As a seasoned analyst with over two decades of experience in the financial markets, I find it intriguing to observe such patterns unfolding within the cryptocurrency landscape. The recent surge in Pendle inflow into whale addresses following Arthur Hayes’ sell-off is a classic case of market dynamics at play.

As an analyst, I observed a substantial increase in Pendle inflows towards whale wallets the day following the sale of this asset by Arthur Hayes, a co-founder of BitMEX cryptocurrency exchange.

Last week, a post by Lookonchain indicates that the ex-CEO of BitMEX, Hayes, sold off approximately 1.59 million Pendle (PENDLE) at an overall value of $5.62 million. This transaction resulted in a loss of around $1.29 million for Hayes.

Over the last two days, Arthur Hayes (@CryptoHayes) disposed of approximately 1.59 million PENDLE tokens for a total value of $5.62 million, with an average selling price of around $3.52 per token.Following his sale, the price of PENDLE increased by 24%, causing the value of those 1.59 million tokens to be now worth roughly $6.91 million.Unfortunately for Mr. Hayes, this transaction resulted in a loss of approximately $1.29 million due to the subsequent price surge!— Lookonchain (@lookonchain) September 22, 2024

The data indicates that Hayes conducted transactions involving Pendle tokens, both deposits and sales, on Binance – the leading cryptocurrency platform in terms of trading activity.

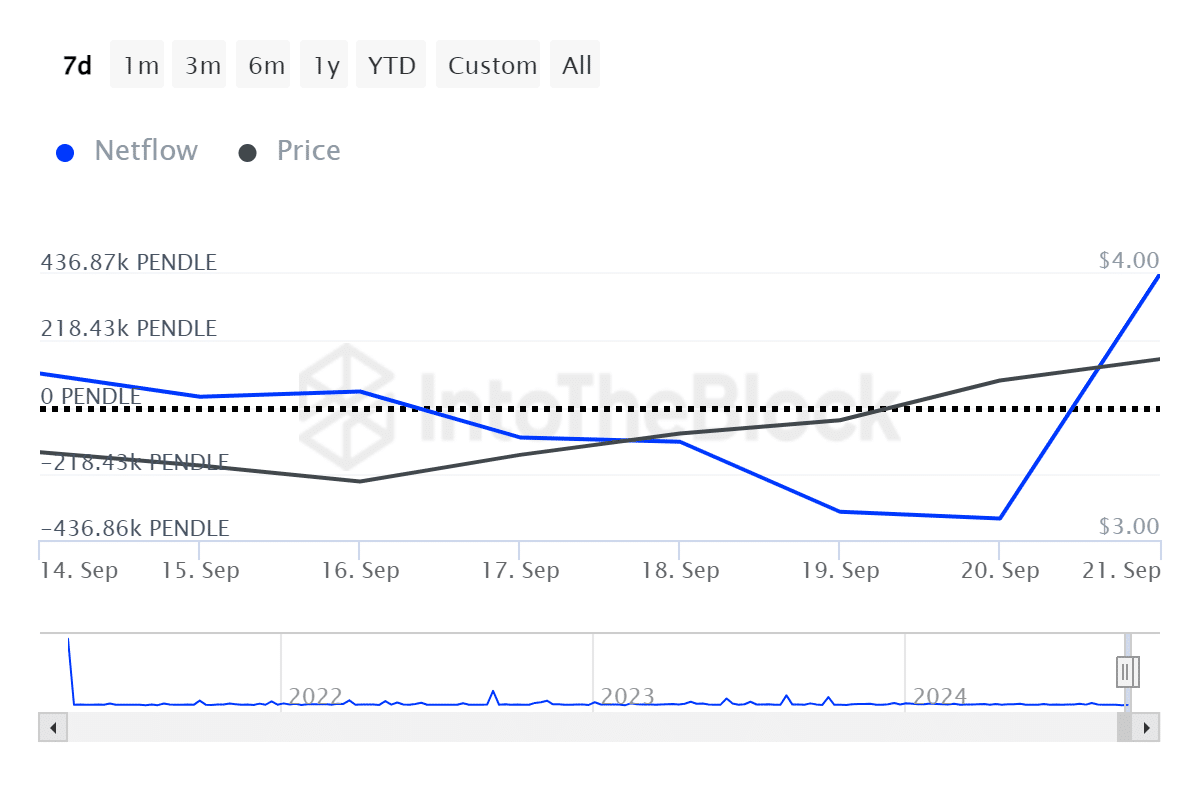

As a researcher examining the recent market fluctuations, I’ve observed an uptick in significant transactions originating from large token holders regarding Pendle. Data from IntoTheBlock indicates that the net flow of Pendle tokens held by whales changed dramatically on Saturday, September 21. Specifically, outflows decreased from 366,310 PENDLE to inflows amounting to 436,860 Pendle.

As a researcher, I’ve noticed an intriguing trend in the data. It appears that entities holding substantial amounts of Pendle are increasingly acquiring it, while larger whale investors seem to be offloading their assets.

Meanwhile, the number of large transactions consisting of at least $100,000 worth of Pendle declined from 30 to 17 on the same day, per ITB data.

To put it another way, the number of significant transactions has consistently grown ever since September 19th. This implies that only some major PENDLE holders could have acquired their tokens following Hayes’ sale of a majority of his holdings.

In the last 24 hours, Pendle has experienced a surge of 28%, currently valued at $4.29 per unit. Its market capitalization stands roughly at $690 million, while its daily trading volume hovers near $380 million.

Significantly, the dominance of whales (large investors) in market movements often leads to increased volatility in the price of cryptocurrencies. This is due to the fact that many of these large holders tend to seek out short-term gains.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- Gold Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Maiden Academy tier list

2024-09-22 19:16