As a seasoned analyst with over two decades of experience in the financial industry, I’ve witnessed the rise and fall of various market trends. The current state of the NFT market, as presented in this report, is a stark reminder of the wild west days of crypto in 2017-2018.

NFT Evening analysts say 96% of 5,000 NFT collections are dead in 2024.

Table of Contents

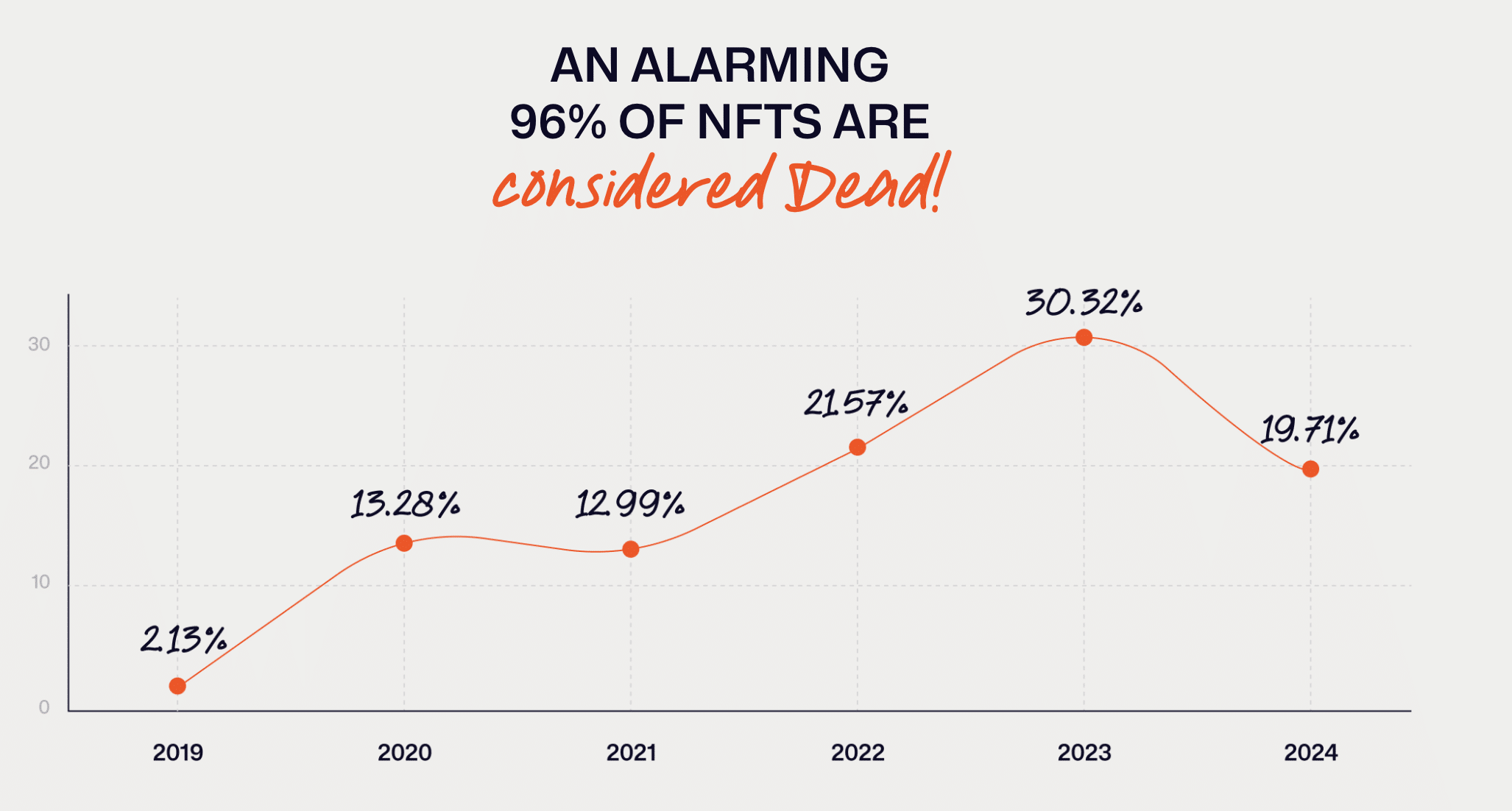

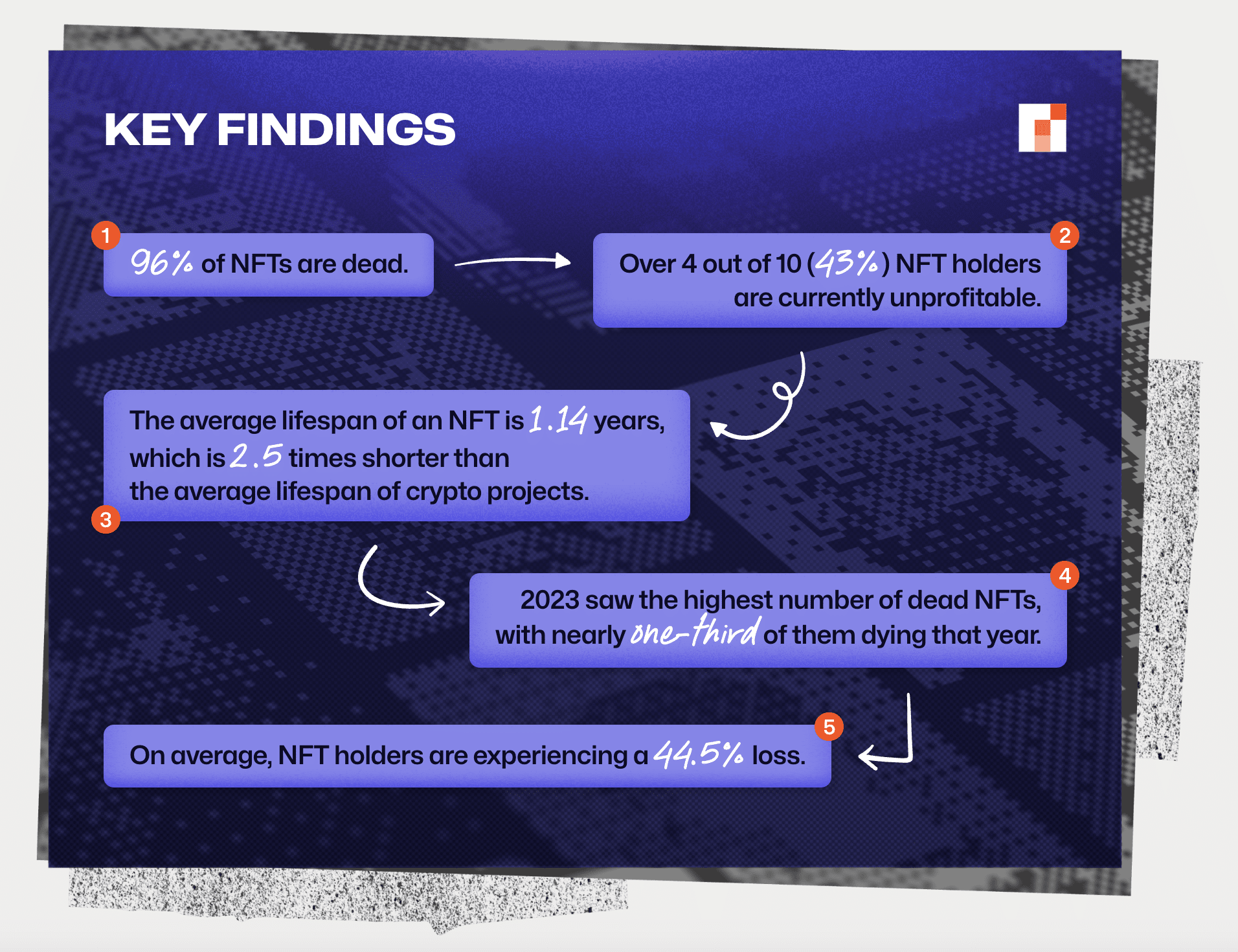

The report provides insights into the condition of the non-fungible token market in 2024, highlighting its challenges. As per experts, a staggering 96% of over 5,000 existing NFT collections are considered ‘inactive.’ This implies that they have no trades, sales for more than seven days, and no engagement on the X social platform.

Approximately four in ten individuals who own Non-Fungible Tokens (NFTs) are currently looking to realize a profit from their holdings. Concurrently, the typical duration of NFT collections stands at around 1.14 years, which is nearly three times shorter compared to the average lifespan of traditional cryptocurrency projects.

Moreover, 2023 marked an unprecedented spike in the number of NFT project failures. In fact, about 30% of projects in this sector were classified as “defunct”. Experts predict that a staggering 44.5% of NFT holders are likely to experience financial losses.

