As a crypto investor with a few years of experience in the market, I’ve seen my fair share of ups and downs, trends coming and going. But one thing that has remained constant is the dominance of stablecoins, particularly Tether (USDT), in the crypto space. That is until recently.

Circle’s stablecoin has overtaken USDT to become the market leader in transaction volume.

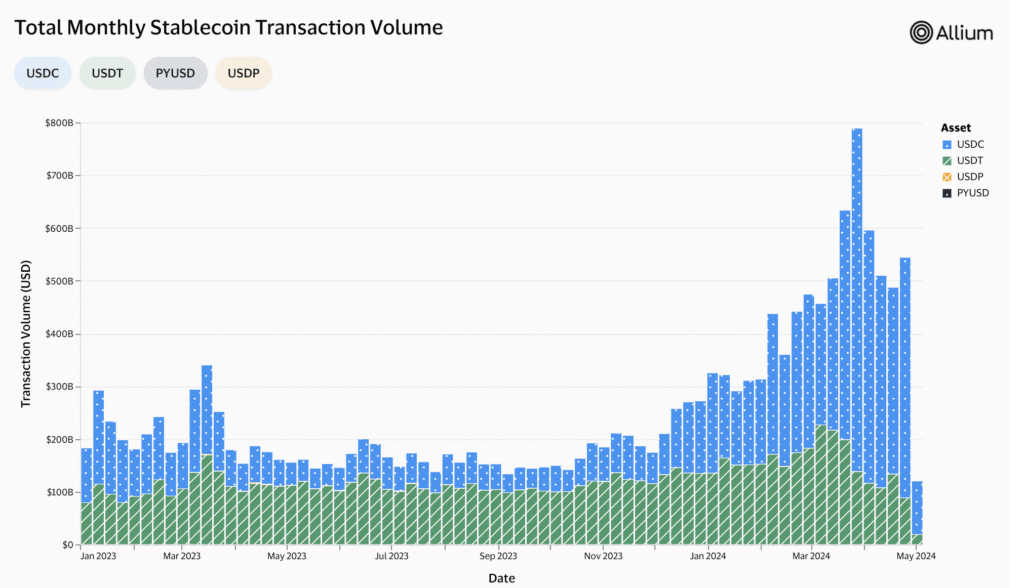

This year, USDC, the stablecoin issued by Circle, has outpaced its main rival, Tether (USDT), in terms of transaction volume based on data from Visa and Allium Labs, the blockchain analysis platform.

Last week, the data from visa metrics indicated a transaction volume of approximately $455.5 billion for USDC, while USDT only managed to surpass $88.5 billion barely.

Starting from January 2024, USD Coin has been responsible for roughly half of all stablecoin transfer volumes. Previously, USDT, the most capitalized stablecoin, held this position dominantly. According to DefiLlama’s estimates, USDT’s market share stands at approximately 69%. The growing popularity and performance of USD Coin may suggest a potential change in user preferences.

According to Bloomberg’s report, as per insights from cryptocurrency analyst Noelle Acheson, the shift in dominance between USDT and USDC can be attributed to the fact that USDT functions more as a reserve of value outside the U.S., while USDC is predominantly used within the country for everyday transactions.

As a crypto investor, I’ve noticed an interesting dynamic between USDT and USDC. While USDT is predominantly held by investors outside the United States as a stablecoin equivalent to the U.S. dollar for value storage, USDC is more commonly used within the U.S. for transactions due to its closer association with the American financial system.

Noelle Acheson, cryptocurrency analyst

As a crypto investor, I’m thrilled to share that Stripe, the renowned online payments pioneer, announced the reintroduction of cryptocurrency transfers last week. Now, USDC, a stablecoin, is accepted on three dynamic networks: Solana, Ethereum, and Polygon. This expansion signifies Stripe’s continuous commitment to embracing the evolving crypto ecosystem.

Circle, the issuer, has teamed up with BlackRock, the largest asset manager. BlackRock initiated its first tokenized fund in late March. Consequently, fund clients have the ability to exchange BUIDL for USDC on the secondary market with this collaboration.

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- Maiden Academy tier list

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-04-29 20:28