As an analyst with over two decades of experience in the financial sector, I’ve seen my fair share of market movements that could make even the most seasoned investor sweat. The recent transfer of 10,000 Bitcoin from a U.S. government wallet to Coinbase Prime has certainly stirred up some intrigue and speculation.

More Silk Road Bitcoin moved again after a U.S. government wallet sent 10,000 BTC to Coinbase.

On August 14th, as reported by Arkham Intel, the U.S. government moved approximately $593.5 million in Bitcoin (BTC) to its chosen crypto brokerage platform, Coinbase Prime. Two weeks prior, this sum of around 10,000 Bitcoins was sent to a wallet identified as “bc1ql”.

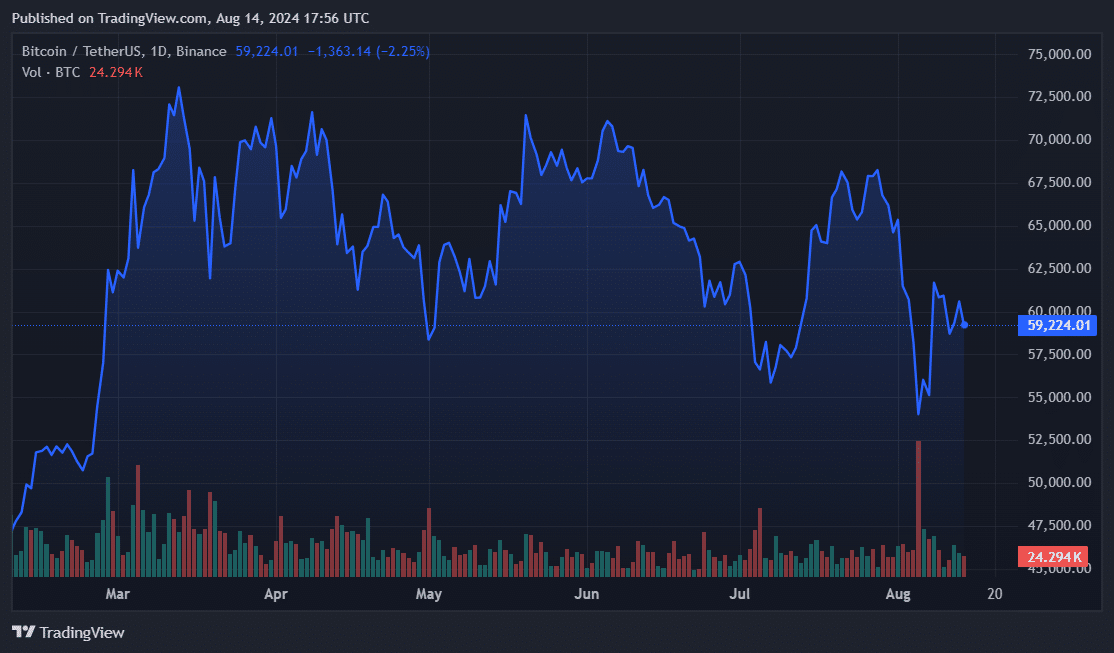

Bitcoin experienced a 3.6% decrease in value shortly after the announcement, but it’s important to note that the price decline started prior to Coinbase Prime receiving the seized Silk Road funds. The cost of one Bitcoin was approximately $59,100 following an initial market surge due to favorable Consumer Price Index (CPI) data.

Is America reducing its Bitcoin war chest ahead of elections?

At the end of July, it’s said that the U.S. administration transferred approximately $2 billion worth of Bitcoin, and there are speculations that this sum was received by Coinbase. According to crypto.news, this report is based on comments made by Tyler Winklevoss, one of Gemini’s co-founders. Following former President Donald Trump’s promise to establish a strategic Bitcoin reserve, government officials reportedly moved the Bitcoin hoard shortly thereafter.

As an analyst, I’m observing a buzzing debate about the possibility that the current administration might decide to sell a significant portion of its Bitcoin holdings before the upcoming winter elections. Regardless of recent transactions, it’s clear that America continues to be the world’s largest sovereign Bitcoin holder, boasting over $11 billion worth of Bitcoin in its possession.

Simultaneously, United States Senator Ted Cruz has voiced his support for Bitcoin. In an address to the Texas Blockchain Council, he referred to Bitcoin as a “source of power” for Texas’s power grid infrastructure.

More sell pressure

Potential increases in demand and price fluctuations could occur in the Bitcoin market, potentially stemming from possible U.S. government sell-offs on Coinbase.

Beyond the total $2.5 billion previously transferred by U.S. officials, on-going refunds to Mt. Gox customers are still being processed. Notably, crypto exchange BitGo received approximately $2 billion in Bitcoin from the Mt. Gox Trustee, and some individuals may choose to cash out their share of these funds.

It’s uncertain how Bitcoin (BTC) will cope with the current selling pressure, but if there’s an increase in Bitcoin inflows into spot exchange-traded funds, it could potentially balance out any market declines.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Silver Rate Forecast

- USD CNY PREDICTION

- Maiden Academy tier list

- PUBG Mobile heads back to Riyadh for EWC 2025

- All New and Upcoming Characters in Zenless Zone Zero Explained

- Castle Duels tier list – Best Legendary and Epic cards

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-08-14 21:26