- Behold! As the fevered anxiety of the American economy swells like a Dostoevskian intrigue, Bitcoin slinks forward, its appeal as sanctuary for the desperate masses rising—because nothing soothes existential dread like zeros and ones. 😏

- The rivers of BTC flowing into Binance grow shallow; the sell-off wolves retreat to their dens, leaving only the silent watchmen—those who clutch their coins like Raskolnikov with his axe, convinced salvation is a matter of waiting it out. 🪓💼

Picture the scene—a grotesque ballet of nervous investors, trembling before the abyss of U.S. economic chaos. Ah, Bitcoin steps onto the stage once more, awkward and magnificent, wearing the battered crown of “global safe haven.”

With the faith in Wall Street whittled down to a husk, the crypto proletariat gathers. They find comfort in Bitcoin, that most unpredictable and misunderstood of miracles, resilient not because it is loved, but because it does not care if it is hated.

Binance, once a roaring bazaar, now resembles the dusty attic of a tormented Russian noble’s mansion. BTC trickles in; the air grows heavier. Is this a sign of hope, faith, nihilism, or some cocktail of the three? As always, no one agrees—but oh, the conviction in everyone’s eyes!

Like a cat in the dark, Bitcoin coils. Its next great leap is felt not in the fevered declarations of analysts, but in the quiet refusal of holders to part with their virtual fortune. The stage is set: Bitcoin is done auditioning as a mere hedge. It seeks a starring role in the theater of global escape plans.

Bitcoin rises amid record-breaking economic turbulence

The U.S. economic policy uncertainty index now resembles the heartbeat of a Dostoevskian protagonist—paranoid and thundering, setting a new record in 2025.

Whenever America’s collective nerves snap, Bitcoin basks in the strobe lights of euphoria. This latest fever is, fittingly, the most delirious yet. Shall we rejoice… or prepare for exile in Siberia?

Trump’s encore performance (Tariffs: The Sequel), the debt ceiling acrobatics, a Federal Reserve indecisive as a Dostoevskian narrator, and the dollar’s latest trial by fire. The crowd gasps—what next?

And let us sprinkle on top some delightful geopolitical drama and regulatory backflips, just in case investors were getting too comfortable. Mayhem in tradition means serenity (or at least organized chaos) in the blockchain.

Bitcoin, immune to the fever dreams of bureaucrats, looks on with a smirk. If belief in the almighty dollar continues to crack, maybe, just maybe, Bitcoin’s time at the confession booth is over. It can finally enter the cathedral as a legitimate object of faith. Kyrie eleison, pass the ledger!

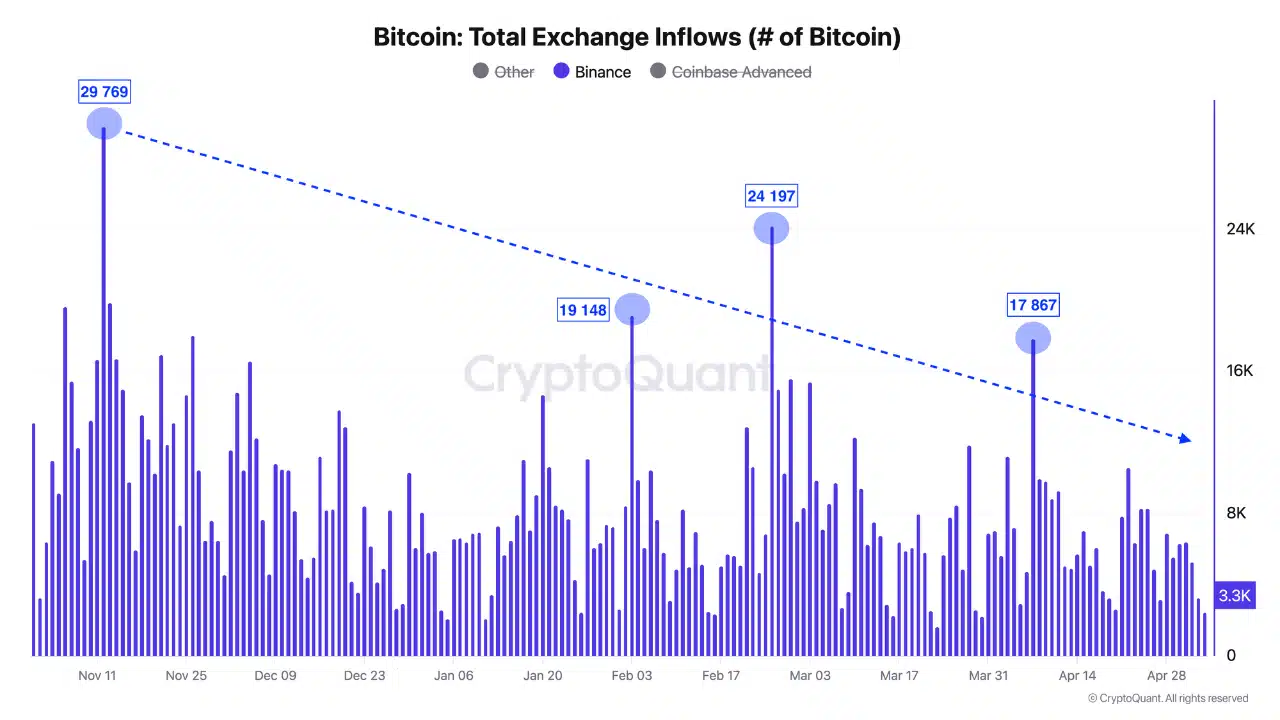

BTC: Easing selling pressure

Once upon a time in late 2024, Bitcoin flocked to Binance like exiles to Siberia. Now? The trickle is so faint even the housemaid would fail to notice. Fewer coins for sale, fewer panicked hands—perhaps only the strong (or the truly desperate) remain.

Occasionally, a spurt above 17,000 BTC. Mostly though, silence. Only the echo of commitment—or the lull before some fresh existential crisis.

Macroeconomic risk, faith in fiat swirling down the drain—no wonder HODLing is suddenly in vogue.

Bitcoin’s price outlook

Our protagonist (BTC) currently lounges at $94,000—a brief retreat after jousting with $96,000. The RSI, having overdosed on its own ambition, cools off at 58. Exhaustion? Perhaps. Overdramatization? Absolutely.

As the MACD teeters on the verge of a bearish swoon, the plot thickens: will Bitcoin’s next chapter star the Bulls, or will it be just more tragic monologuing from the Bears? Support lines above $91,000-$92,000 stand ready for a Shakespearean reversal. Don’t blink or you’ll miss the crescendo—after all, in crypto, everyone is a philosopher until the next price candle appears.

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- Maiden Academy tier list

- PUBG Mobile heads back to Riyadh for EWC 2025

2025-05-07 03:31