On January 14th, the Virtuals Protocol token regained momentum, following a one-day dip, which had formed a doji candlestick pattern. Meanwhile, tokens within its ecosystem also experienced a recovery.

The price of VIRTUAL surged to $2.93, a 32% increase from its minimum this year, as investors seized the opportunity to purchase at a reduced cost.

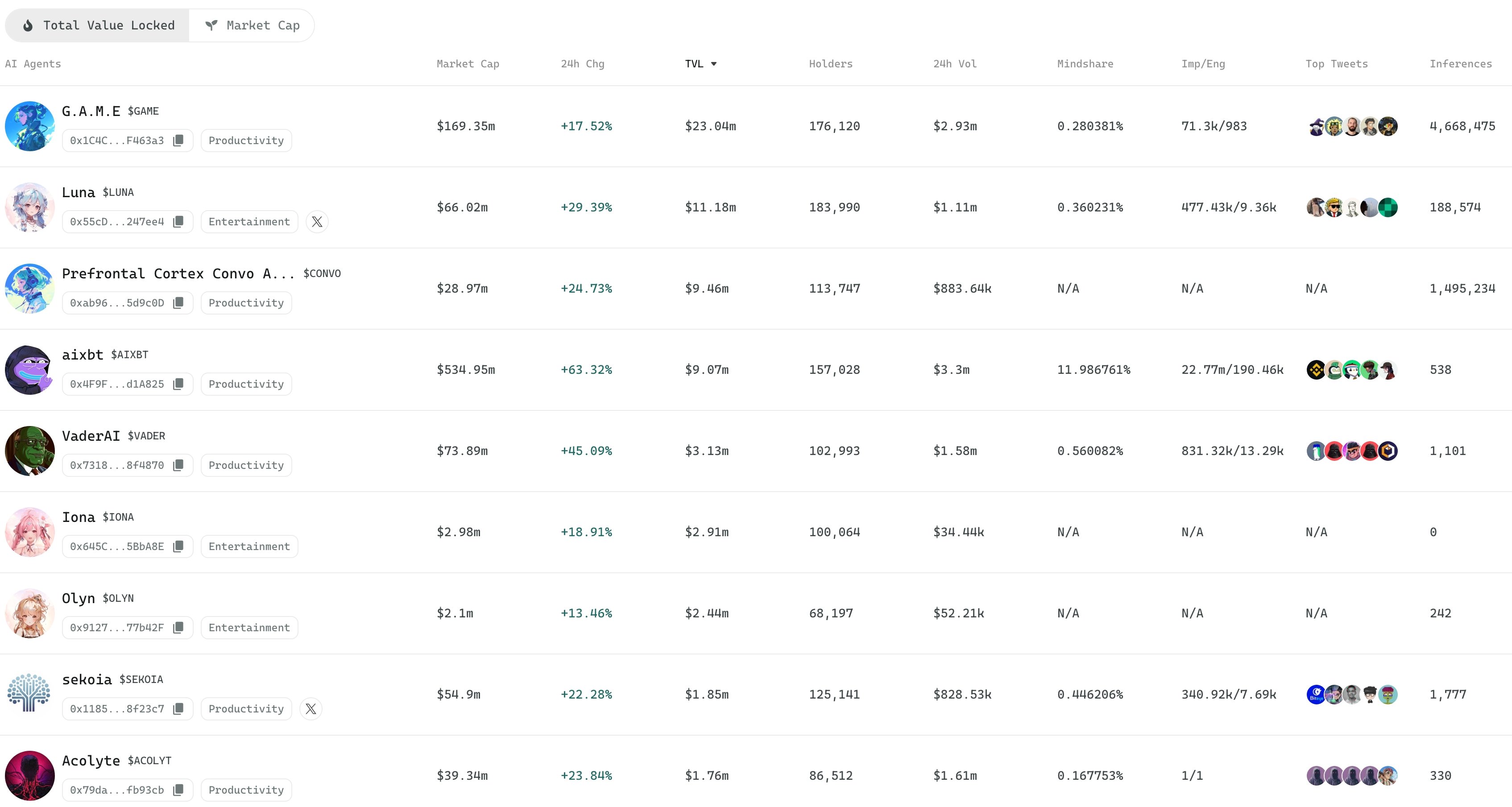

In the Virtuals Protocol environment, many tokens demonstrated excellent performance. For instance, G.A.M.E token saw a 17.5% increase, elevating its market capitalization to over $172.9 million. Luna experienced a surge of 30%, while aixbt skyrocketed by 63%, resulting in a valuation of approximately $546 million. Other notable high-performing tokens within the ecosystem were Sekoia, Acolyte, TAOCat, and WAI Combinator.

The bounce back of the market occurred hand-in-hand with a wider surge across the cryptocurrency sector, notably the AI agent segment. Notably, tokens like ai16z, Humans.ai, BasedAI, and Orbit stood out as significant winners within this industry.

It’s uncertain if these profits will persist, as this surge might just be a brief uptick, often referred to as a “dead cat bounce,” which happens when an asset that has been declining for a long time temporarily recovers before continuing its descent.

