As a seasoned crypto investor with a knack for spotting trends and making profitable moves, I can confidently say that Uniswap (UNI) looks like a strong bet right now. With its impressive rally over the past three weeks, reaching levels not seen in three years, it’s clear that this decentralized exchange giant is on an upward trajectory.

Over the past three consecutive weeks, Uniswap has experienced a robust surge, hitting a three-year high.

In the world of decentralized exchanges, Uniswap (UNI) took a significant leap, reaching $18.38 – an increase of more than 400% from its record low in 2023.

crypto experts are hopeful that the value of the coin could keep climbing and potentially hit an all-time peak close to $45 again. This increase would represent approximately a 135% jump from its current worth.

In a recent analysis on platform X, cryptocurrency expert Sus Ape has pointed out several factors that could potentially propel the price of the coin to new all-time highs.

Initially, he views Unichain as a groundbreaking element in the network’s development. Notably, Unichain – due for release soon – will serve as its layer-2 network, boasting capabilities such as cross-chain token spending, swift transactions, and reduced fees substantially. Historically, cryptocurrencies tend to surge before significant occurrences or launches.

It’s clear that apes are aware of the imminent release of Uniswap Router V4, slated for this year. This new iteration will introduce features like hooks, adjustable fees, and a single instance (singleton) design.

The price of Uniswap could potentially gain from the recent election of Donald Trump, as he has chosen Paul Atkins to lead the Securities and Exchange Commission. If Atkins were to follow through on this decision, he might reconsider the charges brought against the agency during Gary Gensler’s tenure, which alleged that unregistered securities were being sold.

Uniswap’s native token, $UNI (@Uniswap), could potentially be among the upcoming tokens to reach new record highs: Here are some reasons why I think so:

— Sus Ape | (@Sus_Ape) December 6, 2024

It appears that the number of Uniswap transactions has gone up significantly over the past few weeks, according to external data sources.

Its weekly transactions rose by 27% to over $31 billion, more than double what Raydium (RAY) handled. It has cumulatively handled volume worth $1.56 trillion.

Uniswap price analysis

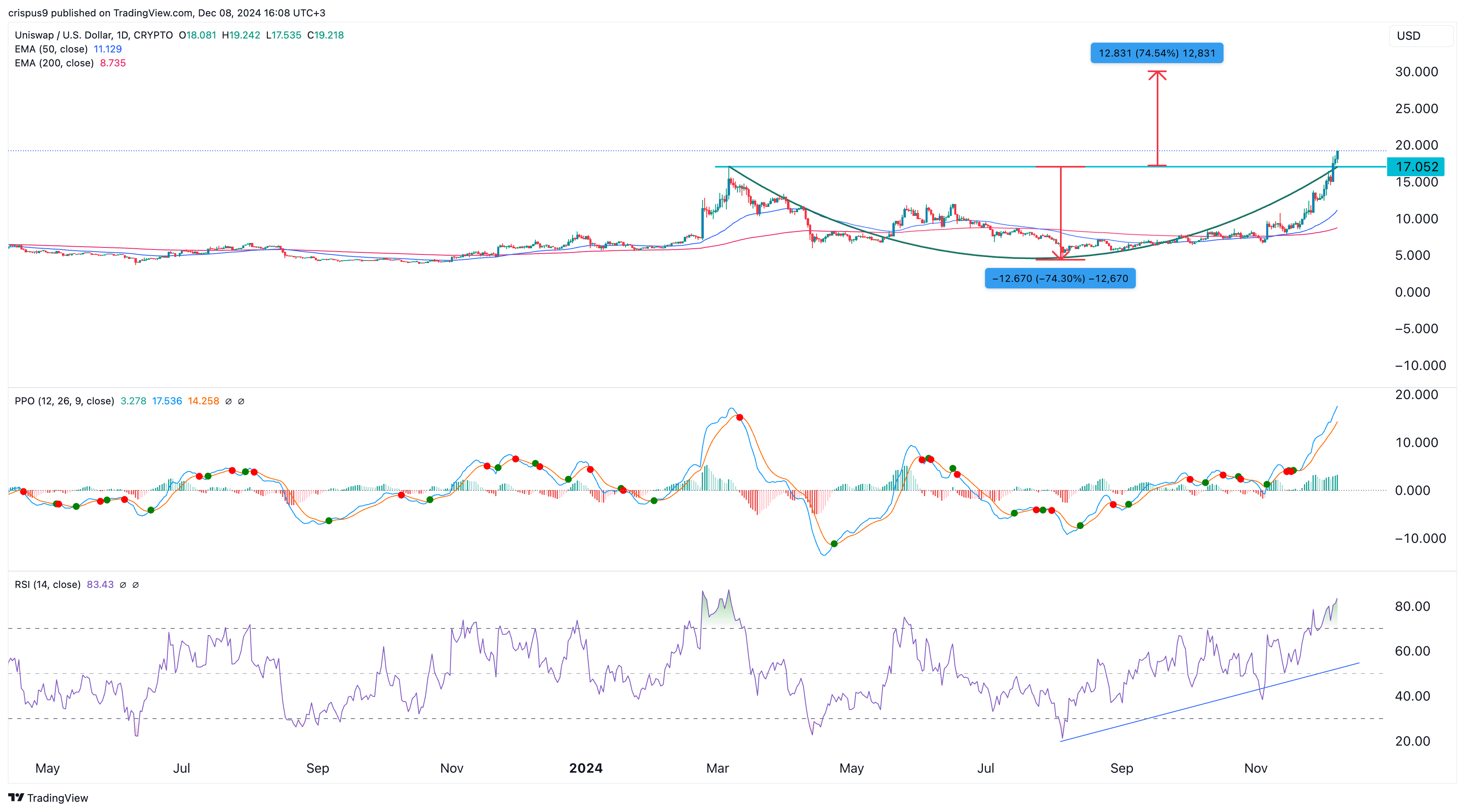

The daily graph indicates that the UNI price has experienced a robust surge over the last several weeks. It has surpassed a crucial resistance point at $17.05, marking the top of the cup and handle pattern. This pattern, known as C&H, typically features a rounded base and often signals continuation.

Uniswap recently exhibited a ‘golden cross’ formation: its 200-day and 50-day moving averages switched positions, indicating a potential bullish trend. Additionally, both the Percentage Price Oscillator (PPO) and Relative Strength Index (RSI) are currently rising, suggesting that it is gaining momentum.

As a seasoned crypto investor, my analysis points towards a possible Uniswap price target of $30. I’ve arrived at this figure by employing a technique known as measuring the depth of the cup formation, and then projecting the same distance upward from the cup’s rim.

Confirming a new all-time high requires the price to surpass its current level, and as long as the cryptocurrency market’s upward trend persists, this could happen.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- USD CNY PREDICTION

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Castle Duels tier list – Best Legendary and Epic cards

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-12-08 21:22