As a seasoned researcher with over a decade of experience in the dynamic world of cryptocurrencies, I find the recent surge in Uniswap (UNI) intriguing. The token’s five-day streak of price increases and its highest level since April, coupled with the optimistic predictions from influencers like Anasta Maverick and HypeManAlex, paints a promising picture.

Uniswap price rose for five consecutive days as crypto analysts predicted further upside potential.

On November 25th, the value of Uniswap’s (UNI) token peaked at $12.37, which is its highest point since April 1st. Remarkably, this price surge has seen an over 150% increase from its lowest point in 2021.

On their latest social media update, well-known crypto expert Anasta Maverick (who boasts an impressive following of more than 26,000) has forecasted that the value of this coin could potentially surge to $17.70 – representing a significant leap of approximately 50% from its current price point.

As a researcher delving into the intricacies of the crypto market, I’ve come across an intriguing prediction by HypeManAlex, a seasoned analyst with a considerable following of 54,000. He posits that Uniswap, a prominent player in the decentralized exchange industry, could potentially surge to $100, which represents a staggering 733% increase. This prediction is based on the unique role and influence of Uniswap within our dynamic crypto landscape.

Information shows that Uniswap operates on over twenty different blockchains, and it recorded a trading volume of approximately $26 billion within the past week. Since its debut, this platform has handled transactions worth over $1.54 trillion, with $81.7 billion processed in just the last month.

In the recent week, Raydium managed a staggering total of $26.86 billion, while its overall accumulated volume stands at an impressive $231 billion.

The system has unveiled Unichain, which is presently in its testing network phase, with the public mainnet anticipated to launch sometime between late 2024 and early 2025. Unichain’s goal is to offer a superior option to Ethereum, Solana, and Arbitrum.

One potential concern for Uniswap’s price is the ongoing selling by large investors, or “whales.” Etherscan data indicates that one such investor transferred over 466,000 UNI tokens, equivalent to approximately $5.4 million, to OKX, a significant move suggesting selling. Similarly, another whale moved tokens valued at $1.29 million to Coinbase.

Uniswap price analysis

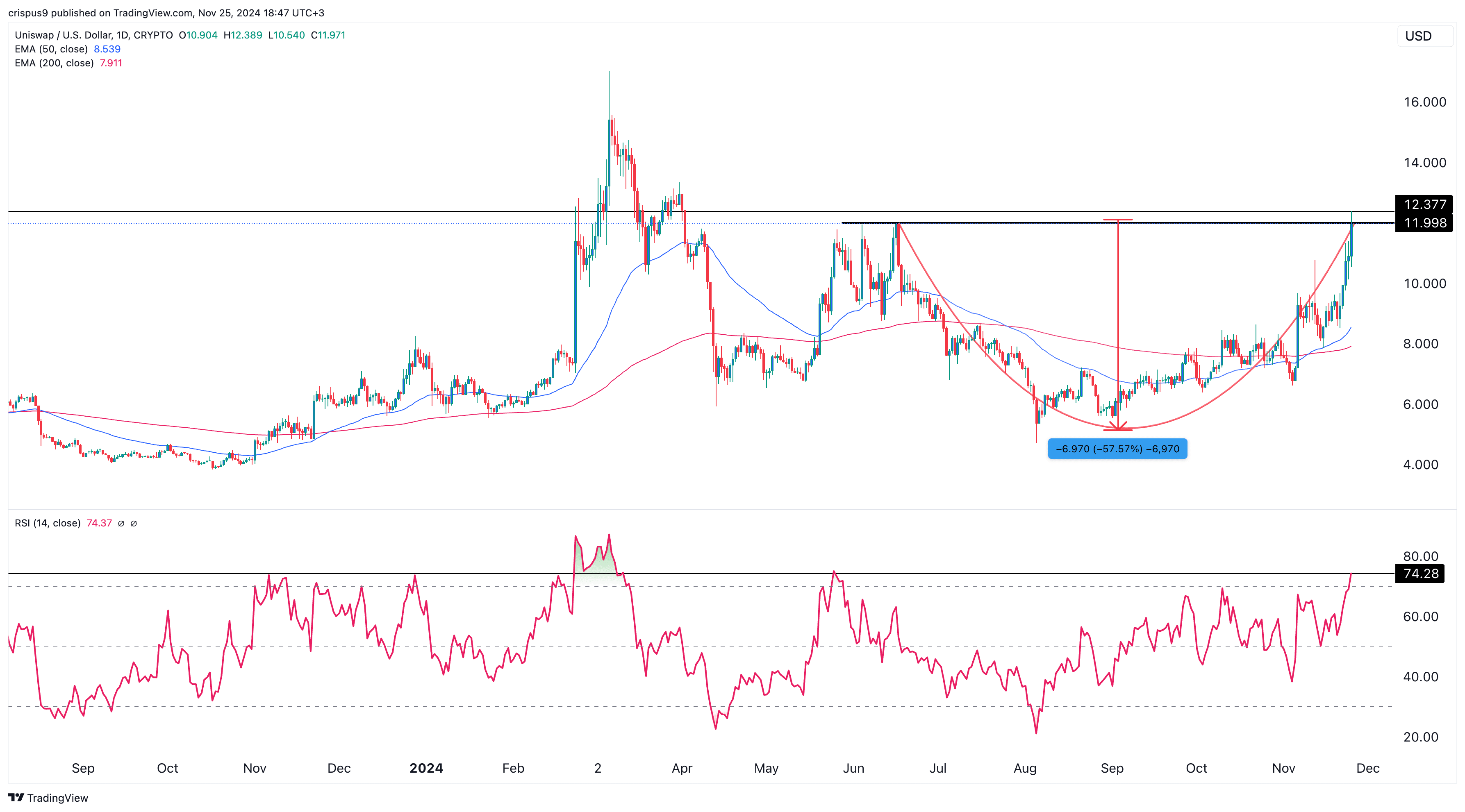

Today’s graph shows that UNI is exhibiting a ‘golden cross’ formation, which means its short-term (50-day) and long-term (200-day) moving averages have intersected each other.

The graph shows a ‘cup and handle’ formation, which has a curved base and then a period of stability. This pattern hints at an upcoming increase towards about $17 in the short run.

It seems that reaching $100 by 2024 is rather improbable because it necessitates a significant increase of 733%, which is beyond the current value. If the price falls below the $9 support, it could challenge the optimistic perspective we have on this asset.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Silver Rate Forecast

- USD CNY PREDICTION

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-11-25 19:18