As a seasoned analyst with years of experience in the volatile world of cryptocurrencies, I find this whale’s move to accumulate more Bitcoins despite being in the red quite intriguing. This is a classic example of the ‘buy the dip’ strategy, a tactic that many seasoned investors employ when they believe the market has overreacted and prices are temporarily undervalued.

A large crypto whale decided to accumulate more Bitcoins despite standing in a huge loss as the asset’s price remains below $63,000.

As reported on a post by Lookonchain, the whale identified as “1L7g……xeTs” has amassed approximately 750 Bitcoins (BTC), valued at around $46.8 million, from Binance within the last day. This is the first activity this whale has shown in over half a year.

Today, a massive whale holding approximately 10,158 Bitcoins (equivalent to about 681 million dollars) added another 750 Bitcoins (or roughly 46.8 million dollars) from Binance, ending its six-month slumber!

— Lookonchain (@lookonchain) October 9, 2024

The whale extended their Bitcoin holding to 10,908 BTC, worth $681 million at the current price, per Lookonchain.

According to a recent post on Lookonchain, it appears that a large investor (whale) purchased approximately 10,158 Bitcoins about six months ago, with an average cost of $67,026 per Bitcoin, from Binance – the world’s leading cryptocurrency exchange in terms of trading volume.

Presently, this whale is experiencing a setback of about $46 million on their Bitcoin investments because the leading digital currency is holding steady below the $63,000 level.

To highlight, it’s important to note that this isn’t the sole instance where large numbers of whales have amassed at this point in time. As reported by crypto.news on October 7, there was a growth of around 2,000 addresses holding more than $1 million in Bitcoin between September 29 and October 2.

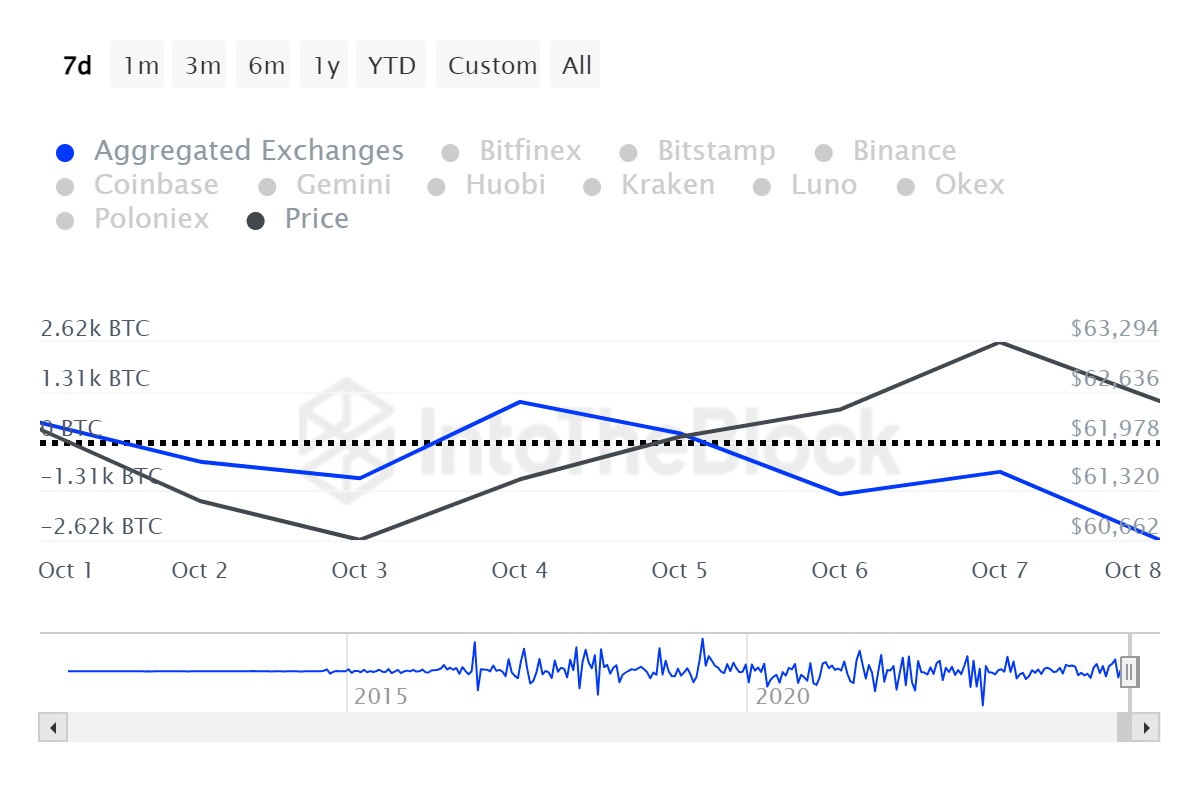

Over the last week, I’ve noticed a significant surge in large-scale Bitcoin transactions, as per the data from IntoTheBlock. These transactions, valued at least $100,000 each, amounted to an impressive $109.96 billion. Interestingly, this whale activity began to pick up on October 5, coinciding with the broader crypto market’s bullish momentum. This trend has piqued my curiosity and has me keeping a close eye on further developments in the Bitcoin market.

As a researcher, I’ve observed that data from ITB indicates a withdrawal of approximately 2,620 Bitcoins from centralized exchanges on October 8th. This trend suggests that Bitcoin might be being accumulated as the widespread selling pressure seems to be subsiding.

Currently, Bitcoin has experienced a decrease of 0.3% over the last 24 hours and can be bought for approximately $62,400. At this moment, its market capitalization remains above the significant threshold of $1.2 trillion, while daily trading volume amounts to around $27 billion.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Silver Rate Forecast

- Maiden Academy tier list

- PUBG Mobile heads back to Riyadh for EWC 2025

- Castle Duels tier list – Best Legendary and Epic cards

- The 15 Highest-Grossing Movies Of 2024

- Mech Vs Aliens codes – Currently active promos (June 2025)

- USD CNY PREDICTION

2024-10-09 10:16