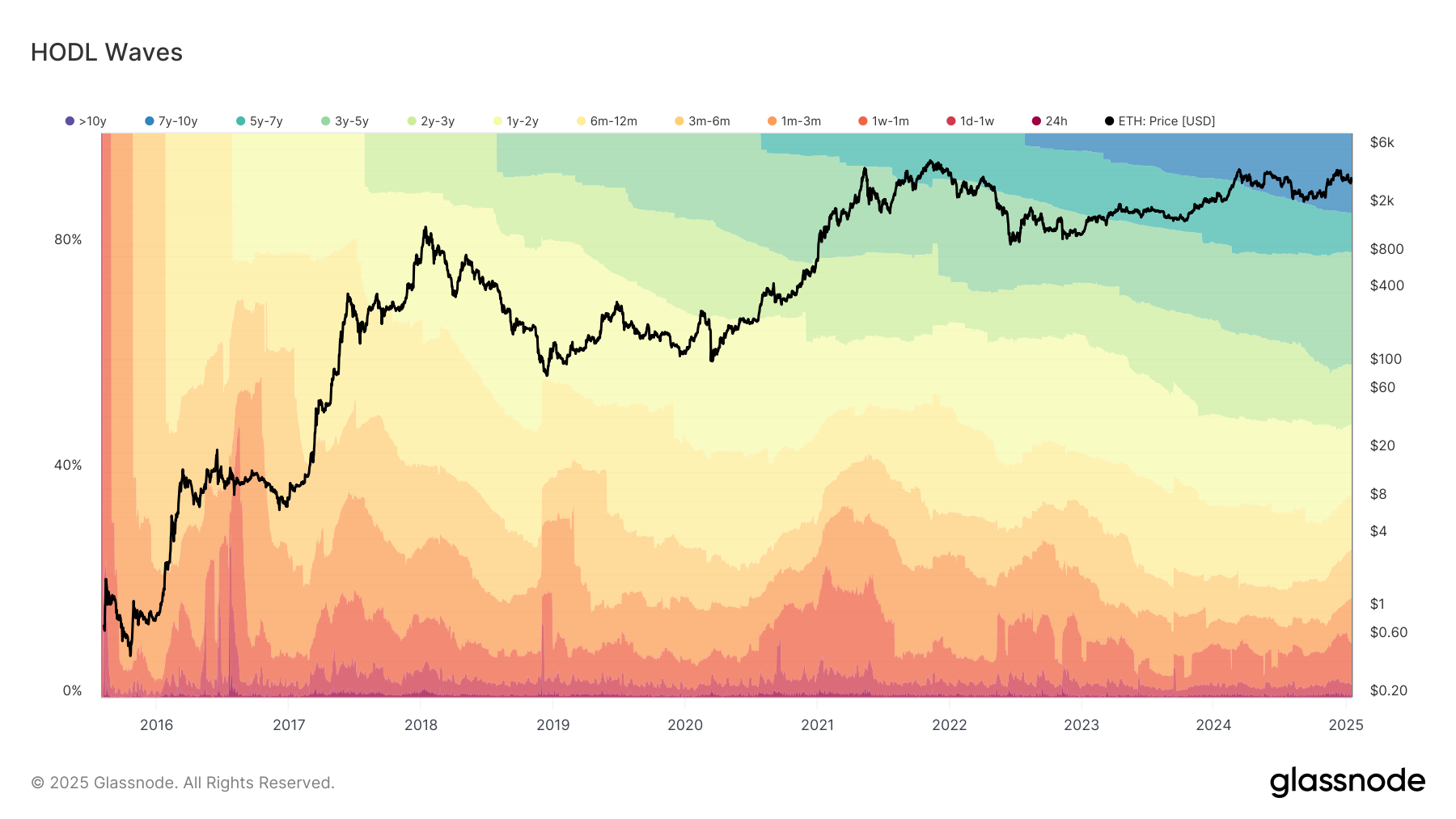

The Moving Average Convergence Divergence (MACD) tracks shifts in momentum that can signal potential price directions, whereas the HODL Waves represent long-term investment habits. When used together, they offer valuable insights into possible future price fluctuations.

The term “HODL” represents strong, long-term investment in Ethereum (ETH), with a significant amount being held for over a year. This indicates sustained investor confidence and reduced immediate selling pressure. These positive occurrences suggest that ETH could be a possible contender for a potential price increase. However, it’s important to note that ETH prices may experience minor ups and downs as the market processes these changes.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- PUBG Mobile heads back to Riyadh for EWC 2025

- USD CNY PREDICTION

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Arknights celebrates fifth anniversary in style with new limited-time event

- Every Upcoming Zac Efron Movie And TV Show

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Hero Tale best builds – One for melee, one for ranged characters

2025-01-17 15:00