Well, well, well! The Uniswap Foundation has graced us with its Q1 2025 financial report, and guess what? They’re sitting pretty with about $95 million in assets. Who knew decentralized exchanges could be so… rich? 💰

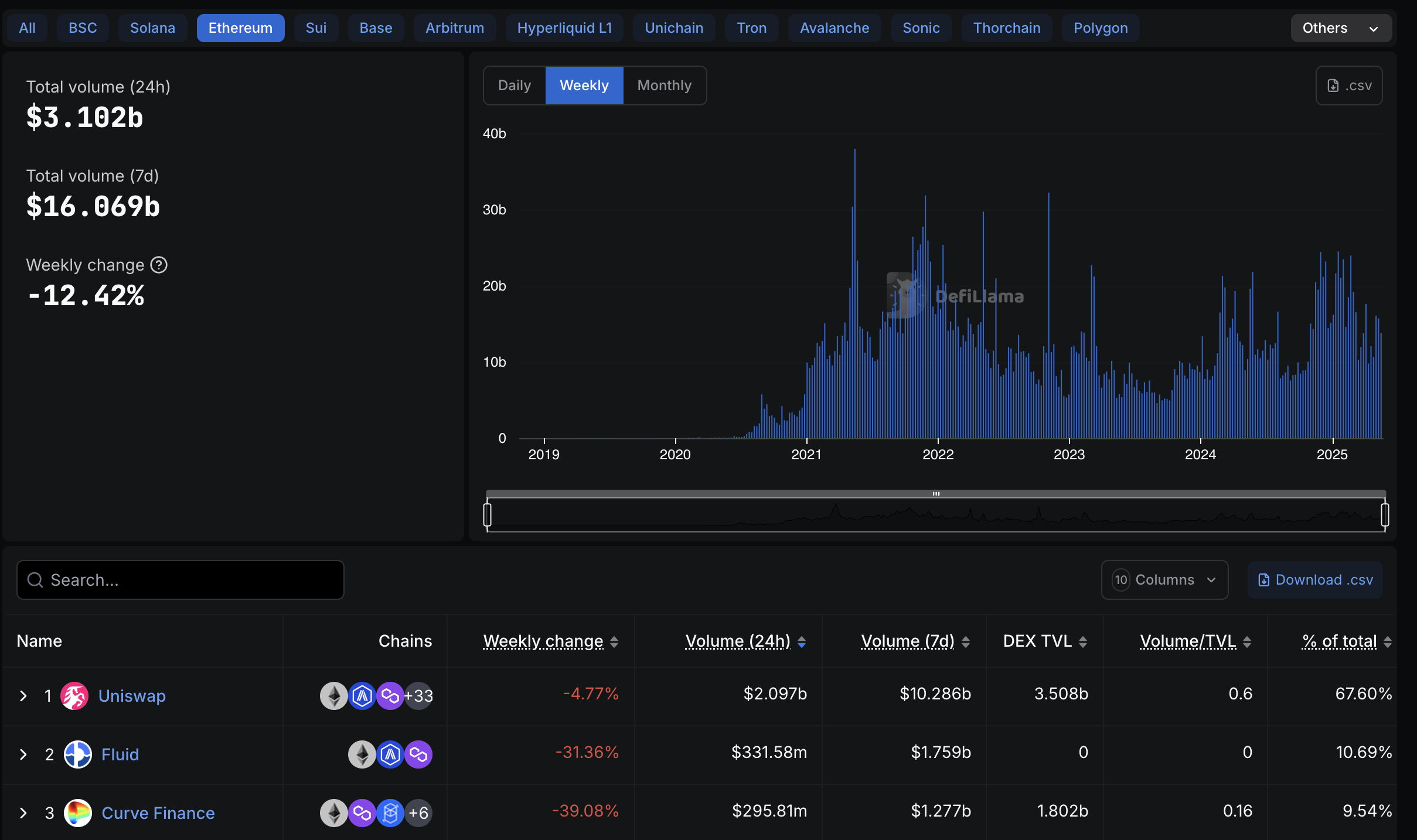

Uniswap is flexing its muscles with a whopping 67% market share among decentralized exchanges (DEXs) on Ethereum. But hold your horses! Just when you thought it was all smooth sailing, rival Bancor decided to throw a legal wrench into the works with a patent infringement lawsuit. Because nothing says “friendly competition” like a good old-fashioned courtroom drama! 🎭

