As a seasoned researcher with a keen interest in the intersection of technology and law, I find this recent ruling by the 5th Circuit Court of Appeals intriguing. Having closely followed the development of cryptocurrencies and their associated technologies, it’s fascinating to see how legal frameworks are evolving to accommodate these innovations.

In simpler terms, a court has decided that the U.S. government acted beyond its powers when it imposed sanctions on Tornado Cash, a platform for mixing cryptocurrencies to hide ownership details, as this tool was found to be associated with cyber-attack groups from North Korea.

A Bloomberg report states that the 5th Circuit Court of Appeals in New Orleans ruled in favor of six Tornado Cash users, who contend that the software itself is not subject to sanctions under present U.S. legislation.

2022 saw the U.S. Treasury Department focusing on Tornado Cash, asserting that it served as a means for laundering approximately $7 billion, which included $455 million stolen by the Lazarus Group from North Korea.

On the other hand, the court clarified that current regulations permit penalties on properties belonging to foreign individuals or organizations, but they do not extend to open-source platforms such as Tornado Cash.

As a legal analyst, I’d rephrase it as follows: In my analysis, Judge Don Willett underscores the necessity of revising outdated laws to effectively regulate contemporary technologies such as crypto mixers. Until such revisions occur, from my perspective, Tornado Cash’s privacy-oriented smart contracts are not recognized as tangible assets that can be subjected to blocking measures.

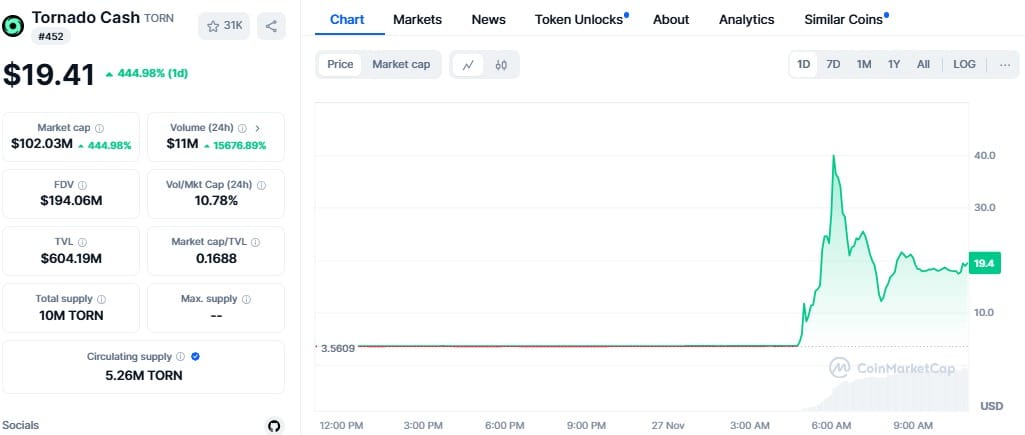

After the decision was made, the value of TORN, the token associated with Tornado Cash, experienced a significant increase of approximately 450%, as reported by CoinMarketCap. However, despite this ruling, Tornado Cash continues to be a subject of controversy. One of its developers, Alexey Pertsev, has recently been sentenced in the Netherlands for allegedly laundering over $2 billion.

As an analyst, I can express it this way: I, as an observer, note that Coinbase, where I work, commended the recent decision they supported in legal proceedings. Their chief legal officer, Paul Grewal, declared it a victory for privacy. His reasoning was that imposing sanctions on open-source technology could stifle innovation and overstep the boundaries of the Treasury’s authority.

As a researcher, I find myself back at the federal court in Austin, preparing for another phase of examination regarding the ongoing discussion surrounding privacy and regulatory matters within the cryptocurrency realm.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- USD CNY PREDICTION

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Castle Duels tier list – Best Legendary and Epic cards

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-11-27 09:41