In the wake of President Trump’s rather theatrical declaration of a 90-day moratorium on tariffs—save for China—crypto whales are reveling in their newfound spoils as they feast upon Ethereum (ETH), Mantra (OM), and Onyxcoin (XCN) with fervor reminiscent of a bespectacled scholar at a buffet of knowledge.

ETH, that enigmatic darling of the digital seas, has seen its stakeholders swell to levels not witnessed since the balmy days of September 2023. Meanwhile, the OM custodians are tiptoeing towards greater commitments as the allure of real-world assets becomes ever more seductive. Ah, and XCN—what a scandal! It has undergone a meteoric rise, a staggering 50% increase in mere hours, as if it were a character in a tragicomedy, desperately vying for attention.

Ethereum (ETH)

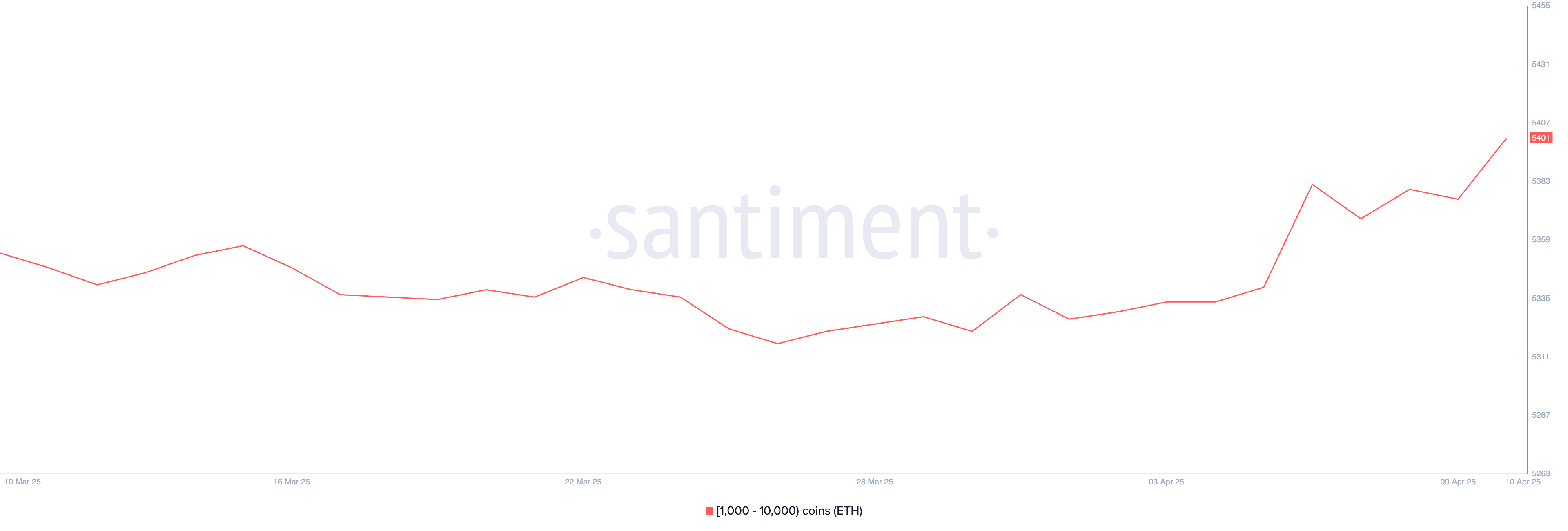

The crypto cosmos has gleefully responded to Mr. Trump’s machinations, a veritable carnival of excitement taking place across the risk asset landscape. On the blockchain, the esteemed Ethereum has also chosen to partake in this jubilation, evidenced by the rise in whale activity; the ranks of those holding fortunes between 1,000 and 10,000 ETH swelled from 5,376 to a splendid 5,417 between April 9 and 10, reaching heights unseen since the fall foliage of 2023.

If Ethereum can sustain this reawakening, one might anticipate a daring approach to resistance levels at $1,749, with aspirations of scaling the lofty peaks of $1,954 and $2,104. Alas, the specter of economic uncertainty looms overhead, a brooding character in this unfolding tale.

A whimsical reversal in sentiment could plummet Ethereum’s price to retest the $1,412 safety net. Should that delicate line be breached, we might find ourselves grappling with the specter of a deeper descent, touching $1,200 or, dare I say, even plunging into the abyss of $1,000.

Some analysts, in a fit of dramatic flair, have likened Ethereum’s downturn to the infamous fall of Nokia, foretelling long-term weakness and shaking their heads in dismay.