The NFT Evening team also identified the most profitable collection to date. It turned out to be the Azuki project, which, on average, increased the investments of token owners by 2.3 times.

The reason for this achievement is that the collection has a robust connection with its community, offers a distinctive artistic charm, and employs successful promotional tactics.

Experts have pointed out that the least profitable NFT collection, the Pudgy Penguins, has been established. This collection saw an astonishing 97% decline in its value, making it the present champion for the largest drop in earnings among owners.

Experts are urging caution for investors in the Non-Fungible Token (NFT) market, as it’s currently experiencing a downturn. Moreover, they advise NFT creators to reassess their strategies when implementing new projects.

End of an Era

NFTs from popular collections bought on the wave of excitement in 2022 are sold at colossal losses.

In 2022, NFTs bought by pop star Justin Bieber for approximately $2 million have decreased in value and are now worth around $100,000. This represents a significant drop of nearly 95%.

Originally, the musician’s Ethereum stash amounting to approximately 2.34 million dollars was added to their wallet. A large portion of this sum, around 1.86 million dollars, was used to buy two Bored Ape Yacht Club items and a set of Mutant Ape Yacht Club pieces. The collection also contained tokens from the World of Women, Doodles, Otherdeed, and Metacard series. Unfortunately, since then, these assets have seen a drop in value ranging from 89.7% to 97.4%.

Furthermore, in August, Deepak Thapliyal, the proprietor of CryptoPunk #5822 – the costliest CryptoPunk token acquired for approximately 8,000 ETH ($23.7 million at the time of purchase) in 2022, decided to sell this asset without revealing the sale’s price details. This transaction ranked as the fourth most expensive NFT deal of 2022 within the thriving NFT market sector.

End of an Era.

👋 #5822, Enjoy your new 🏡

— Deepak (@dt_nfts) August 19, 2024

The community suspected that the token was sold at a loss. The buyer was allegedly user X, who goes by the nickname VOMBATUS. The token was reportedly purchased for 1,500 ETH (~$3.9 million), 80% cheaper than the previous price.

The Rise and Fall of OpenSea

By January 2022, the aggregate value of Non-Fungible Tokens (NFTs) reached over $6 billion. However, as of July 2024, their worth had dropped significantly to about $430 million. Although NFTs are still active in the market, they are currently experiencing a downturn.

As an analyst, I find myself observing a challenging period for OpenSea, the prominent NFT marketplace. The tech publication, The Verge, highlights that the company is grappling with various issues, including investigations by the Securities and Exchange Commission (SEC) and the Federal Trade Commission (FTC), U.S., as well as international tax authorities. Additionally, intensifying competition, allegations of discrimination, and staff reductions are adding to their woes.

Furthermore, following an overvaluation of their stake by a massive 90% (from $120 million to $13 million), one of OpenSea’s major investors, New York-based venture capital firm Coatue Management, caused the startup’s valuation to plummet from $13.3 billion to just $1.4 billion.

Nonetheless, The Verge indicates that the company possesses significant potential, as evidenced by an internal document revealing OpenSea’s crypto reserves amounting to $438 million and $45 million as of November 2023. With this substantial financial backing and a fresh business approach, it seems that OpenSea is well-equipped to navigate through challenging circumstances.

As per an internal report from November 2023, the company had approximately $483 million in liquid cash and around $45 million in digital currency reserves. Currently, the business is operating on this capital while awaiting a potential ‘2.0’ transformation to guide it through rough waters.

What will happen to the NFT market?

For a while now, the realm of Non-Fungible Tokens (NFTs) has predominantly operated within platforms such as OpenSea and Rarible, serving as venues for creators to mint new NFTs or exchange them among themselves.

In simpler terms, there are online marketplaces where you can buy and sell derivative contracts related to popular NFT collections. These platforms enable users to bet on the value of NFTs without actually possessing the tokens themselves.

Nevertheless, the downward trend in the non-fungible token market continues, with the noticeable drop in the prices of top-tier NFT collections.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- PUBG Mobile heads back to Riyadh for EWC 2025

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Arknights celebrates fifth anniversary in style with new limited-time event

- USD CNY PREDICTION

- Every Upcoming Zac Efron Movie And TV Show

- Superman: DCU Movie Has Already Broken 3 Box Office Records

2024-09-21 13:38