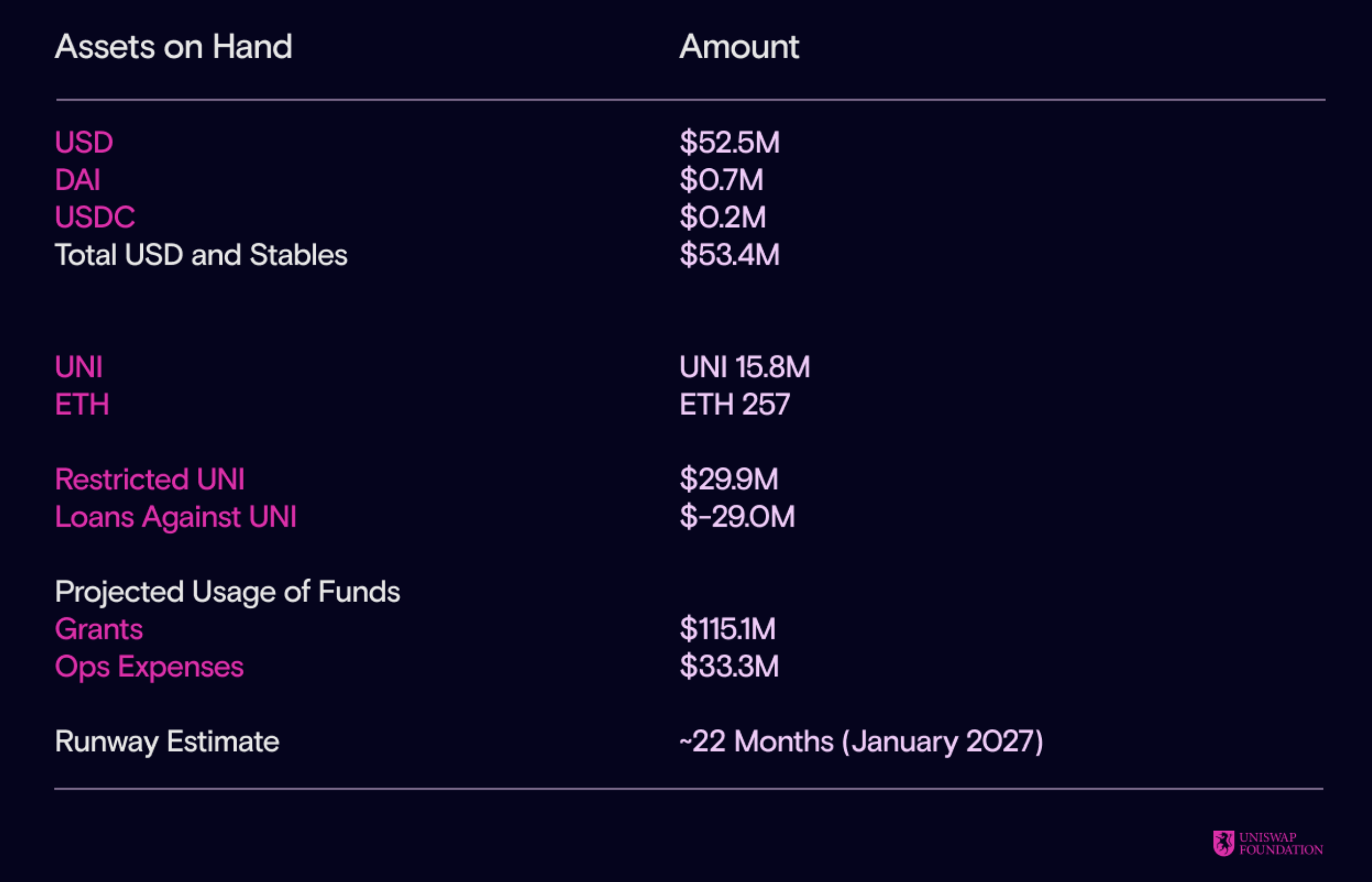

Stable Financial Position

As of March 31, 2025, the Uniswap Foundation has earmarked a staggering $115.1 million for grants and operational activities. That’s right, folks, they’re planning to keep the lights on until January 2027. Talk about a long-term commitment! 💡

And here’s the kicker: Uniswap has staked 5 million UNI tokens to borrow $29 million. It’s like taking out a loan against your own piggy bank while ensuring you don’t break it. Genius or madness? You decide! 🤔

This financial wizardry aligns perfectly with Uniswap’s reign over the Ethereum DEX market. In just seven days, Ethereum DEXs racked up a total volume of $16 billion, with Uniswap hogging over 67.6% of that pie. That’s a lot of trading! 🍰

Previously, as BeInCrypto reported, Uniswap surpassed a jaw-dropping $3 trillion in total trading volume. That’s more zeros than I have in my bank account! 💸

Uniswap is clearly the darling of individual traders and a go-to for institutions, thanks to its high liquidity and user-friendly interface. It seems investors are flocking back to DeFi like moths to a flame, especially with ETH and altcoin prices bouncing back in mid-2025. 🔥

Legal Challenges

After a little tussle with the SEC, Uniswap is now facing off against Bancor, who claims Uniswap has been playing fast and loose with their patented technology. Oh, the drama! 🎬

“As innovators and inventors, protecting our intellectual property is fundamental to the health of the ecosystem. If companies like Uniswap can act unchecked without consequence, we fear it will hinder innovation across the industry to the detriment of all DeFi players,” said Mark Richardson, Project Lead at Bancor. Sounds serious, right? 😬

In a classic “not my fault” move, Uniswap has dismissed these allegations as a “costly distraction.” They’re ready to defend their turf, and with their financial resources, they’re well-equipped to tackle these legal hurdles. Bring it on! 💪

Despite the legal storm brewing, Uniswap is solidifying its leadership in the DeFi space. With a 67% market share on Ethereum DEXs, they’re doing something right. But to keep that crown, they’ll need to navigate legal issues, launch Unichain L2, and fend off rivals like PancakeSwap and Curve Finance. It’s a tough job, but someone’s got to do it! 🏆

Read More

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Grimguard Tactics tier list – Ranking the main classes

- USD CNY PREDICTION

- Castle Duels tier list – Best Legendary and Epic cards

- Cookie Run Kingdom: Lemon Cookie Toppings and Beascuits guide

- PUBG Mobile heads back to Riyadh for EWC 2025

- Silver Rate Forecast

- USD MXN PREDICTION

- Pi Network (PI) Price Prediction for 2025

2025-05-23 16:18