Mantra (OM)

In a twist worthy of Chekhov, the realm of real-world assets (RWAs) on the blockchain has blossomed, surpassing a staggering total of $20 billion, accentuating their emerging importance as a focal point in crypto discourse.

Binance Research, in a stroke of irony, has articulated that tokens linked to RWAs have exhibited a resilience that even Bitcoin could only dream of in turbulent tariff-laden times. Purely delightful, isn’t it?

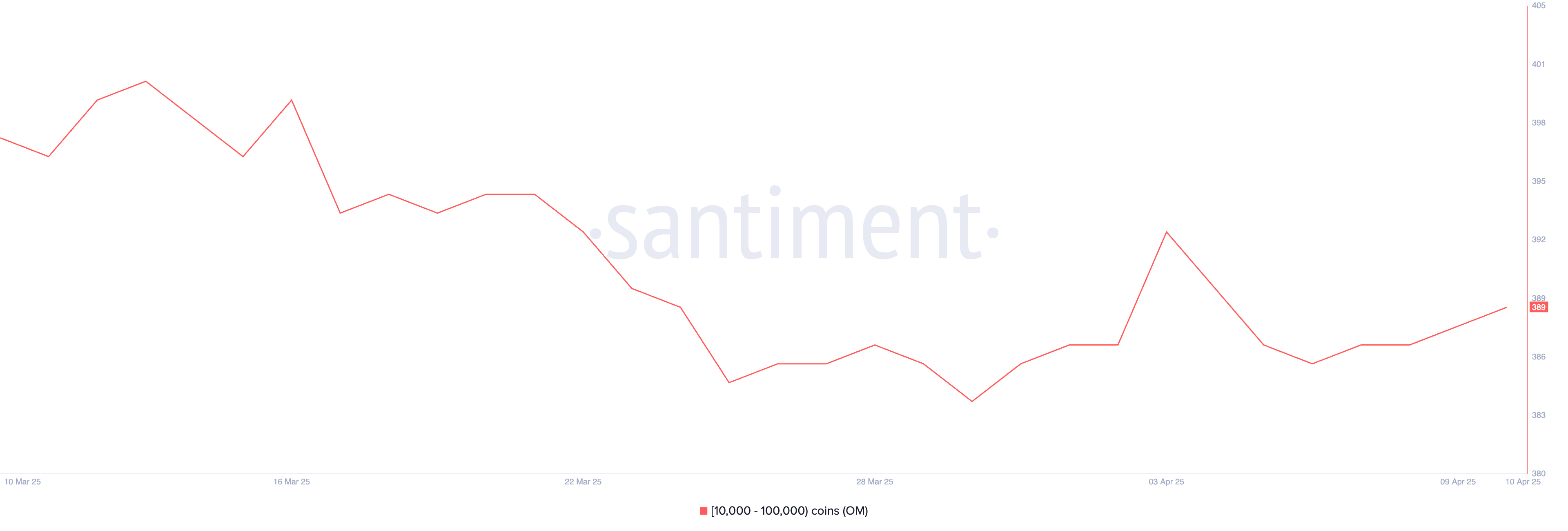

With the RWA narrative gathering momentum, OM stands on the precipice of significant ascendance. Between April 6 and 10, the number of whale addresses clasping fortunes between 10,000 and 100,000 tokens grew from 386 to 389, a flicker of accumulation that whispers sweet promises to discerning ears.

Should OM transcend the daunting resistance levels at $6.51 and $6.85, it may well soar past the $7 threshold. Yet, should the winds of momentum falter, a return to the shores of $6.11—or possibly even the dreaded depths of $5.68—could ensue.

Onyxcoin (XCN)

Ah, the tale of Onyxcoin (XCN)! It has thrust itself into the limelight with an exuberant increase of over 50% in just a fleeting 24 hours, defying gravity in a manner worthy of a circus act, shattering the $0.02 barrier as whales indulge in their own delightful frenzy.

During the span from April 7 to 10, addresses holding between 1 million and 10 million XCN surged from 503 to 532, igniting fresh intrigue amongst the well-heeled patrons of this cryptographic carnival.

Should this surge of bullish fervor persist, XCN may very well find itself in pursuit of resistance at $0.026, $0.033, and even daringly eyeing $0.040. But alas, with such haste comes the bittersweet aftertaste of a potential correction; it could find itself revisiting the $0.020 sanctuary—and heaven forbid, perhaps diving as low as $0.014 if the tides of selling pressure escalate.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

2025-04-12 02:26