A significant risk for Virtuals Protocol is that its most successful investors have cashed out their tokens. For instance, the top earner, LVT Capital, has liquidated all his holdings in the recent past, raking in millions of dollars.

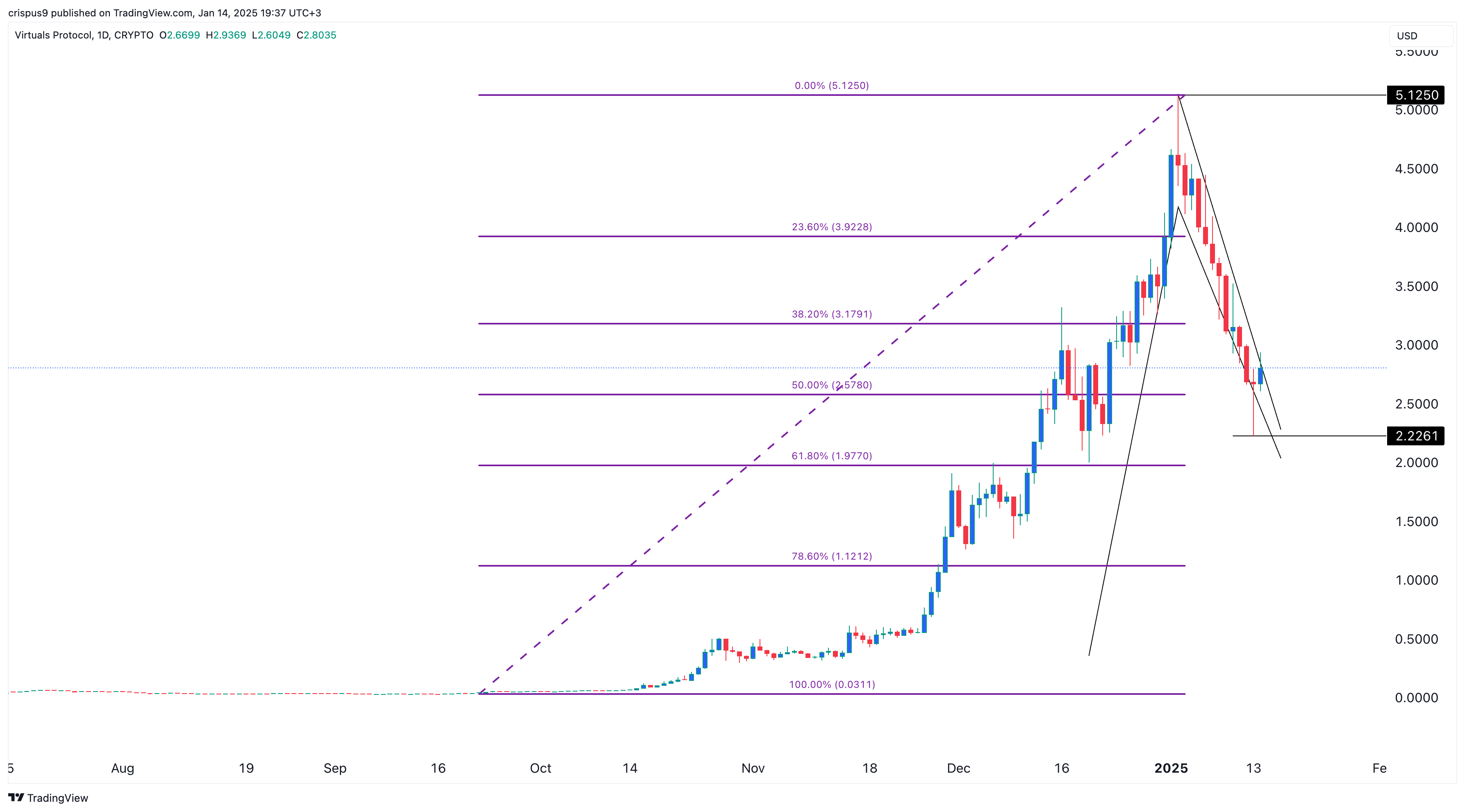

VIRTUAL price analysis

Over the last several weeks, the day-by-day graph indicates that Virtuals Protocol has been experiencing a significant downward trend with a bearish slope. This decline has taken it from its previous peak of $5.1250 to the current level of $2.8.

right now, the token’s price is slightly dipping below the halfway point of its Fibonacci retracement level. On the upside, it has developed a long-legged doji candlestick structure, characterized by a lengthy lower shadow and a small body. Typically, this pattern is perceived as a bullish sign indicating a potential price reversal.

Furthermore, it appears that VIRTUAL is shaping a falling wedge pattern, another positive sign for bulls. Given this technical development, there’s a possibility that the token could experience a significant upward trend in the near future, with investors aiming for the next resistance level at $4 – which represents a potential 40% increase from its current price.

Should the price dip beneath the bottom end of the doji at around $2.2260, it might suggest a shift in the bullish trend I’ve been expecting. In that case, I’d keep a close eye on the $1.50 level as potential new support for my crypto investment.

Read More

- Silver Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD CNY PREDICTION

- Gold Rate Forecast

- Former SNL Star Reveals Surprising Comeback After 24 Years

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2025-01-14 20:45