As a seasoned researcher with years of experience in the ever-evolving world of cryptocurrencies, I find myself closely observing the recent developments at Velodrome Finance. Having witnessed the crypto market’s rollercoaster ride, I must admit that the current situation reminds me of a game of chess – every move seems to have a countermove, and it’s all about strategy and patience.

The process of token consolidation at Velodrome Finance persisted, mirroring the general price trends observed in Bitcoin and other digital currencies across the altcoin market.

As a researcher, I’ve noticed that the Velodrome (VELO) stock has been consistently trading at around $0.065 since August 6, which translates to a market capitalization surpassing $90 million. Interestingly, back in March, this same stock had a valuation exceeding $200 million – a significant difference!

In the past few months, Velodrome, a top three decentralized exchange on the Optimism (OP) network, has encountered notable hurdles. The value locked within its system has plummeted significantly, dropping from approximately $322 million in April 2023 to around $85 million currently. Moreover, as per DeFi Llama’s data, its trading volume over the past week has fallen by more than 34%, reaching $197 million.

As a researcher examining decentralized exchange (DEX) protocols, I’ve noticed a striking pattern: the decrease in trading volume mirrors trends observed across other such platforms, which have witnessed a drop in activity post-the crypto market crash on August 5th – colloquially known as ‘Black Monday’. The total trading volume for DEX protocols in August was $111 billion, marking a significant decline from the previous month’s figure of $190 billion.

Generally speaking, digital exchange platforms (DEX) and centralized services tend to experience a boost in activity when cryptocurrencies are experiencing growth. This is because market rallies attract more investors and traders, who flock to these platforms to capitalize on the upward trend. For example, during Q1, Coinbase’s earnings skyrocketed by 72%, reaching an impressive $1.6 billion, as Bitcoin reached new record highs.

VELO price forecast

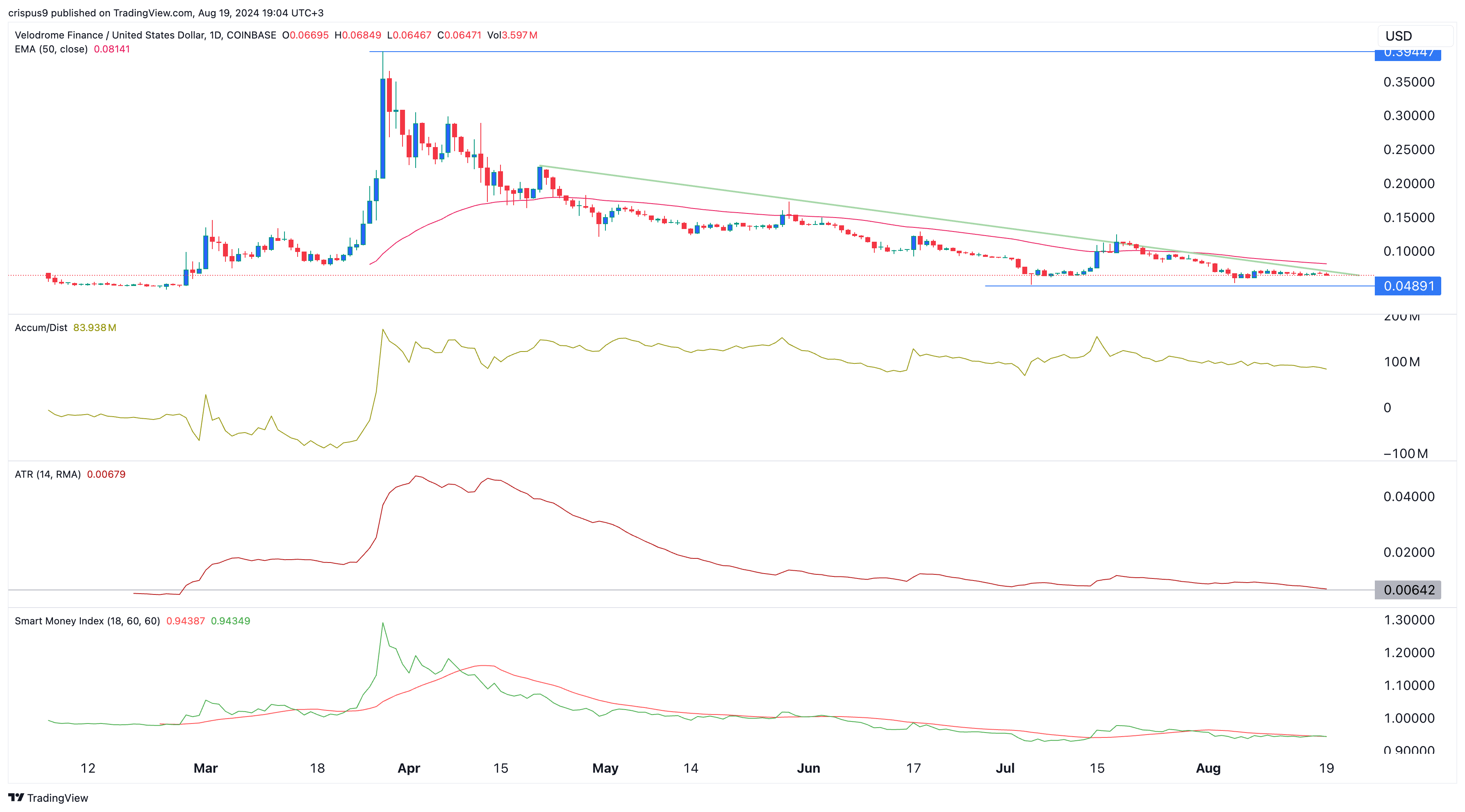

In the past few months, the value of Velodrome Finance’s token has significantly decreased. Reaching a high of $0.3945 in March, it has since plummeted by more than 83%, falling to around $0.065. This means that an initial investment of $10,000 would now only be worth approximately $1,647.

VELO displayed robust resistance at approximately $0.048, forming a double-bottom chart configuration. Since then, the token has been persistently beneath its 50-day moving average marker.

The price has now dipped beneath the downward slope representing the highest peaks since April 21st, forming an ominous descending triangle chart pattern. Such patterns typically precede a bearish drop in price. As we approach the intersection of this pattern, it indicates that major price fluctuations might happen very soon.

These financial indicators – distribution/accumulation and smart money index, along with the Average True Range (ATR) – a commonly used volatility gauge, have all shown a decline. Moreover, the ATR has fallen back to levels last seen in February.

It seems the token’s trend is pointing towards a decrease, with potential support at around $0.048. If it falls below this point, there might be more declines. However, if Bitcoin (BTC) recovers, there’s a possibility that the token could rebound as well.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Castle Duels tier list – Best Legendary and Epic cards

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-08-19 19:18