Key Insights:

- Bitcoin hovers near $120K, with whale activity and declining profits suggesting a dip to $115K might be on the horizon.

- On-chain data hints at seller exhaustion, but the market remains delicate.

- The $115K–$120K range is crucial for BTC’s short-term trajectory.

After reaching the dizzying heights of $123,000, Bitcoin now finds itself in a period of consolidation, much like a weary traveler pausing to catch their breath. Analysts, ever the pessimists, suggest that this might not just be a routine pause but rather a “healthy yet fragile balance.” 🌈

Bitcoin is currently trading between $117,000 and $118,000, with the $115,000 mark serving as a critical downside target. 📉

Profitability Metrics Show Cooling Market Sentiment

According to Glassnode, a recent report reveals that major profitability indicators are beginning to wane. The percentage of supply in profit and unrealized gains have slightly receded. Even though these metrics are still in the “euphoric zone,” the signs are pointing towards a possible correction or consolidation. 🤔

More notably, the Realized Profit-to-Loss Ratio has fallen from 3.9 to 2.6, indicating that more investors are starting to de-risk. This ratio measures the value of coins moved at a profit versus those moved at a loss. A current reading of 2.6 means profits still outweigh losses, but not as significantly as before. 📊

Despite the pullback in profitability, there are no major indications that the bears are taking over. Instead, the market seems to be coiling, possibly forming a new support base. 🐻

Is Seller Exhaustion Around the Corner?

The good news for the bulls is that the market may be nearing a state of seller exhaustion. After such a strong run-up, a slowdown in selling pressure often paves the way for the next leg higher. However, this scenario hinges on BTC maintaining its current support levels. 📈

Glassnode data suggests that if profitability continues to fade, the market could enter a prolonged consolidation phase. The challenge now is how to sustain bullish momentum in the face of weakening profit margins. In other words, the market isn’t turning bearish, but it’s no longer aggressively bullish either. 😐

Traders Watch Bitcoin at $115K as Liquidity Cluster Builds

As the broader market cools, traders are focusing on one specific price level: $115,000. According to analyst Daan Crypto Trades, exchange order books show a significant liquidity buildup in this zone. The longer Bitcoin trades sideways near $120K, the more trading positions accumulate on either side. 📈📉

The longer price hovers around this area, the more positions will build up on both sides.

Those positions will be fuel for wherever this moves next.

The main areas to watch in the short term are ~$115K-$120K.

The biggest liquidity cluster currently sits…

— Daan Crypto Trades (@DaanCrypto)

Volume data supports this theory. $118,000 has seen the highest trading activity in recent weeks, acting as a short-term midpoint that traders are closely monitoring. If Bitcoin dips toward $115K, it could trigger stop-losses or liquidations, creating short-term volatility. On the other hand, holding this level could reinforce it as a strong base for the next upward move. 🚀

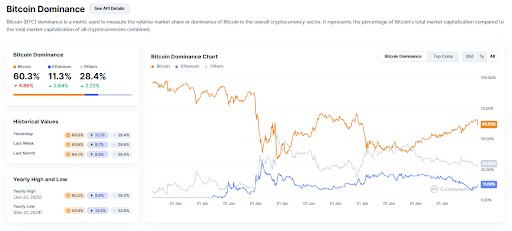

Bitcoin Dominance Drops as Ethereum and Altcoins Gain

Another significant development is the sharp drop in Bitcoin’s market dominance. After holding near 64%, BTC.D has now declined to 58%, marking its second major decline in three months. 📉

This shift is primarily driven by Ethereum, which surged from $2,500 to $3,500 in just ten days, a clear sign that investors are rotating into altcoins. 🦄

Overall, the immediate future for Bitcoin depends on how the market reacts to current support levels. If the $115K–$118K range holds and seller exhaustion sets in, Bitcoin could be setting the stage for another leg up. Conversely, if profitability continues to weaken and liquidity sweeps take prices lower, we may be entering a longer period of sideways movement. 🕊️

Read More

- Gold Rate Forecast

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Silver Rate Forecast

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- PUBG Mobile heads back to Riyadh for EWC 2025

- Arknights celebrates fifth anniversary in style with new limited-time event

- USD CNY PREDICTION

- Every Upcoming Zac Efron Movie And TV Show

- Superman: DCU Movie Has Already Broken 3 Box Office Records

2025-07-23 00:36